Blog

Data Science, Freight Research, Industry Insights

Freight Market Update: 2023 begins as a soft but more “normal” market

Freight Research • Published on January 9, 2023

Our December Freight Market Update analyzes data from multiple sources to help you stay in tune with the market, arm your decision making with information, and help you better manage your freight. Download the full December Freight Market Update report.

December 2022 freight market summary

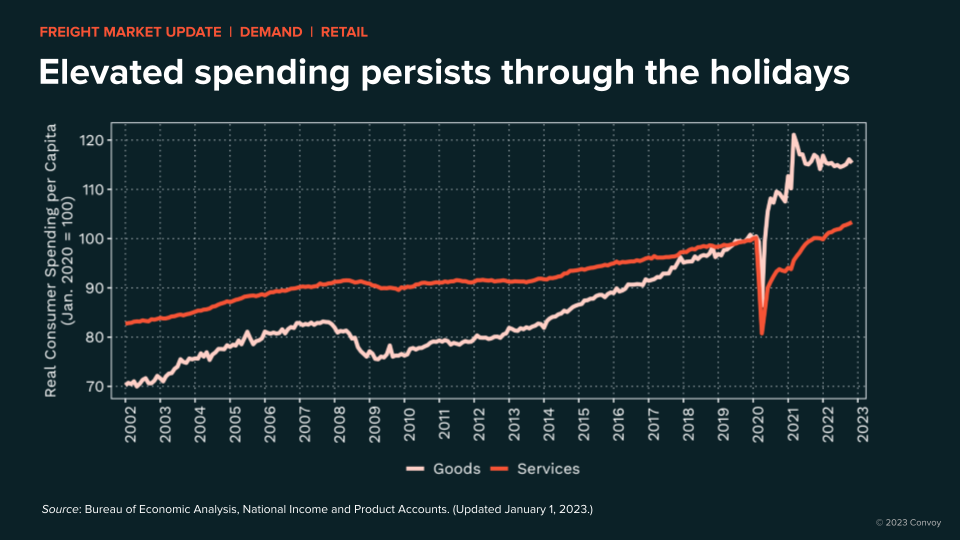

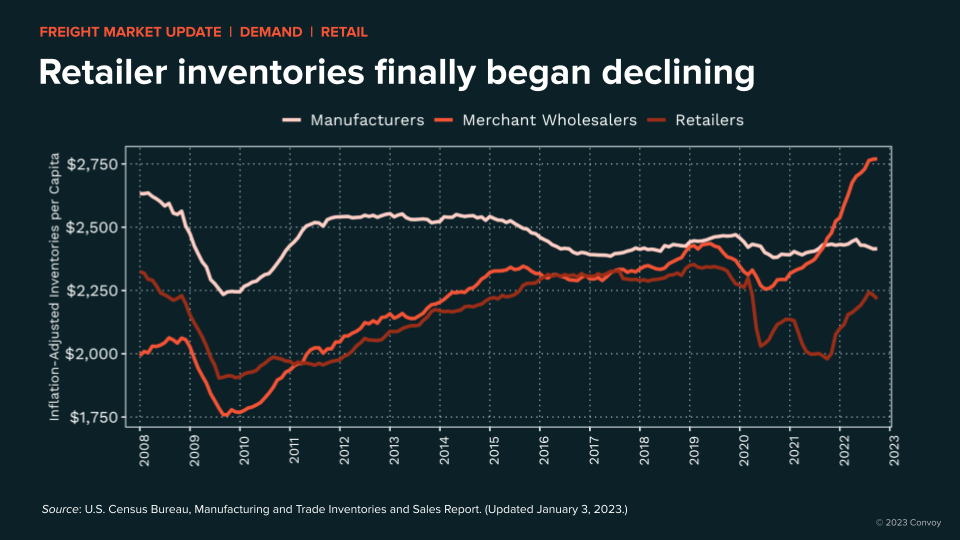

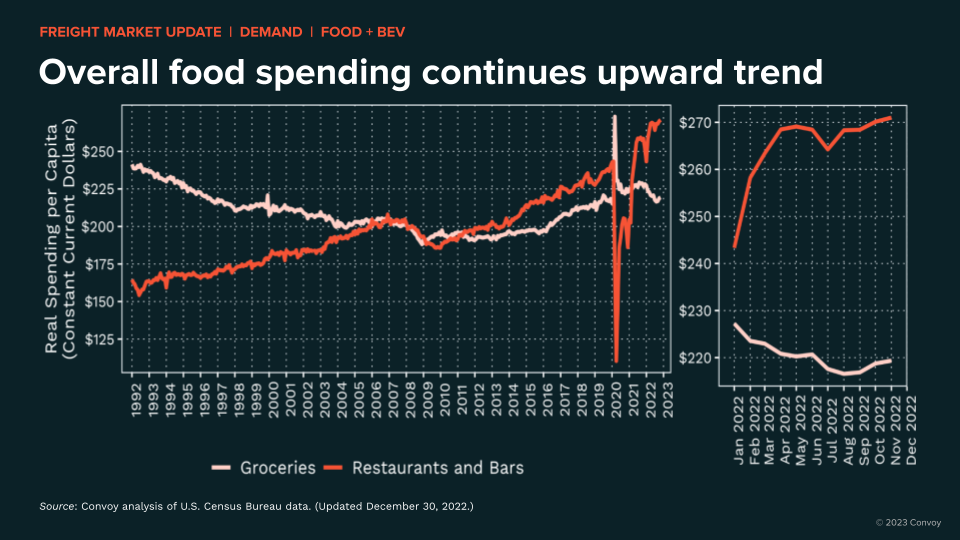

