Asset-based Carriers: 7 Things Shippers Should Know

Industry Insights, Shippers • Published on May 21, 2020

What is an asset-based carrier?

Asset-based carriers are trucking companies that work directly with shippers and own their equipment to provide truckload services. Large asset-based carriers may own hundreds or thousands of trucks, and employ drivers to operate them. Many shippers prefer asset carriers over traditional freight brokers because of their reputation for reliability.

Asset carriers can indeed be a reliable option, but this heavily depends on how well the carrier’s capabilities align with a shipper’s freight network and transportation needs. This is one of several considerations shippers should keep in mind when working with assets and determining how to include them as part of a broader freight transportation strategy.

Three benefits of asset-based carriers

-

Reliability and pricing consistency

Compared to traditional freight brokers, asset carriers have a reputation for greater quality and reliability, especially when it comes to contract freight. Because asset carriers own and operate their own equipment and employ their own drivers, they are able to maintain standards of quality and service across their fleet. In theory, asset-based trucking companies shouldn’t need to procure trucks or drivers from a third-party, however, later in this blog we’ll discuss why that often isn’t the case in practice.

-

Intermodal support

Intermodal transportation is the movement of freight by both rail and road. It requires containers, a chassis, and a tractor, so it’s most often provided by larger asset-based carriers who also work as a 3PL.

Depending on a shipper’s freight network and needs, intermodal can be a cost-effective transportation option. It may also be simpler to work with a single 3PL for intermodal shipments instead of separate rail freight companies and truckload transportation partners.

-

Drop and hook options

Drop and hook shipments, also known as power-only or simply as drop, currently represent the majority of Fortune 500 company shipments. Drop and hook reduces dwell time in facilities, enabling shippers to transport more loads, more efficiently.

To date, most of these shipments have been serviced by large asset-based carriers. Traditional freight brokers and non-asset based carriers don’t own a trailer pool required to operate a drop network. Convoy, a digital freight network, offers a drop and hook marketplace called Convoy Go. This illustration shows how drop loads streamline the shipping process.

Four ways asset-based carriers fall short

-

Limited capacity

Asset carriers have a finite number of trucks. When you work with an asset, you have access to the capacity of their own fleet only. This has two primary drawbacks for shippers: a lack of flexibility and constrained network coverage.

A lack of flexibility can cause shippers headaches in tight markets, when asset carriers may reject contracted freight in favor of higher-paying loads. This forces shippers to consult their routing guides for backup options or rely on the spot market to find a carrier at a higher price.

Due to their limited supply of trucks, asset carriers may operate within specific regions and prefer to service certain lanes. An asset carrier may not be able to meet a shipper’s needs when they fall outside of their primary coverage area.

-

Over-commitments and brokered loads

When supply is tight, asset-based carriers may broker out their loads to other carriers. A 2016 study by LaneAxis showed that asset-based carriers broker out 42% of their shipments.

With this much brokering going on, it’s difficult for to vet their carrier quality, introducing additional compliance risk for shippers. This goes against the conventional wisdom that asset-based carriers have a higher control over their service levels and risk.

-

Greater capital risk

Owning, maintaining, and operating a fleet of trucks is a capital-intensive business, which can expose them to greater risk when business slows. In the first three quarters of 2019, more than 800 carriers went out of business, including Celadon based in Indianapolis, Indiana (3,300 trucks), New England Motor Freight based in New England (more than 1,400 trucks), and Falcon Transport based in Youngstown, Ohio (more than 700 trucks). Asset-based carriers and 3PLs reduced staff due to COVID-19, and some may close down permanently.

-

Higher carbon emissions

When it comes to freight RFPs, brokers tend to bet on high-volume, desirable lanes and leave low-volume lanes under serviced. Traditional brokers have incentives to bid low on lanes because it helps them win more business. However, when the market tightens and trucking prices go up, brokers often reject the freight they earlier agreed to take. When this happens, a shipper will have to consult their routing guide or find another broker on the spot market.

