Shippers Cautiously Optimistic, Rapidly Adapting to Economic Realities

Freight Research, Shippers • Published on August 5, 2020

Enormous uncertainties continue to loom over the horizon for the remainder of 2020, but broad sectors of the economy are already laying their plans. Despite the difficult economic climate, sustainability remains a priority — in some cases, increasingly so.

In early July, we surveyed 139 shippers in Convoy’s network about their expectations for their businesses in the near future, and about longer-term shifts they are contemplating. (The survey closed on July 10, 2020 and captures sentiment well into the current surge in infections.) The results point to both cautious optimism as well as a long-term rethinking of supply chain vulnerabilities.

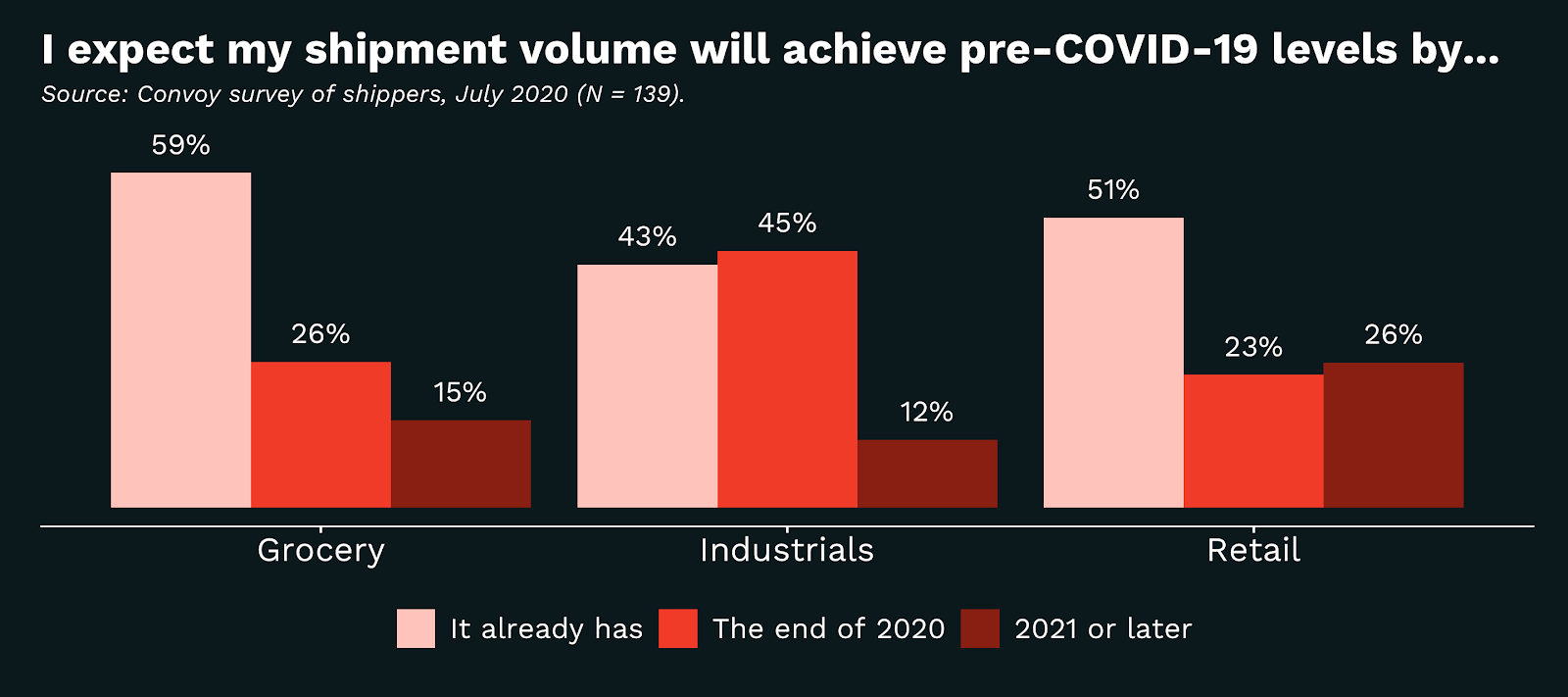

Overall, many businesses are already seeing shipment volumes at or above pre-crisis levels and a majority of the remainder expect volumes to recover in the second half of the year.

- Over half of grocery businesses (which includes food and beverage manufacturers), and just about half of retail outlets, are already seeing shipment volumes exceed pre-COVID-19 levels.