- Elevated consumer spending persisted as services spending continued on an upward climb. Combined with retailer inventories finally beginning to decline, demand appears headed toward more typical seasonal patterns.

- Interest rate increases are slowing automobile production and development of single-family homes. While multi-family home starts trended upward, overall materials demand associated with housing and vehicles should continue softening through Q1.

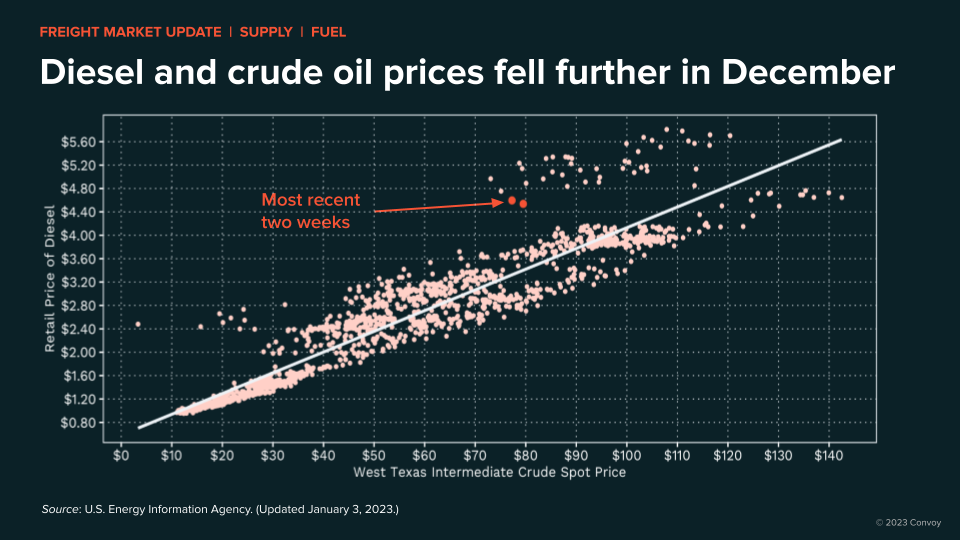

- Diesel prices dropped to lowest levels since early 2021. This eases some of the financial pressures on owner-operators and means excess capacity likely remains prevalent through the beginning of Q2.

