Three Data Points For Better Conversations About the Trucker Shortage

Convoy News, Freight Research, Industry Insights • Published on June 4, 2021

Hiring at trucking firms slowed in May according to payroll data released by the Bureau of Labor Statistics this morning. After a disappointing April, when private sector job gains were weighed down by supply chain constraints and a surprisingly tight labor market, truck transportation industry employment fell by 1,900 jobs (seasonally adjusted) in May. Trucking industry payrolls are still 2.8% below pre-pandemic headcount levels.

The hiring woes of American employers have dominated business headlines in recent weeks but casual talk of labor shortages can sometimes feel like an ideologically-tinged Rorschach test: People see in it whatever they’re looking to find. Amid this cacophony, three data points are worth keeping in mind.

Average hours worked at trucking firms rose further in April after touching a previous all-time high in March.

The average weekly hours worked for non-supervisory employees at trucking firms touched 43.3 in April, coming off of an earlier all-time high of 43.0 hours in March — which was one hour per week longer than the 2015-2019 average of 41.9 hours. Hours worked have increased for most types of trucking firms, but the increases were particularly large for long-distance truckload and long-distance specialized (e.g., flatbed, tank) freight. (Hours worked are reported with a month lag, so today’s data included new statistics for April.)

March’s increase in average weekly hours aggregated over the full universe of long-distance truckload workers is roughly equivalent to a 24,000 employee increase in industry employment (nearly 5 percent) — which illustrates just how big a marginal effect movements in hours worked can have on trucking market supply. May data are likely to show an even larger increase in hours worked for specialized trucking firms given the temporary relaxation of Hours of Service regulations for fuel tank haulers during the mid-May Colonial Pipeline outage.

Household survey data suggest that younger and Hispanic drivers have been most responsive to the trucking industry’s recent hiring push.

The number of actively employed truckers (excluding private fleets) is up by about 25,000 drivers — or about 2 percent — since the fall when the industry began to roll out hiring incentives such as higher wages and signing bonuses. This data is up to date through April 2021 from the U.S. Census Bureau’s Monthly Basic Current Population Survey, made available through the University of Minnesota/IPUMS-USA, and are smoothed and seasonally adjusted.

Younger adults under age 35 and Hispanics are the largest demographic components of that increase. By contrast, shadow slack — including drivers who are employed but not actively working or unemployed — is highest among drivers aged 35 to 54 (both relative to the 2016-2019 average and relative to 2020-Q4).

