Owner Operators Earn More per Hour and Work More than Company Drivers

Freight Research • Published on July 17, 2019

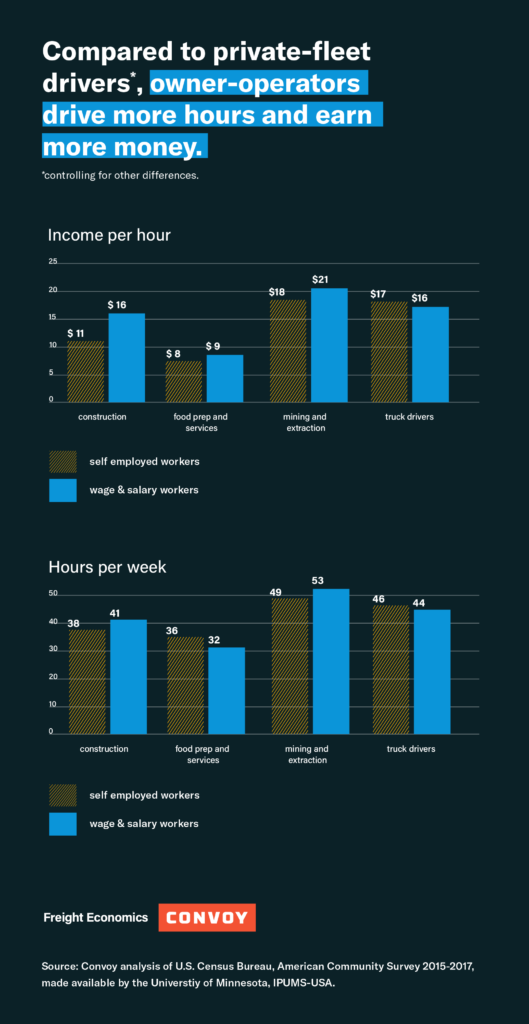

Self-employed truck drivers — known as owner-operators in the freight industry — earn more per hour and work more hours for a combined higher income than company drivers who are paid per mile or per hour, though owner-operator earnings also vary more widely. [1]

Eleven percent of truck drivers [2] nationwide are self-employed, a share that has been roughly flat since the early 1990s — this includes drivers who own and operate their own trucks, and drivers who lease their trucks and may operate under another carrier’s authority. [3] Among workers across all jobs, self-employment has been slowly trending lower — despite increasing during economic downturns when workers who are laid off from other jobs often turn to self employment — from about 16 percent in the early 1990s to about 15 percent today.

Controlling for other factors such as age, education, family status and sex, owner-operator truck drivers earn about 5 percent more per hour compared to company drivers. That works out to almost $1,900 more per year in recent years. [4] In reality, there are also other differences — in age, experience, education, family status and sex — between owner operators and company drivers, and these difference compound. Not controlling for demographic factors, owner-operators earn on average 16 percent more per hour — nearly $6,000 over the course of a year — than company drivers.

The income and hours advantage among the self-employed does not hold up in other jobs that employ large numbers of workers with a similar demographic profile. In construction and mining, for example, both earnings and hours are lower among the self-employed; in food service, the self-employed work longer hours for less money per hour than wage and salary workers.

But it is not all guaranteed upside for drivers considering going independent. The very best owner operators have the potential to earn a lot more per hour — and the worst owner operators risk earning a lot less per hour — compared to company drivers. The top decile of owner operators earn 52 percent more per hour than company drivers, about $19,200 more over the course of a year after controlling for demographic factors; the bottom decile of owner operators earn 30 percent less per hour than company drivers, about $11,000 less over the course of a year.

Owner operators also work about 2 percent more hours, which translates to about 1.1 more hours on the job each week than company drivers. It is possible that, in the past, some owner operators were able to work longer hours by skirting federal rules that limit the number of hours they can be on the job. In 2017, new requirements came into force that mandate truckers track their hours using electronic logging devices (ELDs), making it much harder to get around driving limits put in place by the government to enforce safe driving. So it’s not necessarily the case that this pattern of longer hours for owner operators will continue in the future.

Of course, there are risks to self-employment as well. The self-employed assume the risks of business investment, so when the business climate sours, their personal assets can be on the line. Owner-operators are more exposed to the ups and downs of the business cycle. During the boom years of 2005 and 2006, the hourly earnings premium for owner operators was around 16 percent, but in 2008-09 during the depths of the Great Recession, it essentially disappeared. There are other financial risks too: Owner operators are responsible for the maintenance and repair of their vehicles, and their livelihoods are on the line whenever mechanical issues arise. However, in no year have owner operators earned on average less than company drivers. [5]

Despite the risks, the upside for truckers who want to be self-employed is clear: Being an owner-operator can be both more lucrative and provide more autonomy for the best drivers.

View our economic commentary disclaimer here.

[1] This analysis includes only workers whose primary occupation is at a business they own. It does not include individuals who have a second or third job in a self-owned business, such as gig-economy workers. It also excludes public-sector workers. Current number from the U.S. Census Bureau American Community Survey, 2015-17; historical trend from U.S. Census Bureau, Current Population Survey, Annual Socio-Economic Supplement, March 1990 to March 2018, both made available by the University of Minnesota, IPUMS-USA.

[2] “Truck drivers” in this analysis is based on the Standard Occupational Code 53-3030, “Driver/Sales Workers and Truck Drivers”. It includes workers in jobs beyond what is traditionally thought of as “truck drivers” (e.g., 53-3031 Driver/Sales Workers and 53-3033 Light Truck Drivers, with 53-3032 Heavy and Tractor/Trailer Truck Drivers closest to the common definition), but is the most detailed occupational grouping available in American Community Survey microdata. Driver/Sales Workers and Light Truck Drivers have substantially lower earnings than Heavy and Tractor/Trailer Truck Drivers (35 percent and 19 percent lower respectively in 2018 according to other government data sources), which results in lower overall reporting earnings compared to more narrow definitions of “truck drivers.”

[3] Owner-operators includes any driver who responded to the American Community Survey that they were employed in their own incorporated or unincorporated business or professional practice. Some truckers, known as leased owner operators, lease their vehicles and operate under another carrier’s authority. It is not obvious how these individuals would respond to the Census Bureau question on self employment.

[4] Dollar figures reported in 2017 dollars, inflation adjusted using the Consumer Price Index. Convoy analysis of U.S. Census Bureau, American Community Survey, 2015-17 made available by the University of Minnesota, IPUMS-USA.

[5] Convoy analysis of U.S. Census Bureau, American Community Survey, 2005-2017, made available by the University of Minnesota, IPUMS-USA.