The majority of shipment volume is contracted through an RFP process. The contract locks in rates for a given period of time (typically a year), providing shippers with more predictable budgets and greater familiarity with the carriers servicing their lanes.

The goal of RFPs is to find the best carriers at the best value to create a reliable and predictable supply chain. However, contracted freight can fall short of this goal for a few reasons:

- Overpromising from carriers and brokers – Carriers and brokers frequently bid low so that they win more business. However, when the market tightens and rates increase, carriers may reject the tenders they previously agreed to.

- Oversubscription from shippers – To hedge against risks of tender rejection, shippers may contract more carriers than they need. In soft markets, shippers have a hard time living up to their primary commitments.

- Lack of predictability – The freight market is subject to the whims of unexpected market forces. When securing 12-month contracts during fall of 2019, no one planned for a global pandemic and whipsawing demand in spring of 2020.

Shippers can avoid the pitfalls associated with contract freight by following a few best practices during RFP season.

- Think in terms of bundles rather than individual lanes. A holistic network view and a strategic bundling of lanes can deliver lower prices, better service, and rich data and insights for shippers.

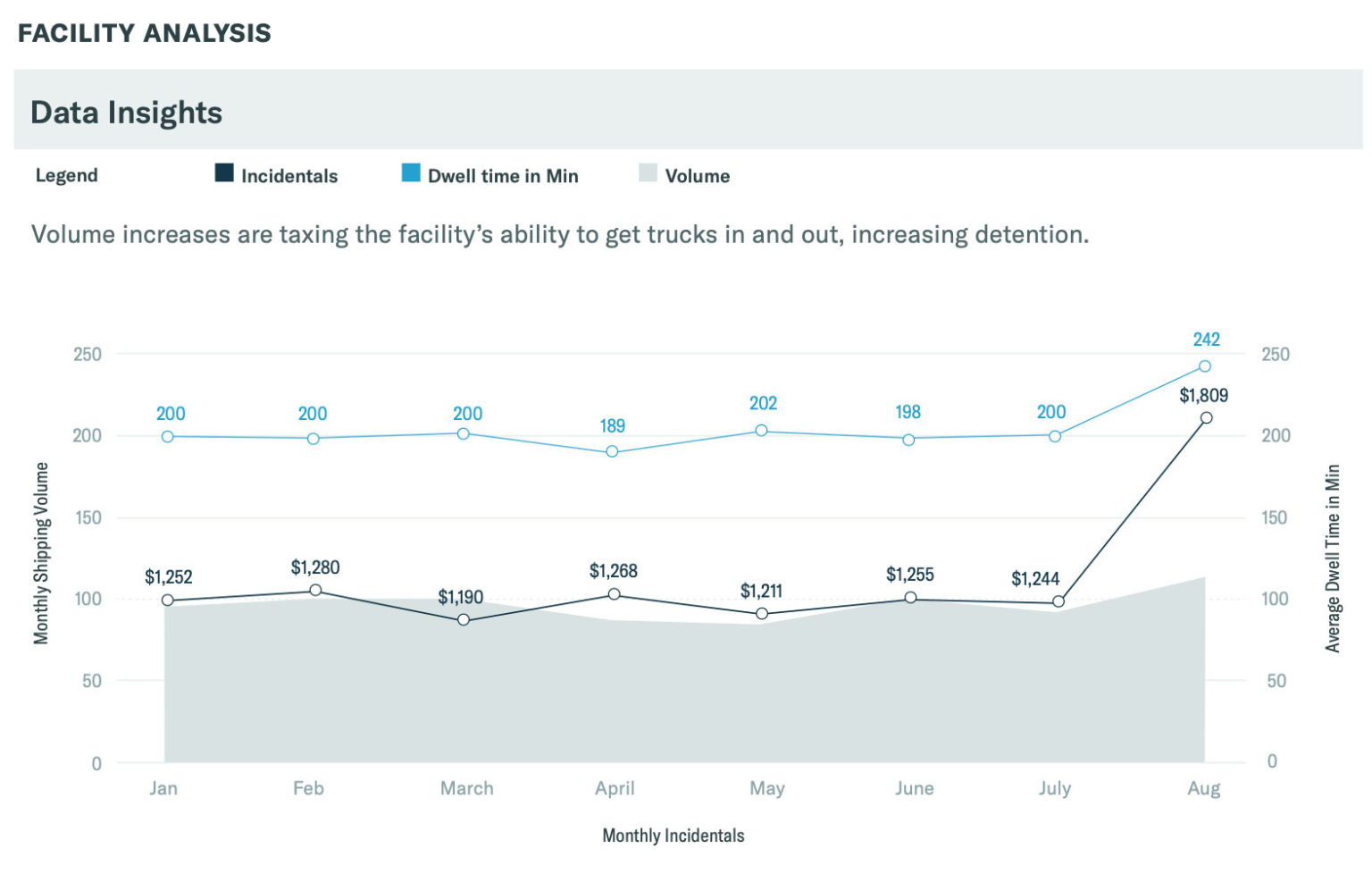

- Use freight data to guide RFP decisions. Whether you seek to improve tender acceptance, make facility improvements, or update your lane strategy, data can help you make better decisions, faster.

- Reduce uncertainty by evaluating tender acceptance rates. Convoy brings more predictability to RFPs by bidding on lanes that align with our network. That’s how we achieve a tender acceptance rate in excess of 95 percent, even in tight markets.

Following these guidelines should give you better performance from your primary carriers. Still, it’s important to build a roster of backup carriers when primary carriers can’t meet your needs.

Assembling a Routing Guide with Backup Carriers

As shippers select primary carriers to service their lanes, they also build out a routing guide with backup carriers ranked in order of preference based on RFP bid responses.

