Are Recession Clouds on the Horizon?

Freight Research • Published on June 25, 2019

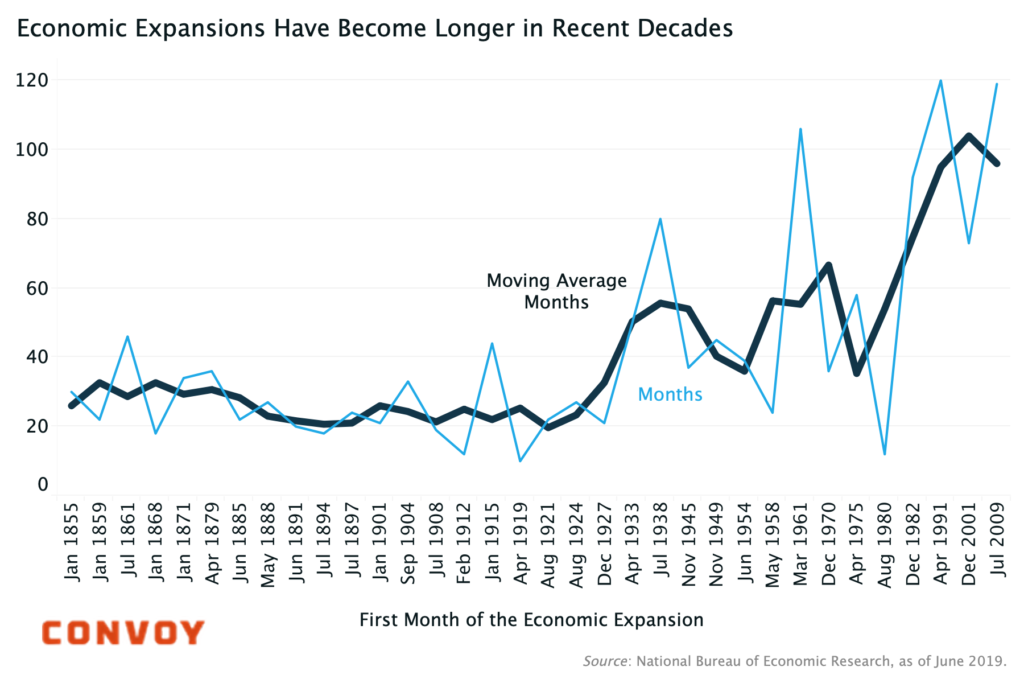

This July, the United States economy marks the 120th consecutive month of economic growth. The economic expansion that began in June 2009 is now the longest period of sustained growth in American history.

It is a nervous anniversary. With each passing month the questions grow louder, asking how long the good times can continue. Recent economic data have added fuel to that fire. Traditional warning signs of a turning point in the economy — such as the yield curve — have been flashing for some time. But the most important data points — unemployment, growth and inflation — remain solid, if undeniably softer than a year ago.

Amid the noise of incoming data and the 24-hour news cycle, three points merit keeping in mind over the weeks and months ahead.

First, there is nothing mechanical about the lifespan of the business cycle. While the longest expansion in U.S. history is now at a decade and counting, other countries have experienced much longer periods of sustained growth: Australia has not had a recession in almost 30 years. Within the United States, there is a wide diversity of local economic experiences: A handful of oil-producing states experienced a short-lived recession in 2014-15 while the rest of the country was still growing. The expansion will end eventually, but not just because it has gone on too long.

Second, economists are notoriously bad at predicting the precise timing of recessions too far in advance. But there is usually a good sense of where imbalances have built up in the economy and what sectors are exposed to risks from a sudden shock. For at least two years now, polls of economists have regularly pointed to trade risks as a potential spark for the next recession when it does eventually arrive.

Third, while we like to think of the economy as alternating between expansions and contractions, reality is more complicated. Unlike economists’ charts, there are no bright lines in time or shaded bars in the soil dividing booms from busts. Instead, economic activity ebbs and flows. As in the freight industry over the past few months, there are periods of slowing — if not outright contracting — economic activity that don’t quite meet the bar to qualify as a recession.

Policy uncertainty clouds the economic horizon, and can harm business’ ability to make long-term investments. No recession is identical and, despite the universal desire to see patterns across time, recessions have become increasingly infrequent and increasingly idiosyncratic. That is one reason that makes the current moment so difficult.

It’s not a foregone conclusion that the United States economy is overdue for a recession. With better access to timely data, our economic policymakers and business leaders should be better able to respond in real time to subtle shifts in economic conditions, making it particularly hazardous to make definitive long-term calls. The longest expansion in United States history cannot go on forever, but it’s not over just quite yet either.

This economic commentary was originally published in the June 2019 issue of the Council of Supply Chain Management Professionals (CSCMP) Monthly Newsletter.

View our economic commentary disclaimer here.