Blog

Data Science, Freight Research, Industry Insights

Freight Market Update: A mixed happy and humbug holiday season

Freight Research • Published on December 13, 2022

Our November Freight Market Update analyzes data from multiple sources to help you stay in tune with the market, arm your decision making with information, and help you better manage your freight. Download the full November Freight Market Update report.

November 2022 freight market summary

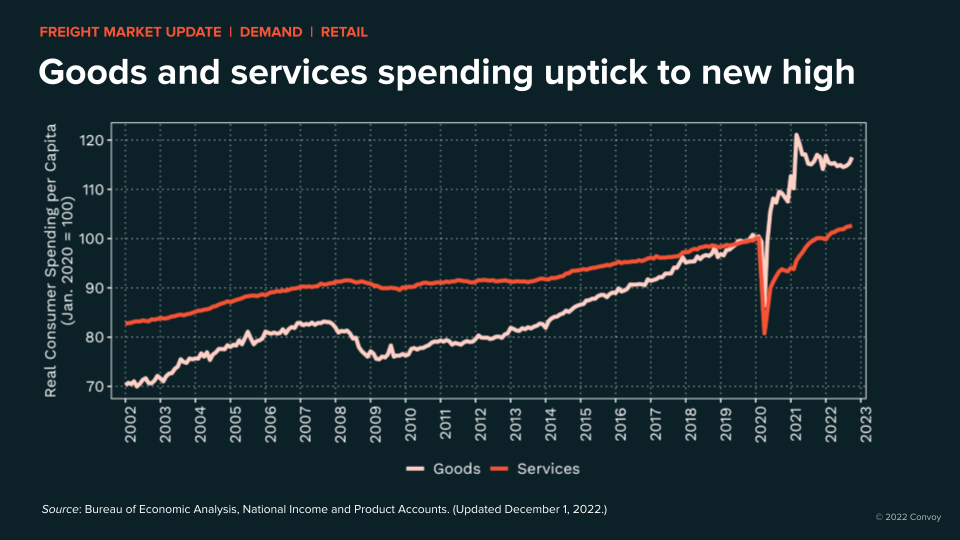

- Despite perceived economic headwinds, real consumer spending remains elevated as both goods and services experienced saw upticks from previous months. Spending comes at the continued expense of savings, making it difficult to anticipate how long demand persists.

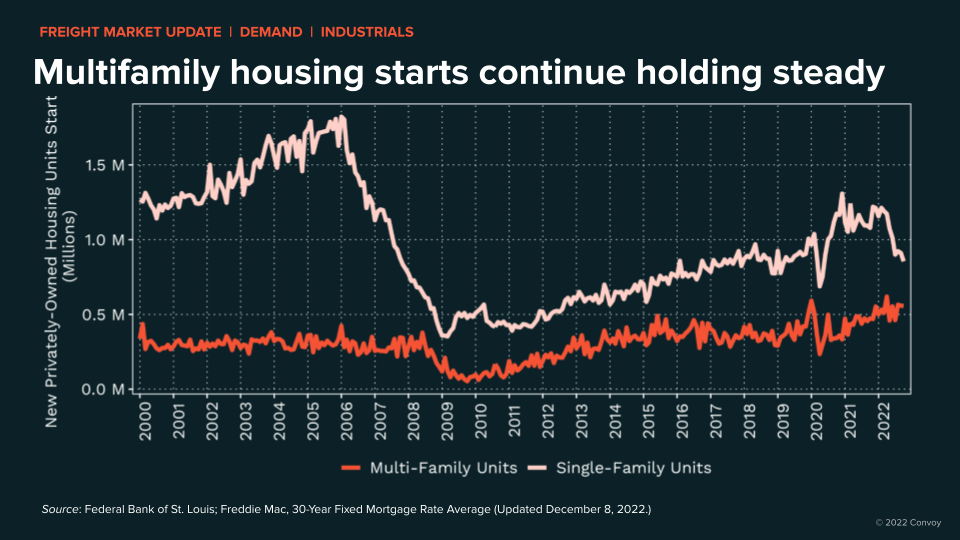

- Single family home building fell, although multifamily appears to be relatively unchanged. Combined with a return of automotive production to more typical levels, demand is stronger than previously anticipated.