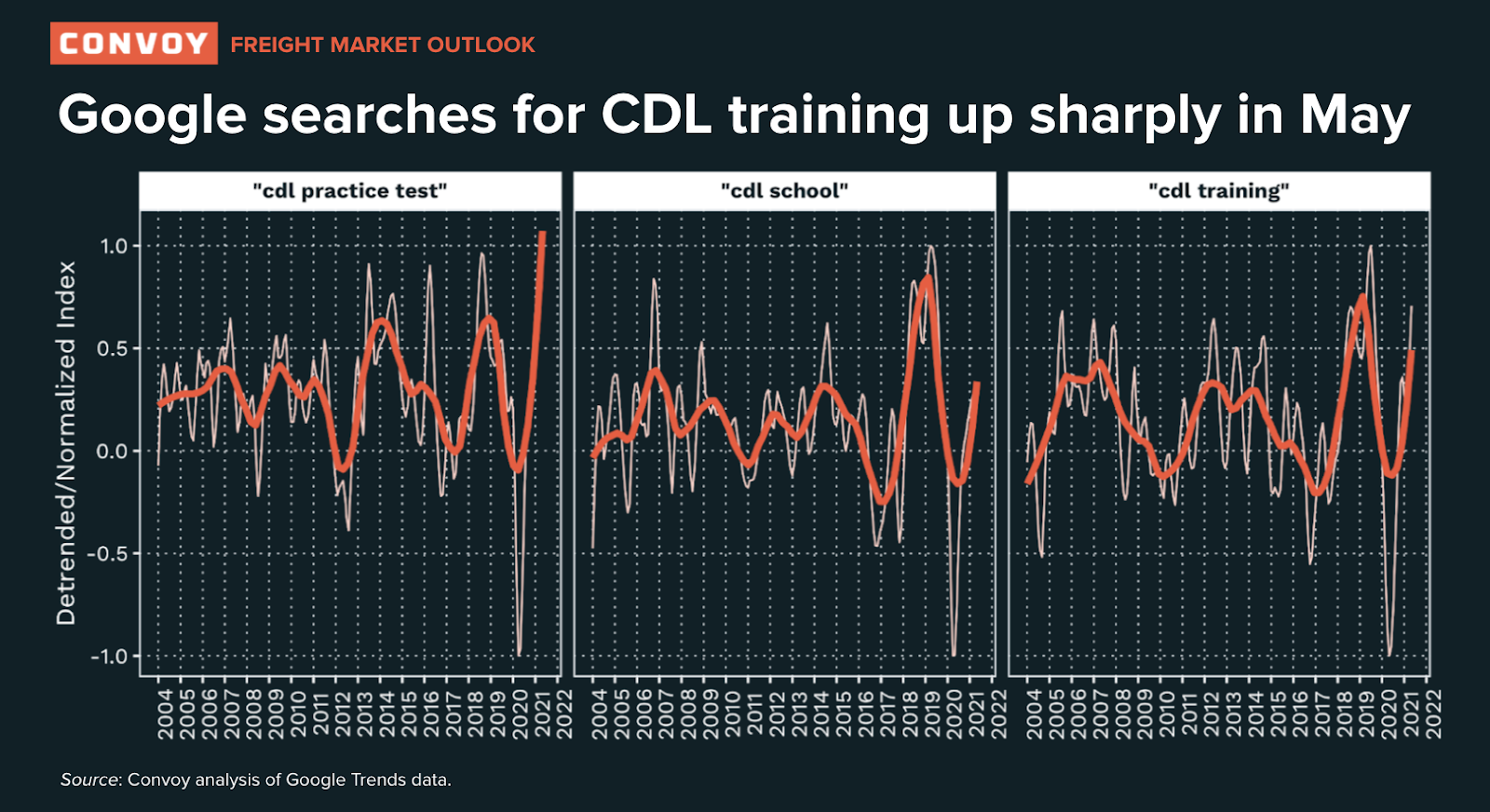

Online searchers for CDL training are up sharply, but the surge is not being driven by states ending emergency Unemployment Insurance benefits.

There has been an enormous amount of public debate over the degree to which pandemic-era policies — particularly the expansion of emergency Unemployment Insurance (UI) benefits — might be keeping workers on the sidelines of the labor market. In recent weeks, 24 states have announced that they will end these emergency benefits in response to rising private-sector alarm over widespread hiring challenges. (State count current as of June 1, 2021.)

Online search activity for keywords that signal early interest in becoming a commercial truck driver increased sharply in April and May (chart below). (As we’ve previously written, online search activity for Commercial Driver’s Licence [CDL] training is a very early indicator of driver supply. The data, which were accessed via Google Trends, begin in January 2004 and are seasonally adjusted and detrended to account for evolving job search behavior over the past two decades.)

However, it does not appear that the increase is being driven by internet traffic from states that have announced an end to emergency UI benefits. Some states that are ending UI benefits in June have indeed seen a surge in online interest in CDL training — for instance Texas, Georgia and Arizona; but so have several big states that have not announced policy changes (e.g., California, New York and Wisconsin). Similarly, a number of states that will be ending emergency UI — such as Tennessee, Indiana, Oklahoma and West Virginia have seen flat to declining online interest in CDL training.

June will provide a true test of the tug-of-war between the industry’s efforts to onboard new drivers and policymakers’ support to the economy. As states unwind pandemic-era policies and the services sector heats up with broader reopening, many of the labor market ideas that the freight industry has been debating in recent months will either yield job gains or fail to materialize. The one thing that is guaranteed to be in plentiful supply this summer is a continued conversation about trucking labor shortages.