Blog

Data Science, Freight Research, Industry Insights

Freight Market Update: A holiday humbug begins taking shape early in Q4

Freight Research • Published on November 11, 2022

Our October Freight Market Update analyzes data from multiple sources to help you stay in tune with the market, arm your decision making with information, and help you better manage your freight. Download the full October Freight Market Update report.

October 2022 freight market summary

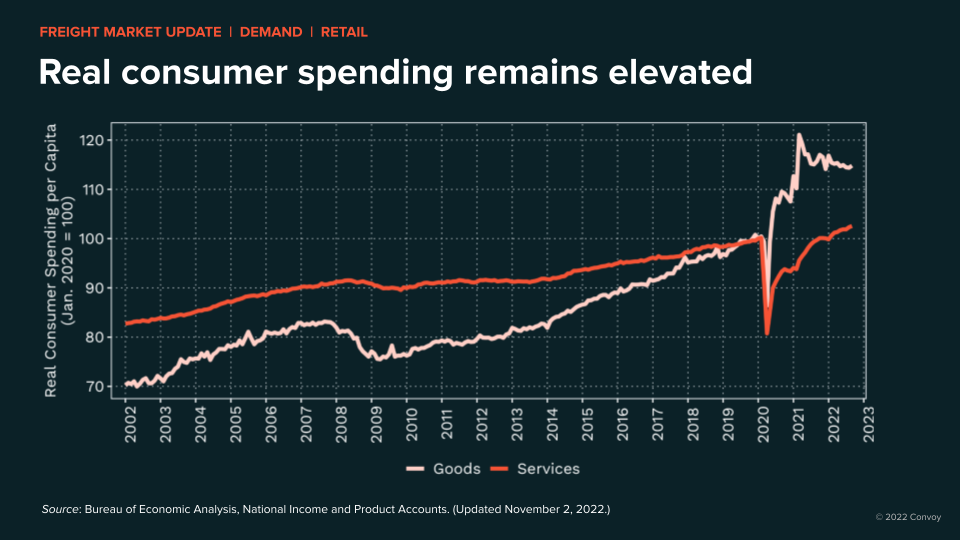

- On-going voracious consumer spending helped drive third quarter growth in GDP, with GDP increasing at an annual rate of 2.6%. However, the mix shift in purchases towards services, combined with fluctuating consumer preferences for goods, is resulting in record inventory backlogs for retailers and merchant wholesalers.

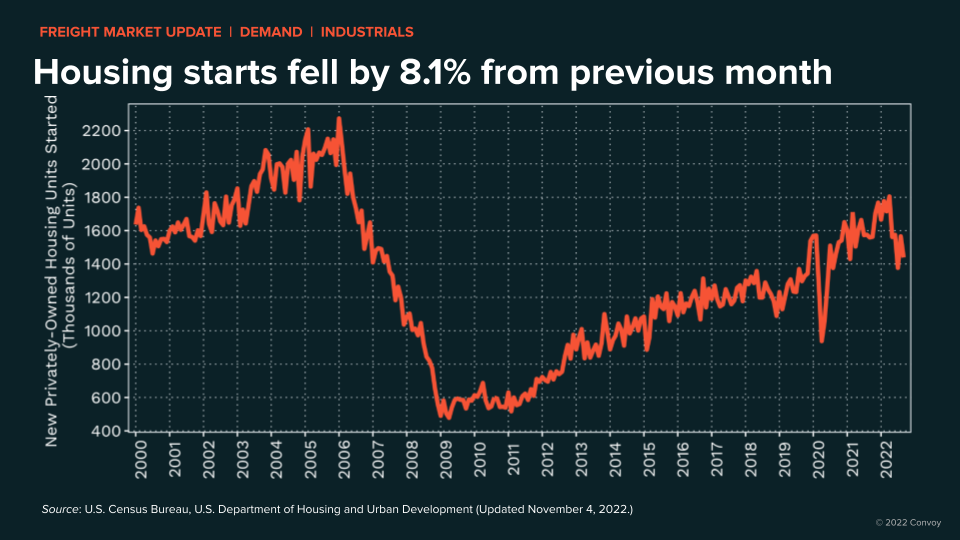

- Successive interest rate hikes rapidly depressed home buying and building. Simultaneously, slowing automotive manufacturing and plateauing of oil rig deployment is resulting in lower overall demand outside the retail sector.

- Market softening persists with the lowest observed tender rejection rates of this freight cycle (rates slipped to 5%) alongside some of the largest spot-contract spread. While some capacity is leaving the market, the early signs point towards lower holiday demand and a continued soft market into Q1.

Freight demand by industry

Consumer retail outlook

- Consumers continue spending at record levels as service purchases reach another new high.

- Expectations on future spending decreased, in part due to (likely unsustainable) historically low savings rates.

- Despite elevated spending, inventory backlogs for retailers and merchant wholesalers set another record.

