Marketplace Update with Kevin Rutherford – Part 2: Supply

Carriers, Freight Research, Industry Insights • Published on August 18, 2020

On Friday, July 10th, Convoy joined Kevin on his webinar series, Positive Matters, to discuss the current economy in regards to supply, demand, and truckload rates. In Part two of the webinar series, Kevin Rutherford and Aaron Terrazas, Convoy’s director of economic research, talked about how driver entries and exits are shaping the market, and how important it is for carriers to understand their operating costs in order to run efficiently.

Turning to supply, we recognize that supply moves in response to shifts in demand as well as in response to rates. When it comes to supply, there are three Es – exits, entries, and efficiencies.

What is Driving Carriers to Exit the Industry?

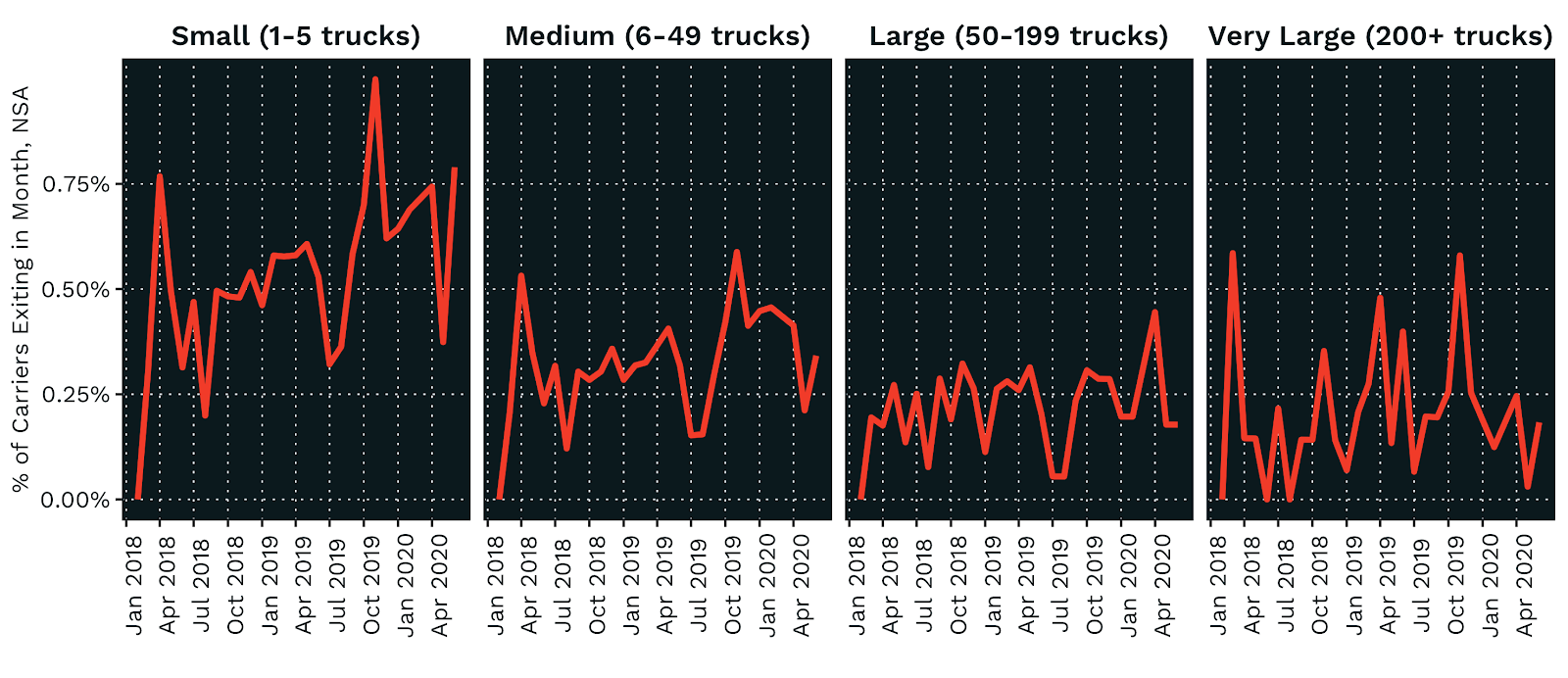

Aaron: There has been a lot of focus on how bankruptcies are contributing to tighter carriers supply recently, and that is certainly the case. But there are also other reasons why drivers and carriers decide to leave the trucking industry — for instance, they can retire or transition into jobs in other industries.

The chart below shows the bankruptcy rate for carriers of different sizes. I’m sure this group feels this very acutely – the bankruptcy rate has been rising, but it’s almost all due to rising bankruptcies in that small carrier bucket.