- For both grocery and retail businesses, an additional quarter expects that shipment volumes will exceed pre-crisis levels by the end of 2020.

- The industrial sector lags among businesses already shipping goods at pre-crisis levels, but businesses in that sector are particularly optimistic for the second half of the year.

- About one-in-four retail businesses expect that it will be well into 2021 before their shipment volumes attain pre-crisis levels.

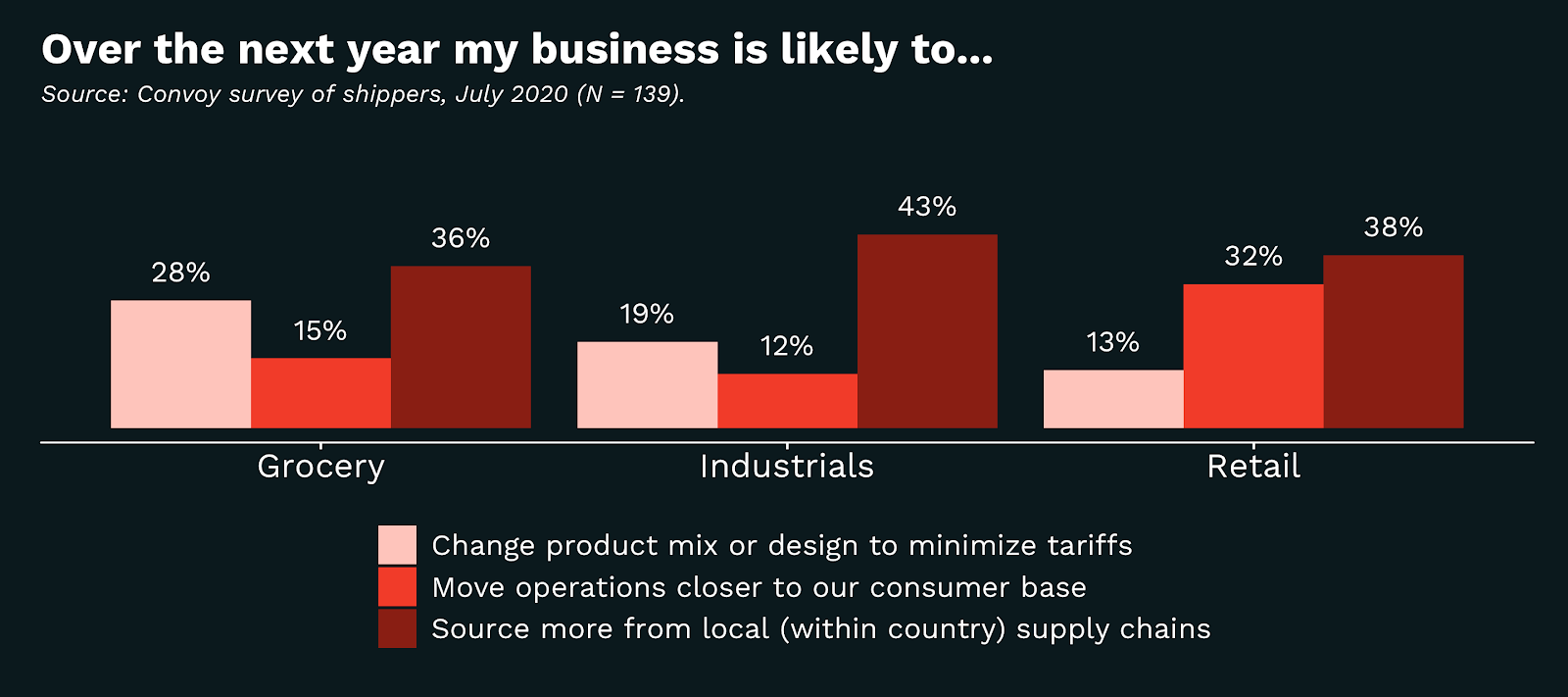

The supply chain disruptions of the past two years — from U.S. China trade tensions and the renegotiation of North American trade rules through the pandemic-induced shortages of consumer goods — have prompted many businesses to rethink vulnerabilities in their supply chains. Over a third of businesses in grocery, industrials and retail say they aim to source more from local suppliers, and over a quarter of grocery shippers (which includes food and beverage manufacturers) say they plan to change product design or mix to minimize tariffs (many industrial and retail businesses have likely already done so).