Food and beverage outlook

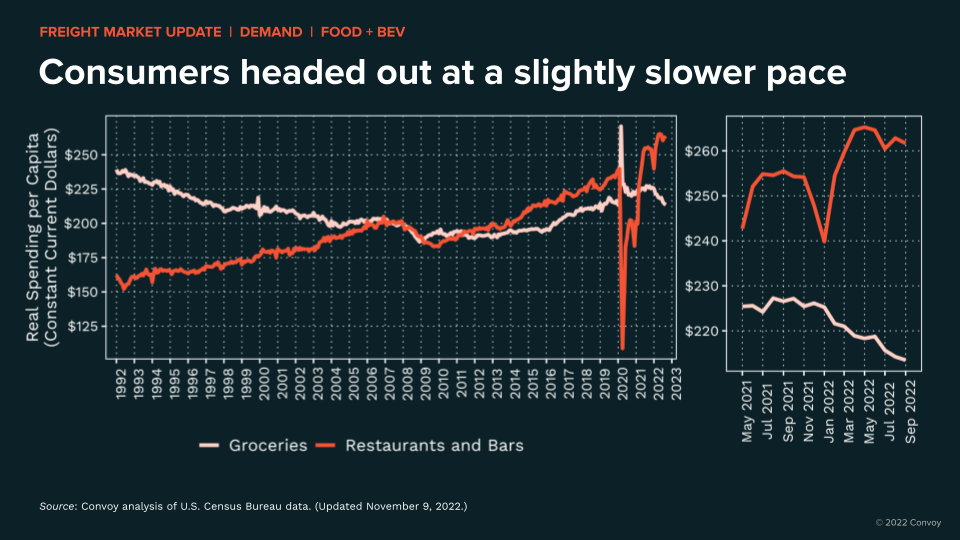

- Restaurants and bar spending shows slight softening, although still near historic levels as consumers continue reducing grocery purchases.

- Interest rate increases are lowering current and future expectations on agricultural business environment.

- The unusually dry fall left two-thirds of the country in moderate or worse drought conditions, putting pressures on late season and winter crop production.

Industrials outlook

- Current and future business perceptions are predominantly negative and generally continuing a downward trend.

- Two decade high mortgage rates are depressing interest in housing and rapidly slowing new construction.

- Lagging automotive manufacturing compared with historic levels and slowing deployment of new active rigs for oil production suggest limited demand through end-of-year.

Freight Supply

Labor, fuel, and equipment overview

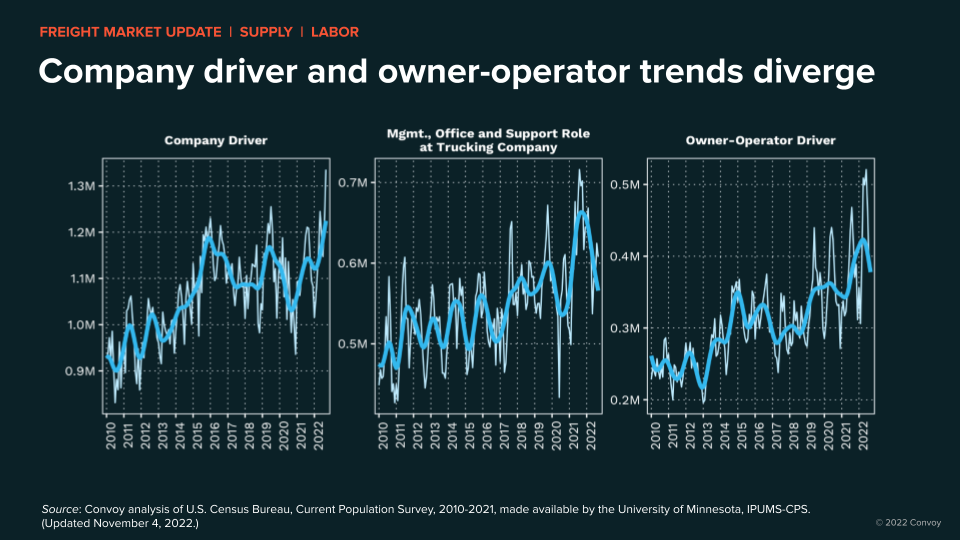

- Asset carriers now employ a record number of drivers while owner-operators are down 25% from the summer peak, suggesting a driver movement away from self-employment.

- Tractor orders jumped by 30,000 in September, leading to the highest net replacement levels since 2018.

- Trailer production substantially ramped up compared with previous year manufacturing constraints, however prices continue escalating due to inflationary pressures.

More on Freight Market Trends

▶️ Interested in additional freight market insights and trends? To get fully up to speed on macroeconomic trends and their impact on freight, hear what’s top of mind for Fortune 500 shippers for Q4, and learn the best planning tips for the peak season, view our 25-minute on-demand webinar.

Watch Q3 2022 Freight Market Update.