FreightWaves: December Market Trends

Industry Insights, Shippers • Published on December 19, 2018

Thanks to all who attended FreightWaves’ December monthly webinar, sponsored by Convoy.

December 2018 Market Trends

We discussed how demand has been cool for the holiday season because 1.) shipping had been relatively uninterrupted by hurricanes or other major storms this fall, and 2.) the economy has begun to plateau. With tariffs pushed back a quarter, the largest risk for supply constraints in the short term will be winter storms. We’re seeing increased tender acceptance as spot rates have remained calm relative to a typical December.

Below, we summarize the webinar for the demand and supply sides of the market — and add our own insights — so you can prepare for a successful new year.

Demand – High Summer Peak Is Smoothing Holiday Spikes

Before we look at present demand, we need to contextualize 2018 trends. As we’ve discussed in previous blogs, the summer demand peak was much higher than usual this year. The economy was expanding, and shippers wanted to get ahead of storm season after a rough 2017, where seven hurricanes made landfall in the Eastern U.S. This fall was a calmer season with only two hurricanes hitting land. Demand moved unblocked, and truckers were not pulled from around the country to deliver emergency supplies.

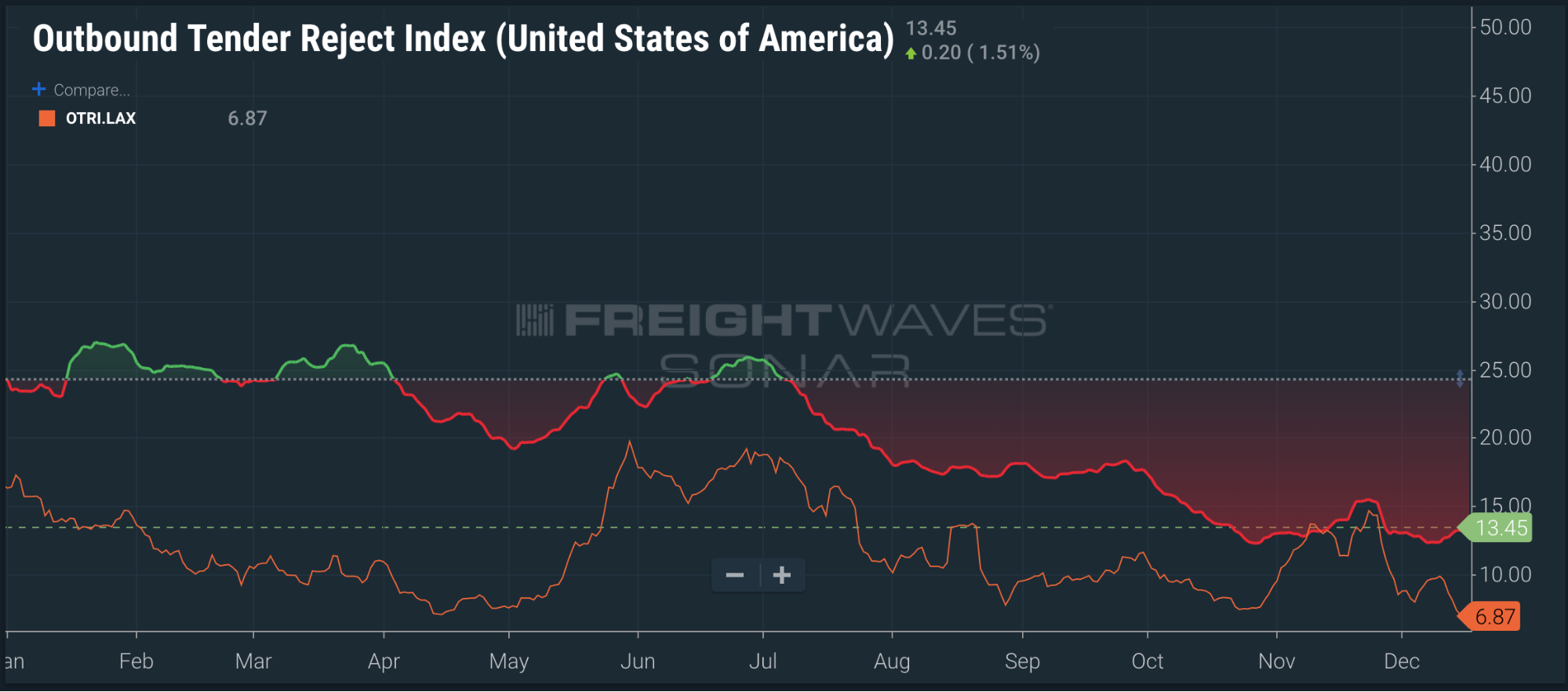

All of these factors have led to fewer delays in supply chains, reducing pressure to move freight before the end of the year. Looking forward, we also see relief in the L.A. market because the tariff increase (from 10% to 25% on Chinese goods) is delayed until Q2 2019. Looking at the data, we’re seeing depressed spot rates and tender rejection of contracts.

Outlook – Looming Government Shutdown?

The headlines in the news right now are highlighting the possibility of a government shutdown. This may have little effect on demand, depending on the length of the shutdown. We will revisit in January if the shutdown is ongoing and starts to affect the economy.

Instead, we are focusing more on Federal Reserve policy. The Fed raised rates to 2.5% on Wednesday 12/19 while indicating fewer expected raises in 2019 then previously stated. This will combat inflation and the increasing value of the dollar, which is hurting exports, especially to Europe. Fed policy could begin to limit growth. The Fed has committed to making data-driven decisions in 2019 as new information becomes available, making them more responsive and nimble.

Looking to 2019 and beyond, economic output is quickly plateauing. We see nondurable manufacturing (e.g., clothes, food, office supplies) dropping for the previous four months. This has been partially offset by tax cuts — but these are temporary boosts, not permanent solutions.

The energy sector has also provided support for overall demand. With WTI hovering under $50 and recent oversupply reports and OPEC struggling to control their supply, investment in new supply has a decreasing return on investment. This will limit just how long the energy sector will support demand.

