10 Considerations for Shipping Contract, Backup, and Spot

Industry Insights, Shippers • Published on April 24, 2020

The freight industry is undergoing unprecedented change. Market volatility is forcing transportation teams to adapt more quickly. Rising customer expectations are putting more pressure on supply chain efficiency. And as many businesses increase their focus on environmental impact, logistics teams are being tasked with contributing to the triple bottom line.

Whether your goal is adaptability, efficiency, or sustainability, your freight allocation matters. With a reliable primary carrier on each lane, a strong routing guide of backup options, and a spot strategy that minimizes risk, you’ll set yourself up to more effectively weather the market as it tightens and contracts. In this post, we suggest 10 questions you should consider throughout your freight tendering process.

Contract freight

The majority of shipment volume is contracted through an annual freight RFP process. The goal of RFPs is to find the best carriers at the best value to create a reliable and predictable supply chain. However, the freight market can shift significantly over the course of a year-long contract, and as we’ve seen recently, unexpected macroeconomic events can cause wild swings in truck prices, leading carriers to renege on contracts.

It’s an all-too-common story: asset carriers and brokers bid low to win business, but then decline freight if they can make better margins on spot when the market shifts.

To mitigate this risk, shippers need to set high standards and hold carriers accountable to quality and performance benchmarks. A few questions to ask when considering a freight service provider in your RFP:

- How much of their freight is contract?

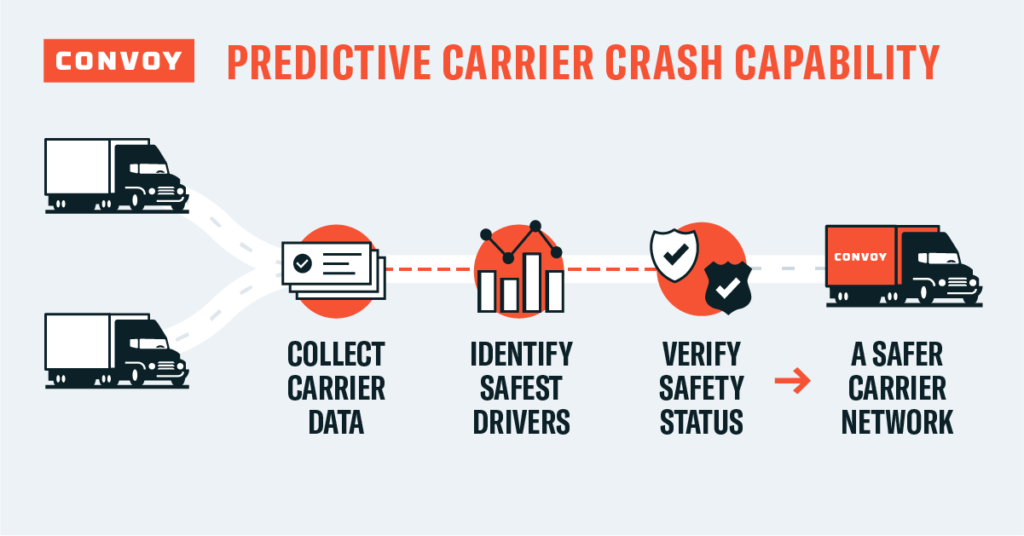

This helps validate the carriers who are bidding on your RFP. You’re more likely to receive reliable service from a carrier who has a proven track record of contract freight and who is trusted by other shippers. - How do they ensure the safety of their trucks and quality of their drivers?

Substandard carrier vetting increases the chances of compliance risk, potentially exposing you to legal, financial, and reputational damage. - What are their tender acceptance rates? What controls do they have to meet your tender acceptance benchmarks?

Carriers with high tender acceptance rates and measures in place to ensure they can service your lanes will be more likely to haul your freight when markets tighten.

More than 70% of Convoy’s freight is contract and we’re a top-five freight partner for Fortune 500 companies in multiple industries, including food and beverage, consumer packaged goods (CPG), retail, packaging, equipment pooling, and more. Procter & Gamble named us their Innovation Partner of the Year. We hold our carriers to the highest of standards and have industry-leading quality and compliance metrics. We identify optimal lanes prior to bidding, which ensures our carrier network can support the lanes we bid on. As a result, our tender acceptance is above 95% even in tight markets.

More about contract freight: RFP 2.0 – Improving the Shipper RFP Experience

Backup freight

Once you’ve selected your primary carriers, you build out your routing guide, ranking backup carriers in order of preference and tendering loads based on RFP bid responses.

This would be a straightforward process if freight markets were perfectly predictable, but the laws of supply and demand make the process much more complicated. When freight rates rise above contracted prices, primary carriers may reject tenders so they can haul more profitable loads.

Once your primary carrier rejects a load, you turn to your backups. These carriers can also reject the load, adding up to higher prices and more time waiting for confirmation that your loads are covered. Worse still, if none of your backup carriers accept, you’re forced to the spot market which means higher rates and greater risk.

A few questions you should consider when evaluating backup freight providers:

- Are your carriers using real-time models to price their backup rates?

Prices you see should account for the unique characteristics of the individual load being tendered and reflect current market conditions. Look for carriers that back up their numbers with data. - How much time do you spend waiting for carriers to respond?

No one wants to wait hours for a carrier to accept or reject a load. Consider using an automated system that reduces your time spent waiting for a response. - Do your carriers guarantee coverage for the loads they accept?

Working with carriers who commit to covering the tenders they accept will save you time and keep you from having to return to your routing guide.

Convoy developed Dynamic Pricing, an automated system that provides real-time market rates with guaranteed coverage for loads. Loads tendered with this system are instantly bookable, meaning that shippers no longer need to wait hours for a carrier to accept or reject a load.

