Trucking Attracted Laid-Off Workers in Past Recessions: Will it This Time?

Freight Research, Industry Insights • Published on May 1, 2020

A version of this analysis originally appeared in trucks.com.

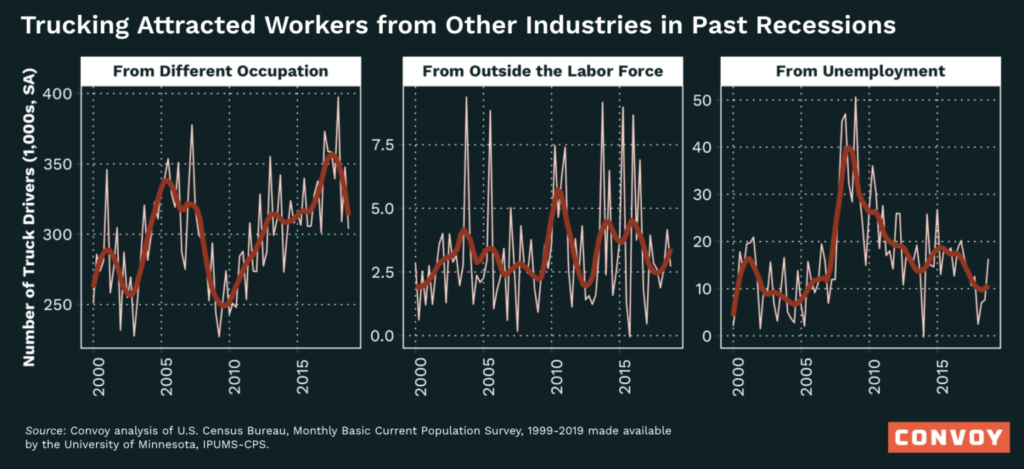

During previous recessions and regional downturns, trucking recruited workers laid off from other industries. That built freight supply just at the moment when aggregate demand was typically soft.

Consider what happened during two recent downturns.[1] From the start of the Great Recession in December 2007 to the employment trough, truck transportation employment fell by 13 percent, but residential construction employment fell by close to 40 percent, according to data from the Bureau of Labor Statistics (BLS). Then, from mid-2014 when oil and gas extraction jobs peaked to the trough three years later, trucking jobs increased by 2 percent while oil and gas jobs fell by almost 30 percent. (BLS data on truck transportation employment do not include owner operators, which would make these trends appear even sharper.)

After layoffs began to increase during recent recessions, there was a strong influx of new workers into trucking, according to data from the Census Bureau’s Current Population Survey: At one point in 2009, for example, nearly 7 percent of all employed truck drivers had worked in construction the previous year. In normal times, anywhere from 2 percent to 3 percent of employed truck drivers were working in construction a year earlier.

The appeal of trucking during nationwide recessions makes sense. Trucking certainly has its own booms and busts. But compared to more volatile job sectors like construction or oil and gas extraction, trucking demand and employment hold up relatively well in periods when the rest of the economy is sagging. Spending on some of the core drivers of overall freight demand such as food and household staples is typically not worse than flat to a small dip during economic downturns. During the current COVID-19 crisis, truckers have played a uniquely heroic role on the front lines, ensuring that critical parts of the economy continue to hum along.

Because of lags in data collection and the types of questions asked, the survey data above do not help us assess real-time evolutions during the current COVID-19 pandemic. Workers who transition into trucking only appear in the CPS data after they have made the switch.