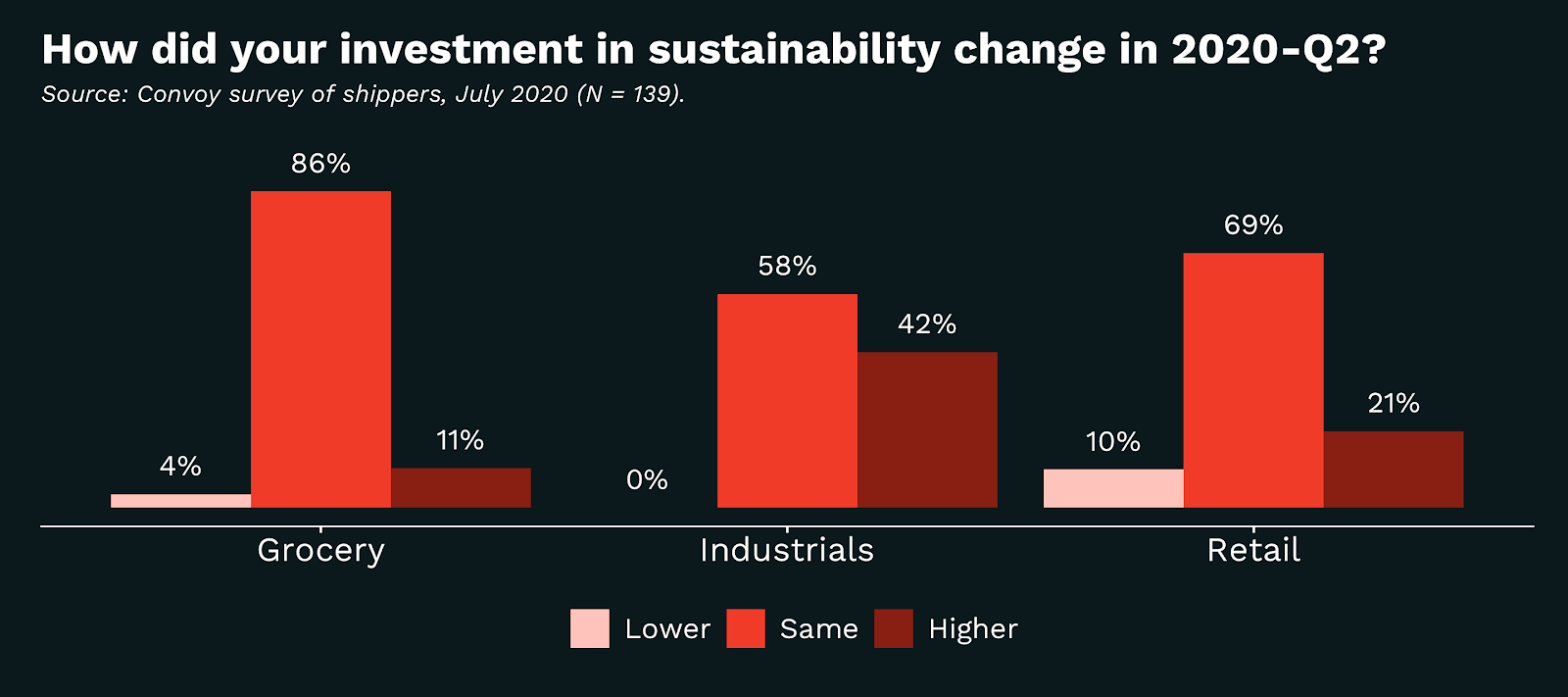

Despite the difficult economic climate, a majority of shippers surveyed have environmental sustainability goals — including about three-quarters of grocery, food and beverage shippers, nearly two-thirds of retail shippers, and just under half of industrial shippers. (We know that Convoy’s customer base skews toward more environmentally conscious businesses, so these results are not necessarily reflective of the full universe of shippers.)

For most businesses, their investment in sustainability was unchanged in 2020-Q2. But across categories, there was a net positive increase in sustainability investments despite the COVID-19 pandemic and associated recession. The most notable shift was among industrial manufacturers: 42% of respondents said they increased their investment in sustainability in the quarter while none said they reduced it.

To the extent that truckload demand provides an early window into businesses’ expectations for sales, these survey results illustrate how quickly businesses are adapting to new economic realities and, to some degree, outcomes will be shaped by these expectations.

View our economic commentary disclaimer here.