Kevin: So I’m looking at that small carrier, which is my market, and clearly with what’s going on this year with the pandemic, you might expect it. Although, when I look at things, we had a pretty short downturn in freight rates, we had all the money being handed out to everybody, and so I’m a little shocked that we’re seeing that rise in bankruptcies already.

Aaron: Exactly. We have a few hypotheses for why we are seeing this trend. The very large carriers, it’s volatile, but on average you can see a flat line there roughly in bankruptcies among the very large carriers. In general, larger carriers were more likely to receive emergency loans — such as loans through the Paycheck Protection Program (PPP) — or have access to financial markets. (We know that some of the terms of PPP loans favored large carriers, such as the timing of applications and the requirement that loan recipients provide health insurance to all employees.

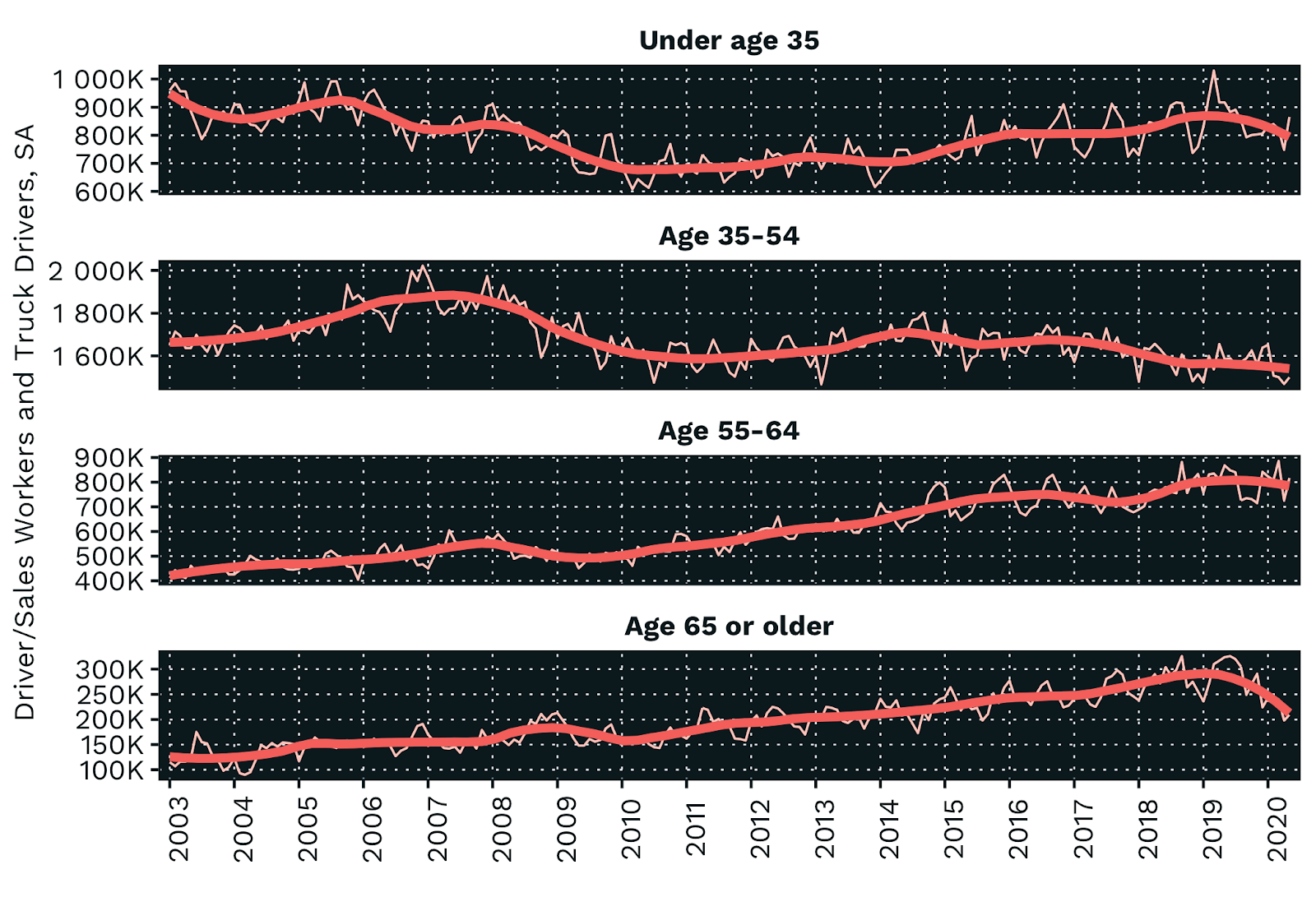

We also see fewer numbers of working truck drivers as a result of this pandemic. I think the interesting thing in the most recent data that I’ve looked at is we see the biggest drop in the number of truck drivers over the past few months among older truck drivers, that age 65 plus cohort, which is really mostly 65 to 70.