Supply – 2018 Will End Much Calmer Than 2017

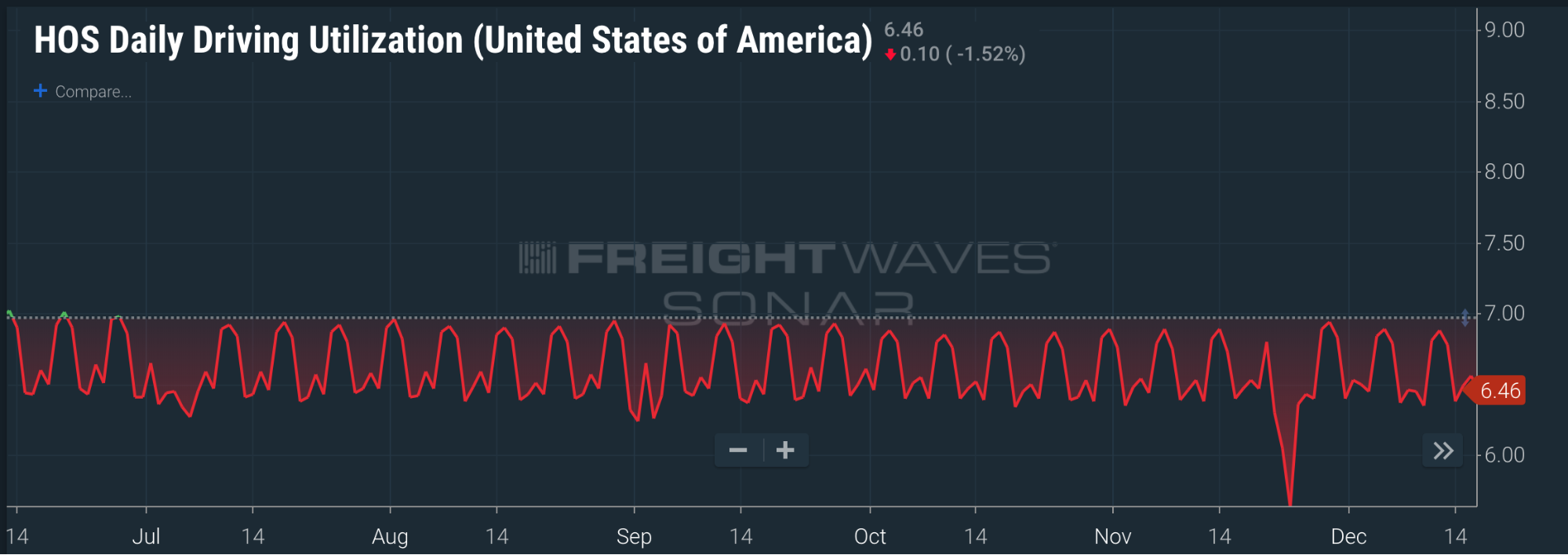

Spot rates this December look to be much calmer compared to last year when ELDs were mandated for all trucks. The effects of ELDs are now fully baked into the markets, so comparing the spot market to this time last year is comparing apples to oranges. We’ve also seen the red-hot flatbed market cool down as construction slows for seasonality, and delayed freight is finally being delivered. Spot rates baked in heavy premiums this summer to meet peak demand. Now, stagnant demand is keeping spot rates low. We’re seeing this in the data, as hours of service are holding steady at autumn levels rather than moving toward summer peaks.

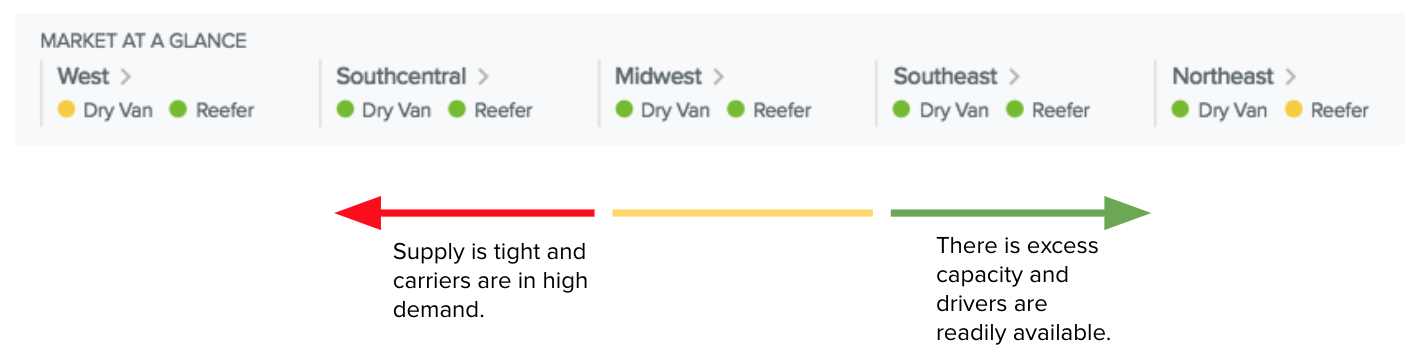

Our Convoy Market Supply Index shows almost the entire country has strong supply. Western dry vans should continue to be tighter than the rest of the market while shippers increase imports from China, but they’re not at June levels yet. The major spot risk is winter storms closing down roads and backing up supply chains. Otherwise, we expect this supply capacity to last well into Q1.

Looking forward, supply is continuing to catch up to demand in capacity. Signals like trucking hires, delays for new trucks, and used trucking prices are pointing to capacity increasing at full steam ahead. As demand plateaus, we expect this to begin to taper. Otherwise, we could see oversupply and rates decreasing. This will dry up the spot market, which has been at record levels in both price and size for the past year or so.

Our Recommendation: Contract Freight Can Move in December

Carriers can look to work on holidays if they want to get favorable spot rates. Holiday premiums this year will be fairly muted. If you take time off for the holidays, make sure to get your contracts organized so you can maximize your revenue in January when the spot market dries up.

Shippers can continue to move freight throughout the holidays relative to other years. You can tender over contracted rates and have some confidence they will be accepted. Last year was likely a blip due to ELDs, and spot rates should reduce like normal in the new year. Also, Q1 is bonus time ahead of increased tariffs in Los Angeles. Plan accordingly and reduce your costs.

Shippers – interested in learning more about our industry-leading tender compliance, on-time service, and data-driven insights? Contact us.

Carriers – interested in a hassle-free experience, automated detention, quick payments, and unique offerings such as Request-A-Load? Contact us.