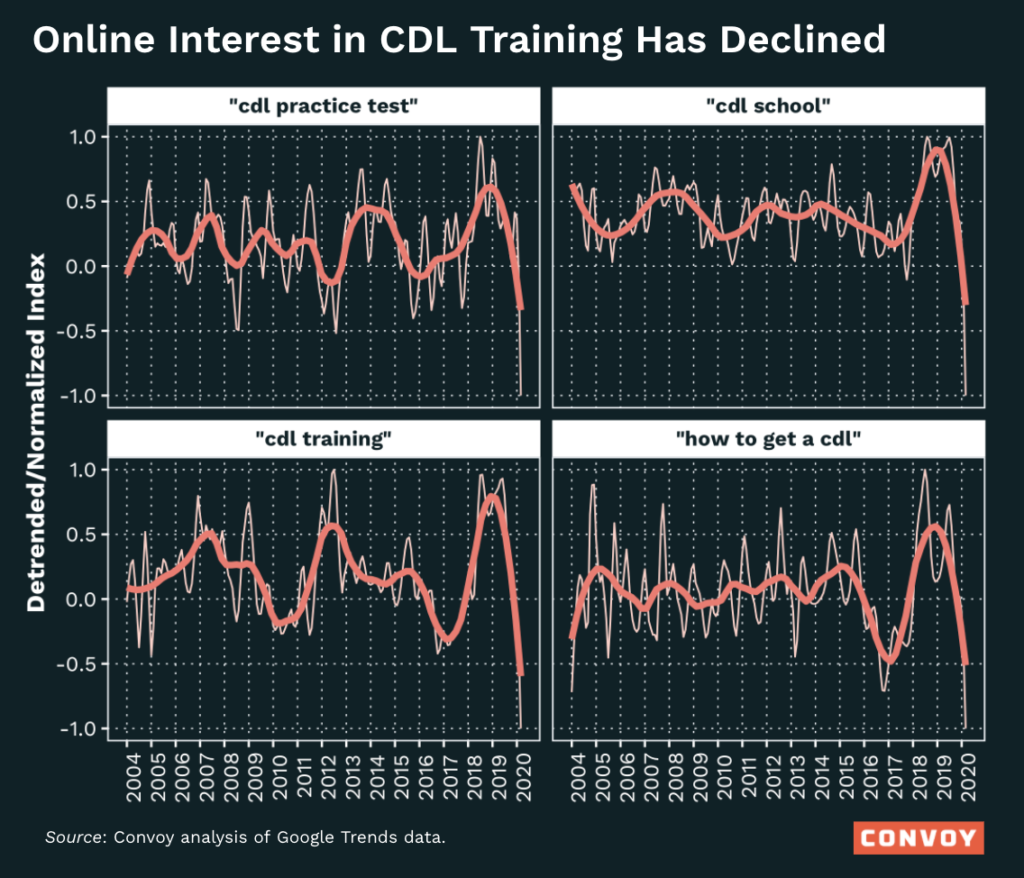

Over the past decade, economists have increasingly turned to Google search data for early insight into people’s hopes and plans. A growing body of research shows that trends in searches for certain words or phrases on Google can predict economic and societal shifts. For example, searches for information about new cars lead official data on car sales by several weeks and searches for terms like “pregnancy test” or “maternity leave” lead the birth rate by six to 24 months.

With this in mind, we analyzed trends in Google searches for terms that might signal interest in becoming a truck driver — phrases like “CDL class,” “CDL training,” “CDL practice test,” or “how to get a CDL” — to get an early indication of whether history might repeat itself with respect to truck driver supply. In general, online interest in becoming a truck driver follows similar ups and downs as the overall freight industry.

Though it is still very early into the crisis, Google search interest in becoming a truck driver declined sharply during March and early April. The downward trend predates the COVID-19 crisis by about a year. But that downward trend has continued and accelerated in March and early April 2020 as the COVID-19 pandemic spread.

There are some obvious timing-related explanations for this. It is likely too soon for many recently unemployed workers to begin thinking about what comes next and some may expect to return to their old jobs once the economy begins to reopen. From a practical standpoint, much of the in-person training required to get a commercial driver’s license is off-limits in places with mandatory social distancing orders.

But beyond timing, workers in the most adversely impacted industries during the 2007-09 housing bust and during the 2014-16 oil bust likely worked closely with truckers who play critical supporting roles in each of those sectors. The food service workers who bore the brunt of job losses during early March may have less exposure to the freight industry. The fact that Google search interest in becoming a truck driver so closely tracks the freight market suggests that word-of-mouth among truckers and their social networks plays a potentially significant role in driving freight supply. When truckers are doing well, they talk about it and some of the people they talk to consider making a jump into trucking.

The relationship between Google searches and worker transitions in the CPS is far from perfect. At some points in time the Google Trends data move in tandem with the CPS data; at other points, there is a leading or lagging relationship. The most obvious sequence would be for Google Trends to lead the CPS data: People’s first step toward becoming a truck driver would be to search online for CDL training, and then if they decide to proceed, they would appear several months later in the CPS data as active drivers.

In recent years, the expected sequence of events holds up better in the data: Changes in the number of workers transitioning into trucking tends to follow changes in Google search activity for terms that would signal interest in becoming a truck driver by two to four quarters.[2] For example, from 2015 onward, searches for the term “CDL school” lead the number of workers who have transitioned into trucking by about two quarters, with the leading relationship especially strong during the freight boom and bust from 2017-2019.

But the relationship is much weaker for earlier years. Some of this discrepancy could be the result of the changing ways that Americans use Google. We have attempted to control for seasonality and long-term trends in the popularity of different search terms (e.g., searches with the suffix “near me” only rose in popularity starting in the mid-2010s but were relatively uncommon before then). But we are unable to control for other potential shifts such as the changing demographic and socio-economic profile of the people who turn to Google (or any online search platform) for career information.

The COVID-19 pandemic struck the freight industry at a vulnerable moment. Coming on the heels of a year-plus of soft freight demand, many trucking companies were already operating with thin margins, if any. Layoffs and bankruptcies in the freight industry were accelerating even before the virus shut down the global economy. A repeat of past cycles when dislocation elsewhere in the economy sparked a boost in driver supply would further extend a market that is already tough for many carriers. But early data suggests that history might not repeat itself.

[1] Convoy analysis of data from the U.S. Census Bureau’s Monthly Basic Current Population Survey (CPS) made available by the University of Minnesota, IPUMS-CPS. The Monthly Basic CPS includes a rotation sample which surveys a subset of individuals for four consecutive months, and then resurveys them a year later. We aggregated the data at the quarterly level, and for each quarter, calculated the number of employed truck drivers who a year prior were employed in a different occupation, unemployed, or not in the labor force. We count as a “truck driver”, the Standard Occupational Classification (SOC) 9130, “Driver/Sales Workers and Truck Drivers”. Though we can identify a driver’s labor force activity a year prior in the CPS data, we do not know their labor force activity before that. So it is possible that some individuals who started working as a truck driver after being unemployed or working in a different job might have prior experience in freight prior to the previous 12 months. [2] Google search terms included in this analysis were: “CDL test”, “CDL practice test”, “CDL school”, “CDL class”, “CDL training”, “how to get a CDL”, “CDL license test”, “CDL license school”, “CDL license class” and “how to get a CDL license”.View our economic commentary disclaimer here.