You typically consult these backup carriers when your primary carrier rejects a load. However, these backup carriers can also reject the load, adding up to higher prices and more time waiting for confirmation that your loads are covered. Worse still, if none of your backup carriers accept, you’re forced to the spot market which means higher rates and greater risk.

To address this scenario, Convoy developed Dynamic Backup. This is an automated system that provides real-time market rates with guaranteed coverage for loads. Loads tendered with Dynamic Backup are instantly bookable, meaning that shippers no longer need to wait hours for a carrier to accept or reject a load. This feature is built into Convoy.

Understanding Spot Freight Rates

The load boards that make up the “spot market” connect shippers with carriers. Unlike fixed contract rates, spot rates adjust dynamically based on the freight market, reflecting full truckload (FTL) prices that can change by the hour.

Although swings in spot freight rates tend to grab logistics industry headlines, spot makes up only about 1/5th of the US trucking market according to FreightWaves.

A shipper’s transportation management strategy will typically include primary and backup contract carriers that help reduce exposure to spot market volatility. However, there may be times when tendering via the spot market is necessary or even advantageous to the shipper. You can read our overview of what drives spot freight rates to learn more.

Managing Freight with a TMS

Managing freight is a complex and dynamic process. Thankfully, there are tools to help shippers manage their supply chain logistics and operations. One example is a transportation management system, or TMS.

A TMS can help shippers move freight with greater efficiency and reliability. There are several ways a TMS saves time for shippers. A TMS also provides a single, centralized source of view to provide insights into a shipper’s freight network.

Convoy integrates with any TMS that supports EDI message exchange. Through EDI interactions, Convoy can accept and reject shipments, send basic shipment status information (such as pickup and drop-off appointment set, arrival at pick up and drop-off locations, departure from pickup and drop off location, ETA at consignee’s location, and more), and manage invoicing. In addition, Convoy integrates its Dynamic Backup into leading TMSes including BluJay, MercuryGate, and others.

Through integrations with supply chain visibility solutions like FourKites, Project44, MacroPoint, and 10-4 by Trimble, Convoy can provide real-time location visibility within leading TMSes.