In March 2020, demand surged as consumers flooded supermarkets due to the COVID-19 crisis. This caused capacity constraints, making it difficult for shippers to find coverage. Shippers who used Convoy’s Dynamic Pricing found coverage while avoiding more expensive, last-minute spot rates.

More about Dynamic Pricing: A real-time, guaranteed rate for routing guides

Spot freight

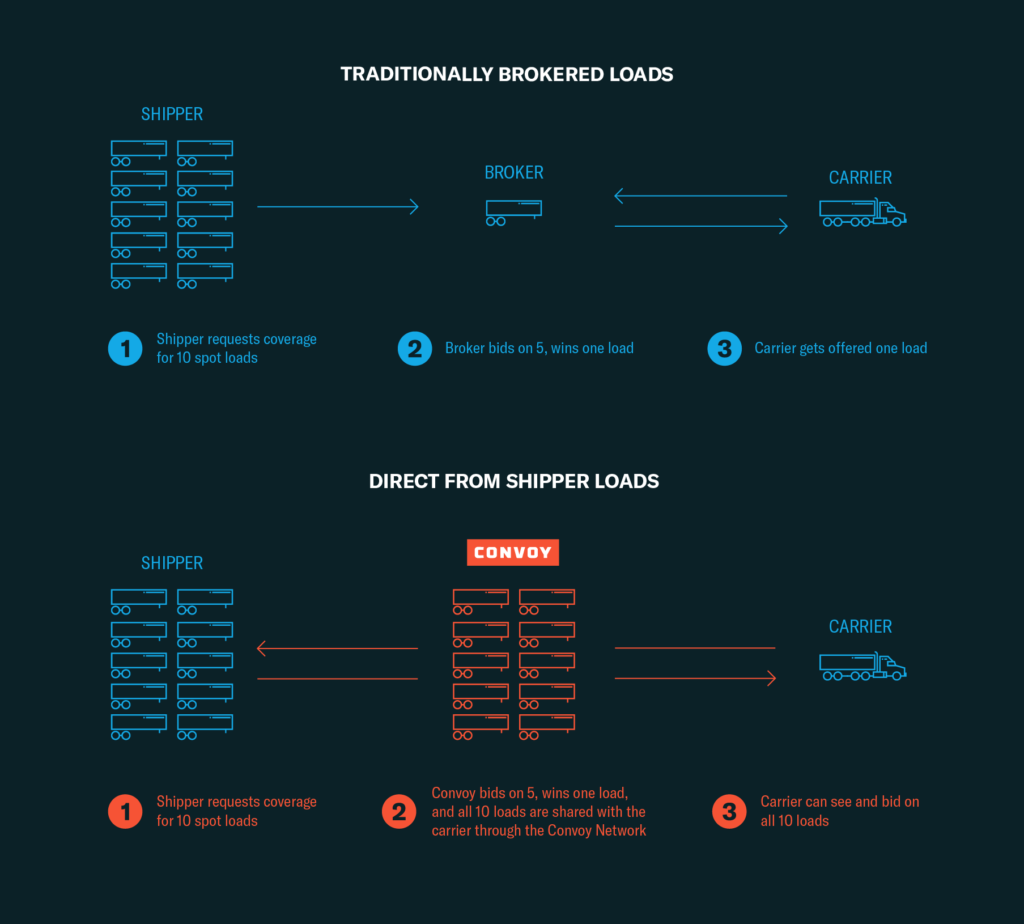

Depending on market conditions, the spot market can result in higher prices relative to contract or backup options. Unlike fixed contract rates, spot rates adjust dynamically based on the freight market, reflecting truckload prices that can change by the hour.

This means that shippers who use the spot market are likely to deal with volatility of short-term rates, driven by one or both of the following:

- Increased shipper demand (e.g., strong economy, produce season and holidays)

- Decreased carrier supply (e.g., extreme weather, major holidays, DOT week, and new regulation)

There are a handful of considerations that can help mitigate the costs of the spot market:

- Are you accounting for historical tender acceptance rates when selecting a primary carrier?

The best way to mitigate spot market risk is to reduce the number of times you need to rely on the spot market. That means selecting primary carriers with a proven track record of high tender acceptance. - Are you reducing the risks associated in working with an unfamiliar carrier?

Worrying about inconsistent service levels, the safety of your freight, and customer satisfaction are understandable when working with a new carrier. When selecting on the spot market, you’ll want to make sure the carrier meets your quality and compliance requirements. - Will the carrier you select give you visibility into your shipment?

You want the option of tracking your load every step of the way. Consider carriers who provide real-time GPS tracking or integrations into your supply chain visibility solution. - How can you reduce the time spent confirming bookings?

If you’re shipping spot, it’s likely that there’s urgency to your shipment. Look for carriers that provide real-time quotes and guaranteed coverage to reduce your time spent waiting on carriers to respond.

Convoy’s digital freight network gives you access to carriers located throughout the country. We’ve maintained industry-leading primary tender acceptance, helping you get loads off your docks reliably. For those who tender through the spot market, our automated matching connects the best carrier to each load, saving time even when capacity is tight.

We track every step of the shipment process so that you never have to ask, “Where’s my truck?” And we provide unique insights into your facilities, lanes, and carrier network to help you identify inefficiencies, improve operations, and reduce costs.

Read more: Spot Market Volatility and Primary Tender Acceptance

More resources on contract, backup, and spot freight shipping:

- Whether you’re selecting a freight partner or starting an RFP process, consult our guide to developing a freight transportation strategy.

- Build a durable supply chain for today’s environment and prepare for future volatility: 6 ways a digital freight network can help shippers during COVID-19

- Use Convoy to get transparent visibility in your spot shipping.