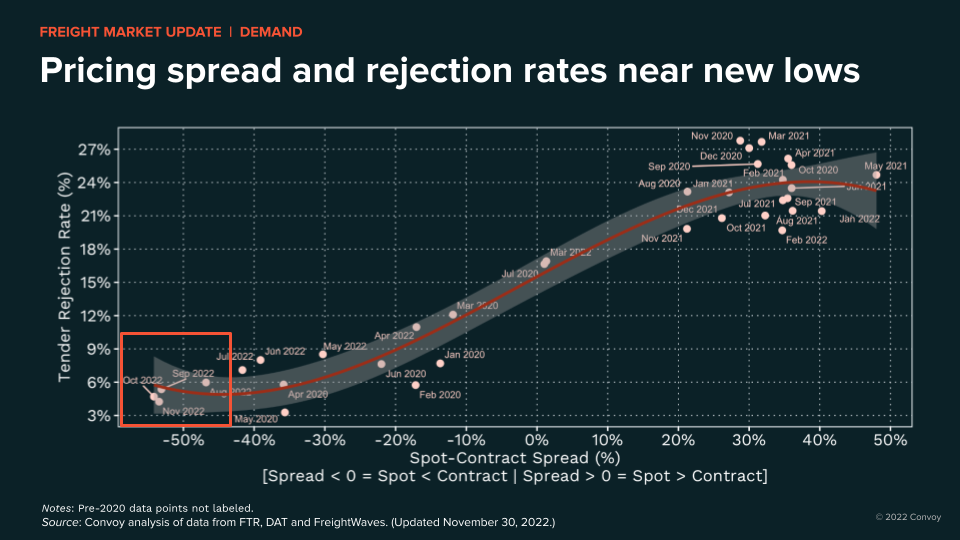

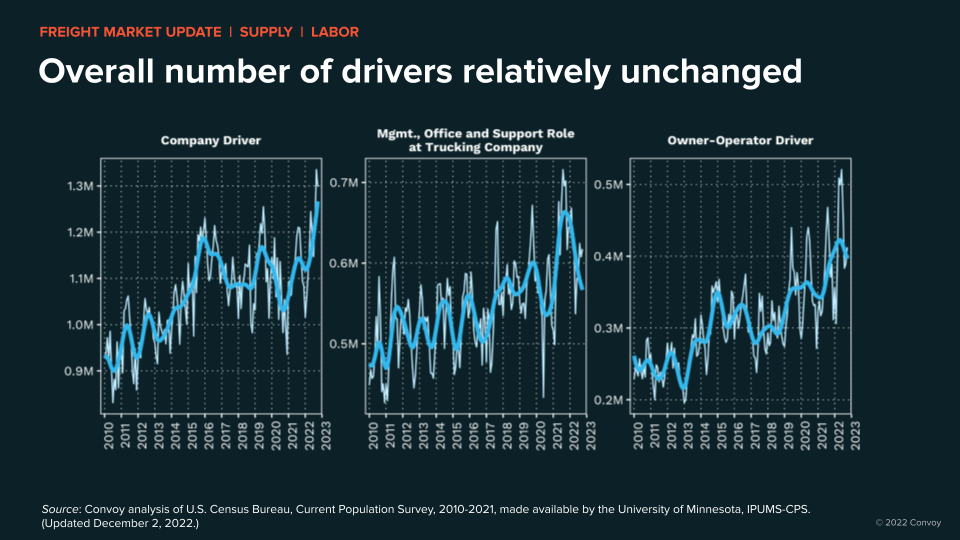

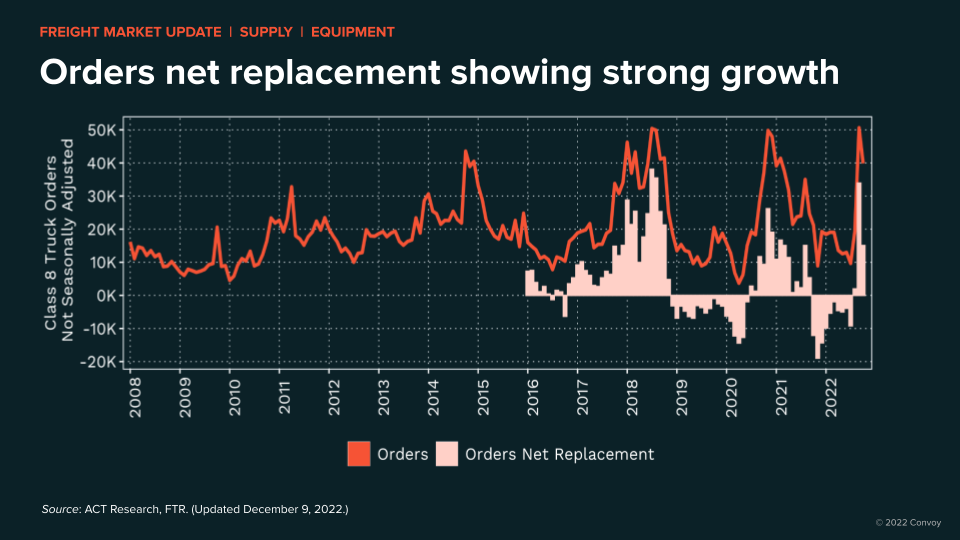

- Excess capacity (with more on the way based on recent Class 8 truck orders) is still present in the market. While rates may increase slightly during December, the ongoing soft market shows limited sign of changing heading into Q1.

Looking ahead to 2023

- Expect the gap between contracted rates and spot to narrow in early 2023 as shippers reset contracts. Balancing cost and service necessary for weathering any 2023 volatility becomes critical. Best-in-class shippers are contracting static volumes and exploring more elastic solutions for volatile or lower-volume lanes.

- The expected lull in demand cycle presents an opportunity to improve systems and processes. Leaning into data and insights to identify and address bottlenecks / performance issues now can help prevent issues during subsequent freight cycles.

- After a tumultuous past couple of years, shippers get a bit of a mulligan in 2023 for price, cost and capacity. Using this time to modernize supply chains and advance digital adoption allows shippers to enter the future tightening market from a position of strength.

Freight demand

Freight supply

More on Freight Market Trends

▶️ Interested in additional freight market insights and trends? To get fully up to speed on macroeconomic trends and their impact on freight, hear what’s top of mind for Fortune 500 shippers for Q4, and learn the best planning tips for the peak season, view our 25-minute on-demand webinar.

Watch 2022 Freight Market Update.