Convoy’s approach to estimating and forecasting truck driver employment

Freight Research • Published on June 5, 2020

The BLS’ monthly Employment Situation report includes a measure of employment in Truck Transportation businesses. However, because of the definition that BLS uses, that number excludes about half of the individuals who work as truck drivers.

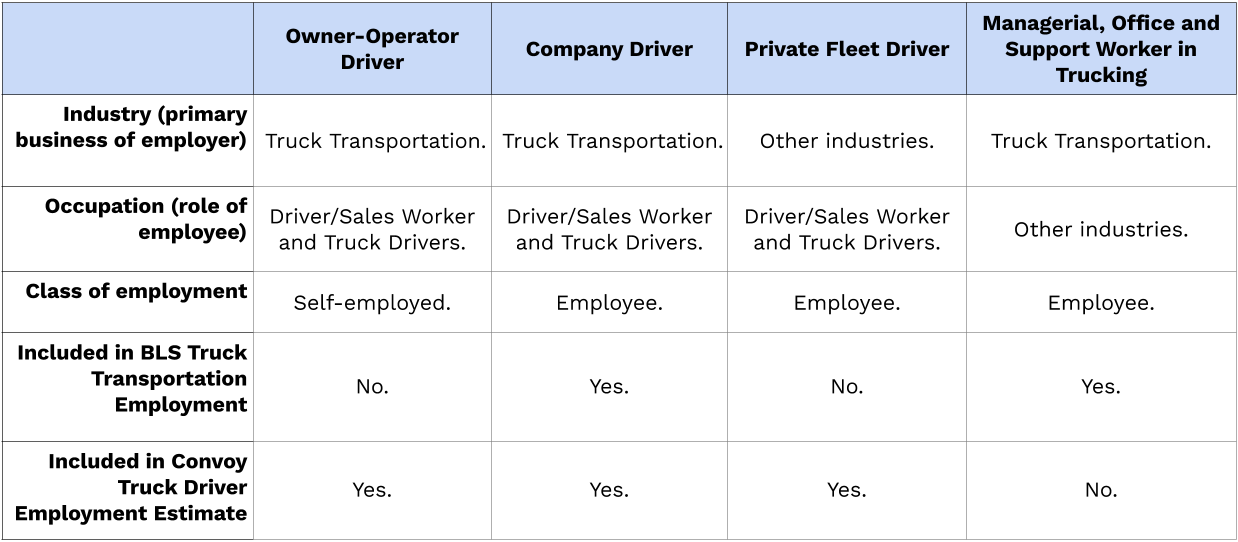

The difference between the Truck Transportation employment number reported by BLS and a more obvious accounting is driven by the distinction between industry and occupation employment, and the fact that BLS’ monthly report includes only payroll employees (i.e., excludes the self-employed). The BLS Employment Situation reports industry employment — which is based on the primary business of a worker’s employer.

A more useful categorization distinguishes between four types of workers based on their particular role (occupation), the primary business of their employer (industry), and their employment class (self-employed or employee, sometimes referred to as “1099 employment” as opposed to “W-2 employment,” in reference to the relevant federal income tax forms for each employment class).

We estimate employment in each of the more detailed categories using individual survey response data in the U.S. Census Bureau’s Monthly Current Population Survey (CPS). CPS data are part of the BLS’ monthly Employment Situation report and are used to produce official estimates of the unemployment rate and labor force participation rate. The individual response data (microdata) are typically released a week or two after the BLS report. We access the harmonized CPS microdata files published by the University of Minnesota’s, Integrated Public-Use Microdata Series, IPUMS-CPS.

The estimates that Convoy produces for each detailed category described above are based on a model which incorporates both historical (ARIMA) movements in the CPS employment numbers for each category, as well as each category’s relationship to the BLS’ reported Truck Transportation industry employment. All series are first-differenced to permit forecasting.

The pre-release forecast of Truck Transportation industry employment is based on a model that incorporates both historical movements in the series as well as the relationship between the series and several other labor market indicators which are published prior to the monthly Employment Situation report, including:

- Continued Claims for Unemployment Insurance (monthly average of weekly data);

- New Business Applications (monthly average of weekly data);

- the General Business Conditions Index from the Federal Reserve Bank of New York’s Empire State Manufacturing Survey;

- the Employment Diffusion Index from the Federal Reserve Bank of New York’s Business Leaders Survey;

- the Employment Diffusion Indexes from the Federal Reserve Bank of Dallas’ Texas Manufacturing Outlook Survey, Texas Retail Outlook Survey, and Texas Service Sector Outlook Survey; and

- The truckload carrier bankruptcy rate from Convoy analysis of compliance data.

View our economic commentary disclaimer here.