Basically the number of truck drivers in that age group had been basically steadily rising for the past 20 years, but starting in the past few months, has really started to fall off a cliff down by a third, a hundred thousand drivers, since the start of this year. When we initially spoke with Kevin, we had speculated that it was due to retirement, but Kevin suggested that a much sadder phenomenon could be driving this..

Kevin: Yeah. Unfortunately, we talk about the statistic that the average career male truck driver might not make it to 60. It’s just a really unhealthy group. So this could be some deaths, could be that we scared the older drivers saying that they’re really at risk for this. Maybe they decided it was just time. I don’t know. It’d be nice to see more detail on that.

Aaron: Yeah. I mean in other industries you generally do see workers on the cusp of retirement leave the market during downturns. If they’re laid off and they say, “You know what? It’s not worth the hassle to go and try to find another gig. I was two years away from retirement. I’m not going to bother,” but again, with that lifespan number, it is perhaps maybe something more morbid.

Are Drivers/Carriers Entering the Market?

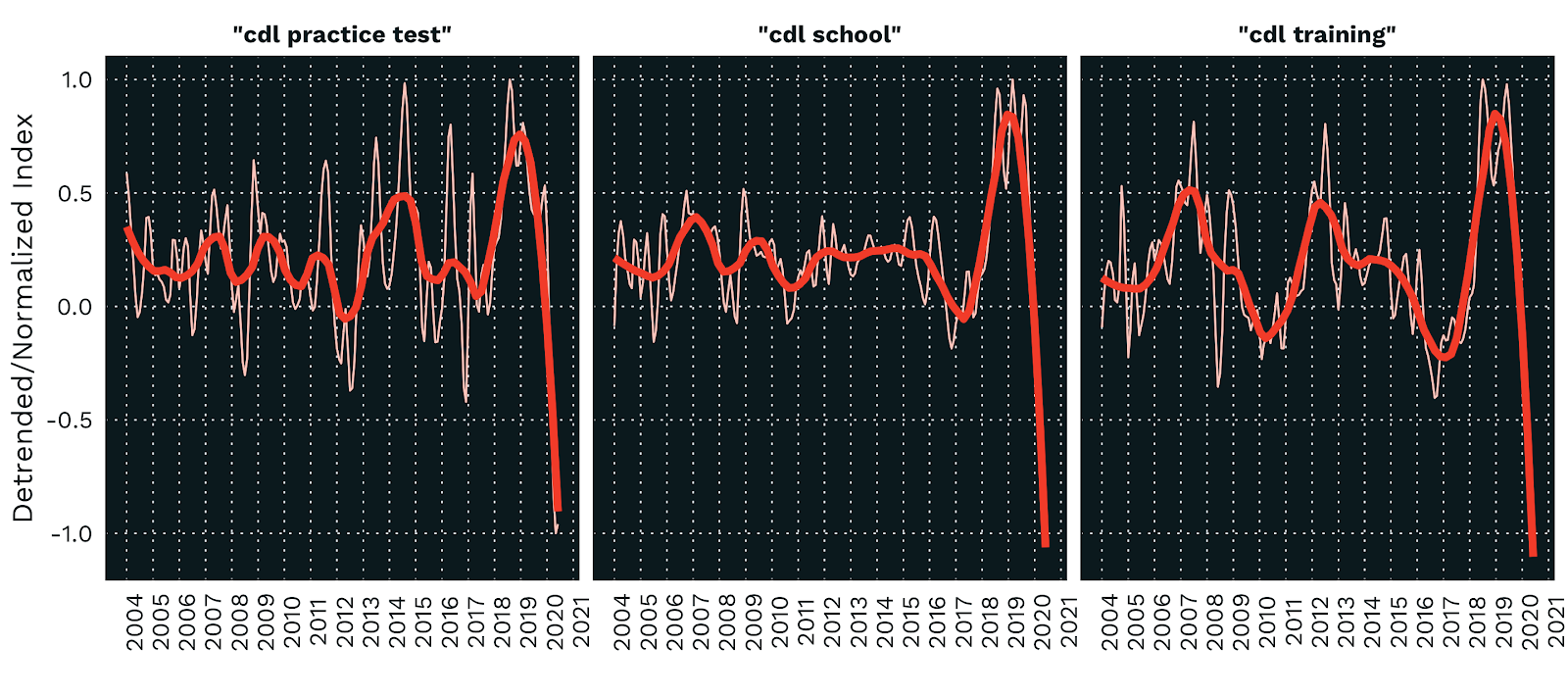

Aaron: We talked a little bit earlier about the entries and the new driver pipeline. This is something I’ve been researching over the past couple of months. If you look at Google Trends, the number of people searching for different words that might signal interest in becoming a truck driver, it follows pretty closely the freight cycle.

