FreightWaves October Webinar Recap

Carriers, Shippers • Published on October 27, 2018

Thanks to all who attended FreightWaves’ October Monthly webinar sponsored by Convoy. Overall, October was a slow month for freight. The market is starting to come down from recent peaks, slowing demand, while capacity is steadily increasing.

Hurricane season came and went with much less impact on the US logistics network than in years past. Hurricanes Michael and Florence were estimated to impact $60B in damage. For context, last year, US hurricanes caused $210 billion in total damage and hit more metropolitan areas.

Below, we summarize the webinar for the demand and supply sides of the market and add insights from Convoy to prep for a successful holiday season.

Demand – The Economy is Strong. Is it Peaking?

We’re seeing macroeconomic indicators soften in Q3. GDP YoY Growth is down to 3.5% from 4.2% in Q2. While down from highs, this still shows strength in the economy for the next few months.

Geopolitical shifts have largely impacted Los Angeles. NAFTA renegotiations were by and large negligible on logistics markets, but Chinese tariffs have caused freight flows to increase into LA as companies increase inventories ahead of some tariffs jumping from 10% to 25% on January 1, 2019. Look for LA to remain a hotspot for freight on top of normal holiday seasonality.

Supply – The Bottleneck is (Slowly) Loosening

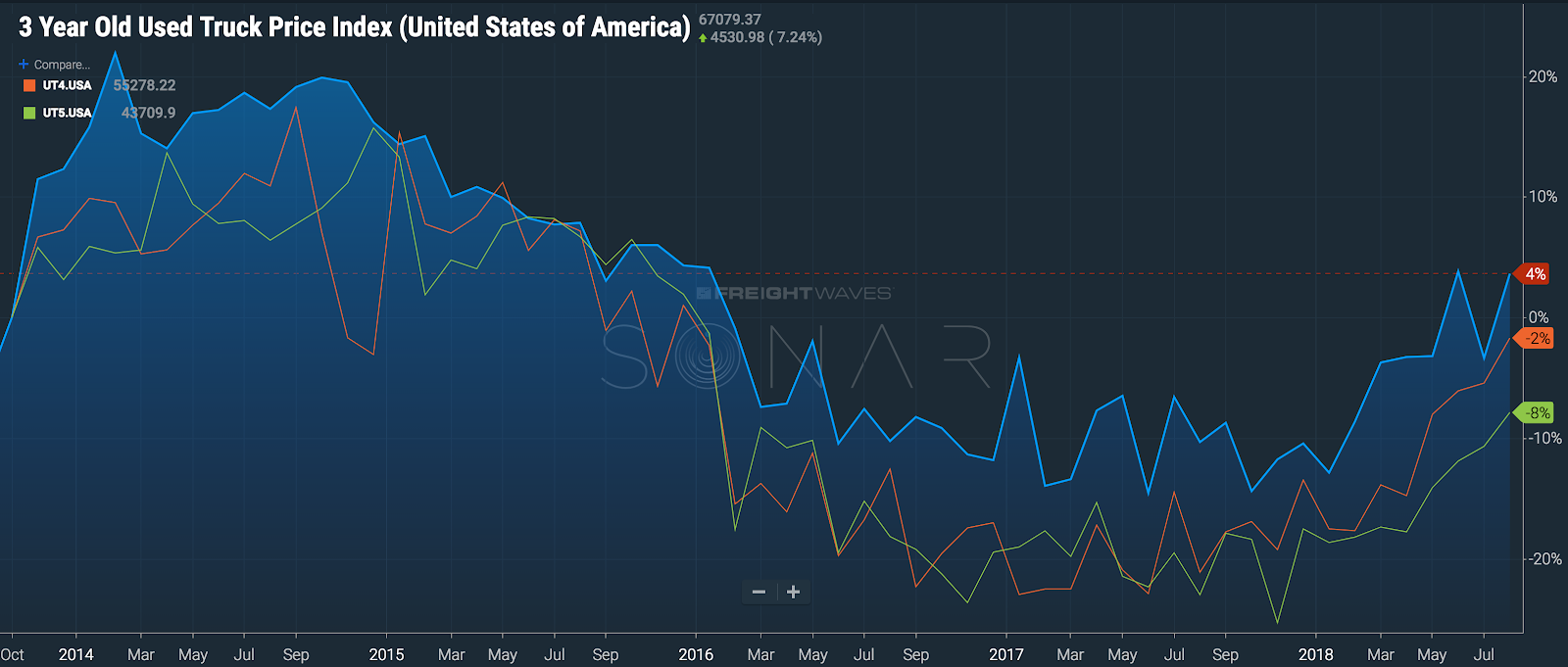

The trucking supply story for October is more of the same. Capacity is slowing increasing, but not enough to meet demand – yet. We’re seeing hiring in trucking up more than other industries with +2.2% YoY trucking versus +1.5% for all non-farm roles. Other signals are pointing to capacity continuing to increase. New truck orders are at an all time high while used prices are also peaking. We’re noticing fewer manufacturing reports citing driver shortage as their bottleneck.

Convoy Recommendations – Move Freight NOW

Dry van and reefer demand is expected to continue to increase throughout the holidays. Shipping costs will increase with demand. Between now and mid-November shippers should take advantage of low rates and move as much freight as possible. In a few weeks, demand will start to spike and we will hit the holiday season. When drivers take vacation to be with their families, supply decreases, and spot prices go up.

Shippers want to learn more about our industry-leading tender compliance, on-time service and data-driven insights? Request a demo or call us at 206-209-0305.

Carriers – interested in a hassle-free experience, automated detention, free quick pay and unique offerings such as Request-A-Load? Call us at 206-202-5645