What the August Employment Report didn’t tell us about trucking jobs

Freight Research, Shippers • Published on September 4, 2020

The Bureau of Labor Statistics’ (BLS) monthly Employment Situation Report is widely recognized as the most authoritative portrait of real-time economic activity. But for the freight industry, the report provides an incomplete snapshot of the state of trucker employment.

This morning’s data showed a 0.7% (10,000, seasonally adjusted) increase in truck transportation jobs in August — practically flat compared to larger job gains in other sectors — but the headline numbers overlook two important facts about the trucking labor market as the economy emerges from the depths of the Covid-19 recession.

- Fact: Almost one-in-four independent truckers sat on the sidelines of the market in July

The BLS data do not include owner-operators — the self-employed truckers who account for nearly one in ten drivers in normal times — and over the course of the pandemic, the behavior of these truckers has been very different from company drivers who are on the payroll of a trucking company.

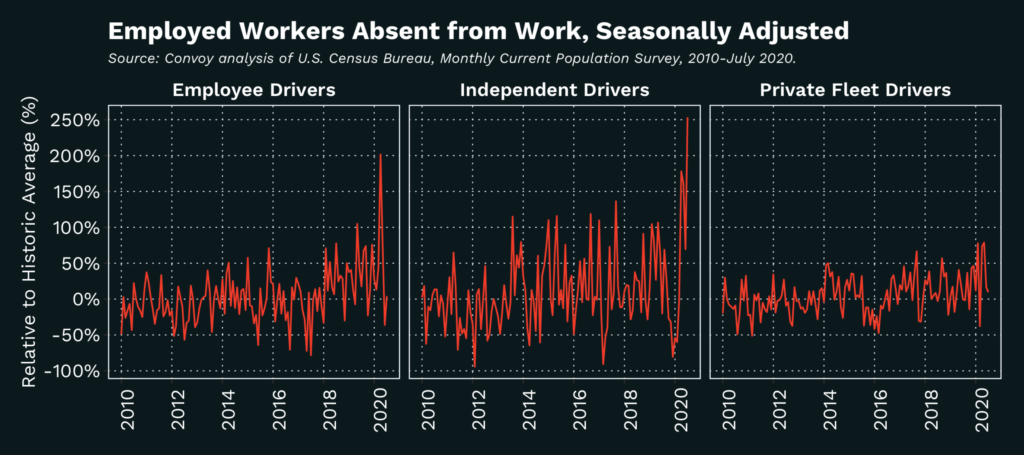

Response-level data from the Current Population Survey (CPS) — a monthly survey conducted by the Census Bureau which is released later in the month — show that an unprecedented number of owner-operators reported being employed but not actively working in July.

In total, about 22% of all owner-operators — equivalent to about 5% of total for-hire trucking capacity — sat on the sidelines of the freight market in July. This translates to an additional 40,000 drivers who sat idle, even as truckload demand surged. There was no parallel increase in the number of company drivers who reported being employed but not actively working.

There is some speculation as to their motivations: some may have been voluntarily sitting out the soft freight market of early summer, some may have chosen to remain home to avoid exposure to the Covid-19 virus, and some may have chosen to receive Pandemic Unemployment Insurance benefits. The data don’t allow us to know for sure. But it is likely that the combination of higher linehaul rates and the expiration of expanded federal benefits at the end of July pulled some independent drivers back to the open road in August.

- Fact: Office and support workers in the trucking industry were not immune from job cuts

The BLS data includes office and support workers in the freight industry, who account for about a third of industry payrolls. Employment among these office and support workers in the trucking industry is typically more resilient during periodic downturns than employment among drivers. But not this time.

Through July, employment among office and support workers in the freight industry was about 8% below its pre-2020 average while employment among industry drivers (which, again, excludes independent owner-operators) was 9% above its pre-2020 average.

This data is for employees who are actively working and excludes individuals who remained employed but were not working (e.g., on furlough or temporary layoff) — so it’s likely that some of these office and support workers returned to work in August. But July showed many trucking companies that it is possible to run a substantial portion of their businesses with less back office support (and less back office overhead).

View our economic commentary disclaimer here.