What this means for you as 2023 begins

- The Q1 RFP cycle creates an opportunity for best-in-class shippers to review all partners for the value they add and clean their books of non-strategic partners and 3PLs accumulated during the COVID capacity grab. Reducing the number of carriers boosts efficiency (fewer carrier scorecards, updates, reviews, etc.) and helps limit potential liability associated with riskier carriers that worked their way into routing guides.

- Smart shippers are focused on strategic partners who are vested in jointly solving problems and guarding against the illusion of savings through paper rates offered up at this trough of the market. In particular, finding partners who can boost digital capabilities helps hedge against potential productivity declines if headcount reductions become necessary.

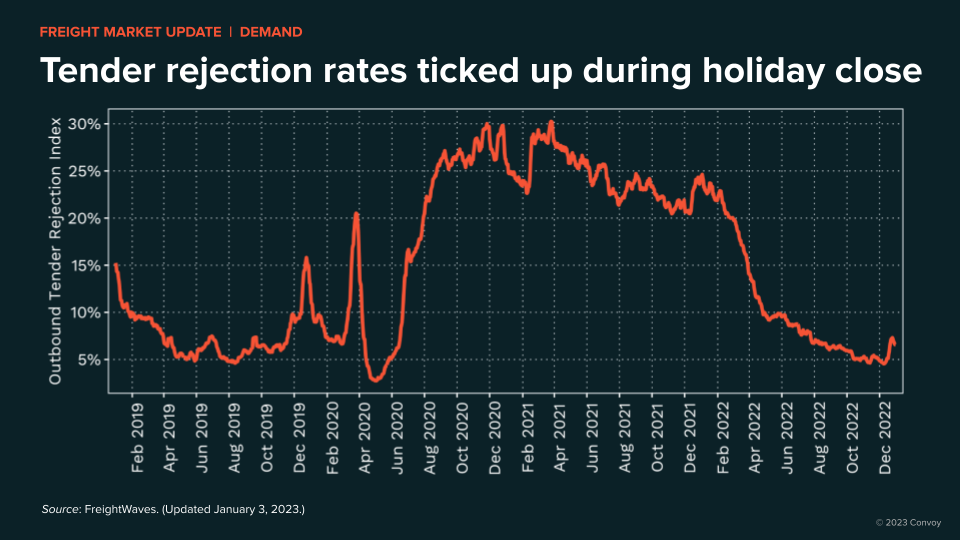

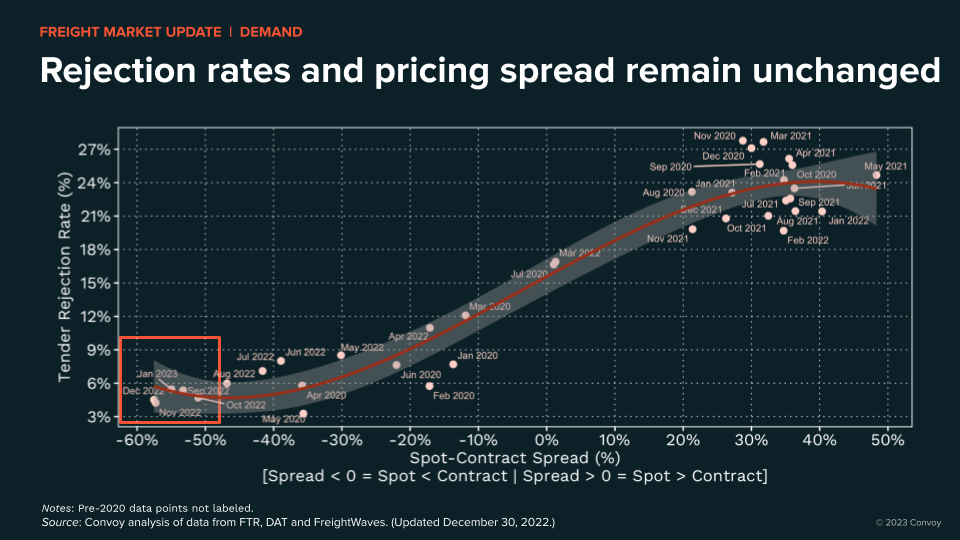

- A market tightening is likely coming at some point in Q2. That tightening may come quicker if consumer demand remains elevated and diesel costs rise due to unexpected external events (forcing capacity out of the market). A tightening may come later in the summer if demand falls and if diesel prices go lower.