Typically, in recessions, the freight world sees laid off workers from other industries come in and train to become truck drivers — it happened with construction workers in 2008, and oil and gas workers in 2014. However, we have some data showing that that’s not necessarily happening in this crisis. Well, at least not yet. In fact, we’re seeing the number of people searching for these words that would signal interest in becoming a truck driver fall off a cliff. That may have to do with all the in-person training required to get a CDL, but it is way down.

You can imagine some explanations for that. Maybe they don’t think that their job loss is permanent. Maybe it’s a barista or a restaurant waiter who is probably not going to become a truck driver because it just doesn’t fit their lifestyle. But it’s not happening.

With some carriers declaring bankruptcy, we see more vehicles hit the secondary market, and sooner or later second-hand vehicle pricing becomes very attractive, and encourages others to invest in expanding their fleets. We can also see this with specialized drivers. You think about all the people who drove tanks or flatbeds for the oil and gas industry who aren’t going back to work for a while — some of those folks are now looking for Drop and Hook opportunities.

Kevin: So this one really shocked me. And because I’ve watched trends like this and when the economy starts down, we do see those spike ups, we see people move into trucking a lot, in and out of construction, in and out of a couple others. If this number would have just stayed steady, I would’ve thought, “Yeah, no big deal.”

This big drop… And if we look at what was going on in the media, truck drivers all of a sudden became heroes, which hasn’t happened in a long time, and truck drivers were still working and making money. And if you would’ve asked me, I would’ve thought this number would have gone exactly the opposite direction. What I’m wondering is how this data is correlated.

Aaron: Certainly. I think that is one of the challenges of working with Google search data, people change the words that they’re searching for. For instance things like “CDL school near me,” people never used to search. But in the past few years, people have started attaching “near me” to search terms.

Macey: Kevin, I’d actually like for you to talk a little bit more on this. Is there an opportunity for drivers to do virtual training for their CDL? At what point do they need to be in a truck?

Kevin: I’m not aware of any. It is a pretty hands on experience. Every school I’ve looked at really does a minimum of classroom style training. The classes show you how to fill out a log book and review the safety stuff, but they need to get you out in the truck so that you can learn how to shift some gears and back up into a dock. And even those, it’s not a lot of training.

We have a pretty poor training system, really, for drivers. So I can’t see virtual training working unless somebody had some really killer simulator technology, and I’m not even sure how that would work unless they come into a center with the simulator. So I think that’s pretty challenging. That may be one of the best explanations as to why this is dropped, because we have converted a ton of our training to online, and so has everybody else. It’s a huge trend. But I just can’t see it working for a truck driver. When I did my training, there were six of us in a truck in a tiny sleeper sitting on top of each other with no seat belts, and definitely no social distancing.

Macey: You mentioned that when you first got into the industry after completing a two week course, there was not a driver shortage. How did you get your foot in the door to obtain the year of experience that you may have needed to start driving underneath your own authority?

Kevin: First off I’m third generation in the industry, my grandfather was an owner operator when the seat was a wooden bench in the truck and he actually contracted one of the major van lines back then. And a trip from the East Coast to the West Coast was measured in weeks, not days or hours. There were no interstates, truck stops were almost unheard of. It was a crazy time.

My father was a frustrated owner-operator because he loved trucks and working on them. So he wanted to own one, but he didn’t know how to run a business. He would buy a truck, run it till he ran out of money, and would then go back to a union driving job, save up money and just cycle through that. I watched him run through this cycle and I’m sure that is what motivated me to do what I do today – learn the business and help other people so they don’t struggle like that.

When I went to a two-week driving school, I had a lot of connections in the industry. To be specific, I had four brothers who were driving as owner-operators, two brothers-in-law, and a couple of uncles. After I finished school, I bought an $8,000 truck and was a local owner operator with my own authority on day one. So I had a, I won’t call it an easy entry into the market, but easier than most. I was hired by customers and brokers because they knew my family members and I doubt that somebody off the street would have gotten hired in those contract positions.

Long story short, I’ve never been a company driver. It’s one of the few things in the industry I haven’t done, but with the driver shortage we’ve had with the turnover, it’s really not that difficult. The jobs are out there. You have to put in your dues and struggle through that first year and hope you don’t tear too many things up and keep your record clean. And once you do, the way our market’s been for a couple of decades, you should be able to write your own ticket by then.

Interested in hearing more from Kevin and Aaron? Check out part one in the Marketplace Update series.