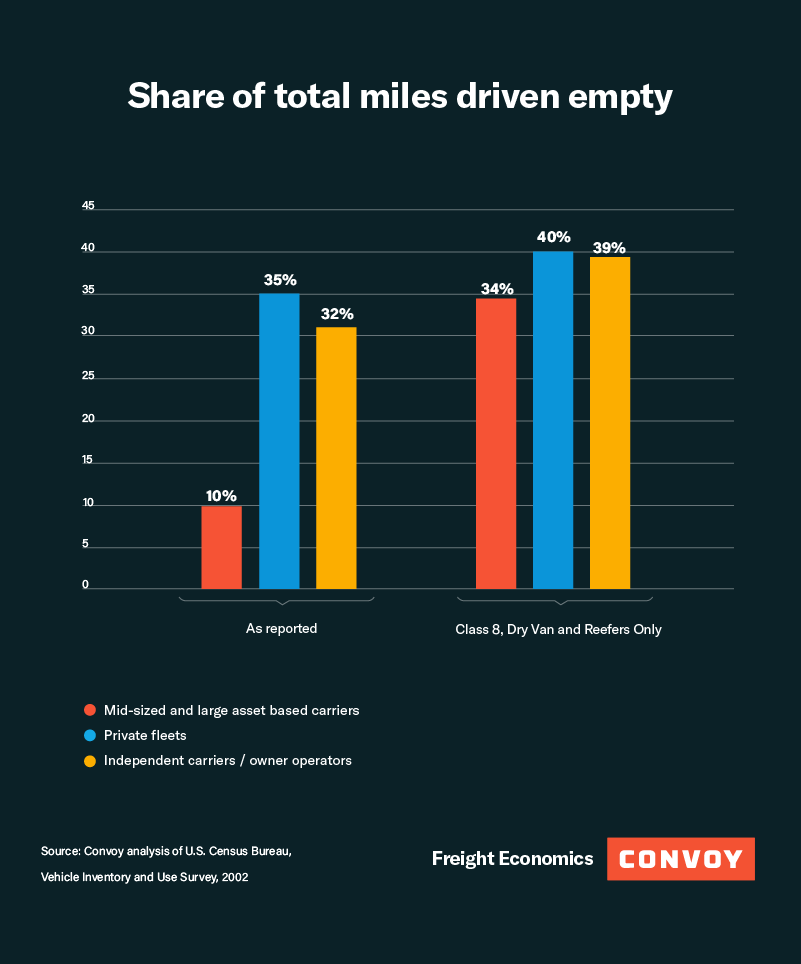

According to Convoy’s analysis of US Census Bureau data, the share of total miles run empty for mid-sized/large asset-based carriers is 34% for Class 8 dry vans and refrigerated vans (reefers). Asset-based carriers are prone to understating empty miles they drive.

Why Fortune 500 companies are allocating shipments to digital freight networks

The past five years have seen the rise of the digital freight network, an alternative option to large asset-based carriers. A digital freight network is a fully connected freight marketplace that uses machine learning, automation, and other software to efficiently connect shippers and carriers. Convoy’s digital freight network provides many of the benefits of truckload asset-based carriers while addressing their shortcomings.

Larger carrier network = Greater flexibility and nationwide coverage

The largest asset-based carriers have between 10 and 25 thousand trucks each. By contrast, Convoy’s digital freight network has hundreds of thousands of trucks located throughout the nation. More available trucks means greater flexibility to accept tenders across a broader set of lanes, and to quickly find new trucks when an unexpected problem occurs, such as a mechanical issue that affects an inbound truck.

Durable performance in volatile markets

When it comes to handling volatile markets, according to Gartner, “Digital freight networks are helping shippers overcome COVID-19 challenges by delivering the reliability of an asset-based carrier and the flexibility of a broker.” Convoy’s digital freight network proved resilient during COVID-19. For our top food shippers who saw the highest surges, we flexed our network capacity over 50% to meet demand.

Higher carrier quality and safety

Convoy holds the most stringent quality and compliance standards in the industry. Our network of carriers is 15 percent safer than the industry as a whole, and is safer than the majority of the nation’s leading asset carriers. With 24/7 tracking, shippers can have peace of mind that their cargo is on track and in capable hands.

Lowered carbon emissions

As many businesses increase their focus on environmental impact, logistics teams are being tasked with contributing to the triple bottom line – people, planet, profit. Convoy launched Automated Reloads to reduce the amount of time drivers haul empty trailers. The program matches carriers with multiple shipments to cut down on empty miles. Fast Company recognized this breakthrough as a World Changing Idea. Fast Company reporting that, “shipments using the program were seeing a 45% drop in carbon emissions.”

Improved supply chain visibility

Shippers with the best data, and the ability to make effective decisions with that data, stand to lower shipping costs, improve customer service, and contribute to business growth.

Digital freight networks collect hundreds of data points on every shipment, including information on facilities, wait times, incidentals, carbon emissions, on-time performance, and more. Then, using machine learning, digital freight networks can identify patterns and anomalies in the data, and translate them into business insights that help shippers improve the efficiency of their operations.

With a focus on transporting freight more efficiently and also partnering with shippers to optimize their supply chains, digital freight networks like Convoy provide services that go beyond the capabilities of traditional asset-based carriers.

More resources on how digital freight networks can help shippers:

- Read the 10 things shippers should know about traditional freight brokers.

- Whether you’re selecting a freight partner or starting an RFP process, consult our guide to developing a freight transportation strategy.

- If you’re interested in learning more about digital freight networks, now is the best time to get started. Sign Up with Convoy today.