Freight demand overview

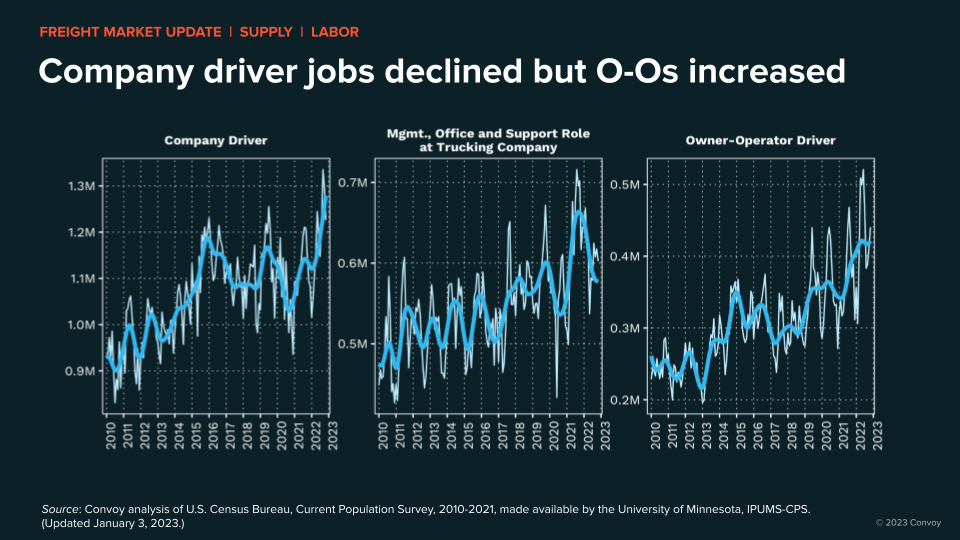

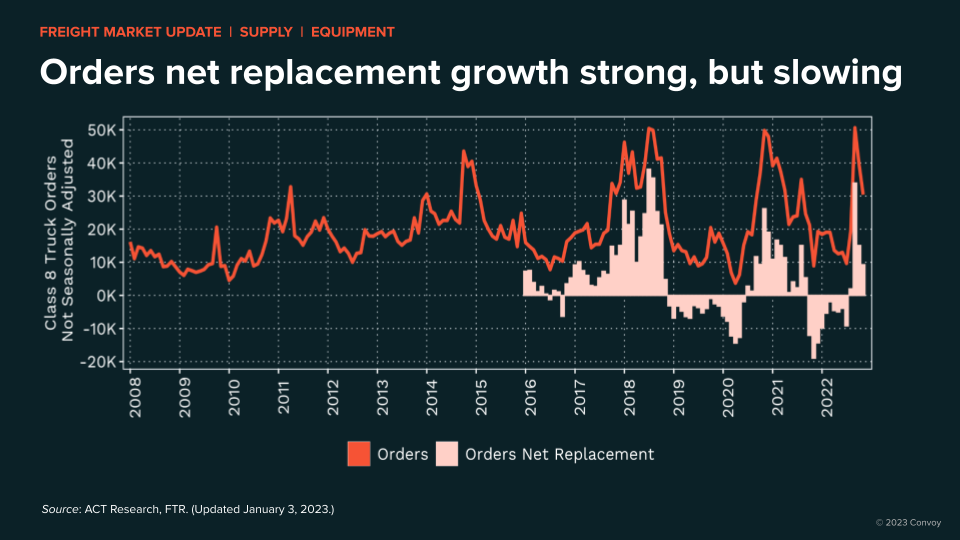

Freight supply overview

More on Freight Market Trends

▶️ Interested in additional freight market insights and trends? To get fully up to speed on macroeconomic trends and their impact on freight, hear what’s top of mind for Fortune 500 shippers, and learn the best planning tips for the peak season, view our 25-minute on-demand webinar.

Watch 2022 Freight Market Update.