Marketplace Update with Kevin Rutherford – Part 3: Rates

Carriers, Freight Research • Published on September 11, 2020

On Friday, July 10th, Convoy joined Kevin on his webinar series, Positive Matters, to discuss the current economy in regards to supply, demand, and truckload rates.

In part one (demand), we looked at data on factory output and the headwinds and tailwinds in the freight economy. In part two (supply), we focussed on how driver entries and exits are shaping the market. And finally, in part three of the webinar series, Kevin Rutherford and Aaron Terrazas, Convoy’s director of economic research, talked about the driving forces of supply and demand, and their impact on rates.

Aaron: Let’s finally get to what we all care about, which is rates. The theme when I talk about rates, to echo what Kevin said, control what you can and recognize what you can’t. The freight market is this big beast of a system with no single person or company or individual controlling it. That’s what a market is. A market is this chaotic, multidirectional interaction.

But what you can control is your underlying cost. And that’s what Convoy has been thinking about, is how do you lower the operational costs of finding a load, completing the shipment, and getting paid.

So if you think about the actual matching process, how do we introduce efficiency into the matching process? In traditional brokering, a load is tendered to the broker, the broker goes through their Rolodex, calls up a bunch of carriers, sees who can do it, who’s available, thinks about the prices, negotiates back and forth, then matches the load and executes it. That is something that takes hours. On average, 10 calls or emails which is a very intensive and slow process.

Convoy’s platform is a Digital Freight Network — so there is automated matching and pricing. Algorithms identify available shipments and posted rates, carriers accept or bid in the app, bids are automatically analyzed, and that matching process –which in a traditional brokerage takes hours –typically happens in minutes without any calls or emails. That is the ease and efficiency of a digital freight network.

Who Sets the Rates?

So I think the natural question is: If there’s no human in the negotiating process, who sets the rate? Well it’s the market. No single broker can set the rate. I think we all know that the freight market is extremely competitive. There’s over 15,000 brokers, hundreds of thousands of carriers, hundreds of thousands of shippers, and even the biggest players only have, at best, 4% market share.

With no individual supply or demand or intermediary dominating the market, that means price is set by the results of those factors I talked about in the first section: Demand and supply. When demand is above supply, prices go up, and when demand is below supply, prices go down. Convoy is a tiny (but efficient) player out there, and act as a price taker just like everyone else in this very competitive market.

With that competitive market, the upside is that carriers can choose the best option. The cost to switch between the various brokers is approximately zero, and it’s even less so with the apps. And carriers regularly work with multiple brokers, they have the freedom to pick their best option shipment by shipment. We know that on Convoy’s platform, the typical carrier does about two loads per month with us. And I know Kevin, something that you mentioned was that carriers should utilize about three to five good brokers for the bulk of their freight. That way they understand the expectations for working with each of them.

Kevin: Exactly. Going back to your first point, focus on what you can control. I see so much frustration with owner-operators and carriers because they do the opposite. I watch them focus on what they believe drives pricing, and unfortunately many carriers still believe low rates are caused by brokers trying to trick them. However, back in 2018 when rates were $3 a mile they had no problem with how the market was reacting. The point is if brokers could control the price, why did that ever happen?

And you just explained why – it’s a fiercely competitive market with so many players in a dynamic market, and yet carriers don’t always take the time to focus on what they can. I used to say, “Look, work on your expenses. It’s fairly easy. I can show you how to do it.” Then if you want to get better rates, you have to work on really strong relationships and you need to be in the data. Carriers need to understand the market, which in trucking is tricky because the supply and demand is always moving. It’s all over the place and that means we’re changing the dynamic all day long.

Lower Your Expenses, Keep the Wheels Turning

Kevin: In a way I’ve kind of given up on everyone understanding the highs and lows in the market because it’s too time intensive, and it’s not really necessary because technology has really taken away the need.

Although drivers should spend time looking at the big picture and studying the rates in the lanes they run in a lot, we know the best way to make money is keep the wheels turning. Lower your expenses, keep the wheels turning, and with technology and companies like Convoy, you can always bid on the rate that you need to run at.

It’s amazing that here are opportunities now to bid and negotiate on pricing directly in an app. We’ve spoken about carriers working with three to five good brokers to get the most out of their rates. This is important because you get to know their system, get to know their technology, and then the point is when you leave the house, you just keep the wheels turning. Just run. Run at a decent average rate and keep your expenses down.

Aaron: Bidding is the way we are able to identify the most efficient truck and help carriers that are the most efficient expand their operations. If we think about how truck costs respond to all these different supply and demand, local week to week regional factors, it’s impossible to predict them accurately that far out. If I asked you: What should a truck cost to run from Los Angeles to Las Vegas, or Chicago to St. Louis? What would you say?

Well, the only honest answer is that there’s no single price. There are a bunch of different prices out there. Every carrier has their own price. That price is going to depend on their vehicle financing payment, the price is going to depend on where they’re located to start, the price is going to depend on whether or not their kid has expensive tastes. Everyone has their own costs. And bidding helps us understand what the various prices are out there, because there is no single price.

Negotiate for the Rate You Need

Aaron: On the Convoy app we have the Accept Now price (which is a floor and the lowest we’re willing to accept) and the bidding option. It’s incredibly important to note that 70-90% of all Convoy loads are won via bidding. And this bidding allows us to identify the most efficient truck for the shipment.

Kevin: I have a point out that this makes this bidding really attractive. When I first saw this technology coming into the market, my first reaction was, “Oh, I hope this doesn’t turn into a race to the bottom.” And now I look at bidding completely differently.

And one of the things I look at is I struggled for years to help owner-operators learn how to negotiate. And I just kept telling them, “Look, you got to learn this. You got to learn it.” And they weren’t. They didn’t want to. I failed at it miserably, and I got frustrated. And then I realized why.

I myself am not a good negotiator. I know all the tactics. I’ve studied it. I can teach. In the real world, I’m not good at it because I’m an introvert and I don’t like controversy. I feel cheap, like I’m haggling. So I avoid it even though I know I shouldn’t because I’m leaving money on the table. Truck drivers are mostly introverts: they don’t want to negotiate, no matter how much you try to give them the tools. Bidding allows them to negotiate without all of that controversy and stress. And I think that’s awesome.

Aaron: Exactly. And this idea of democratizing freight and giving everyone equal access to request their rate, is what Convoy is all about. But we also spend a lot of time thinking about how we can find the most efficient truck for a shipment.

Identifying the Most Efficient Truck

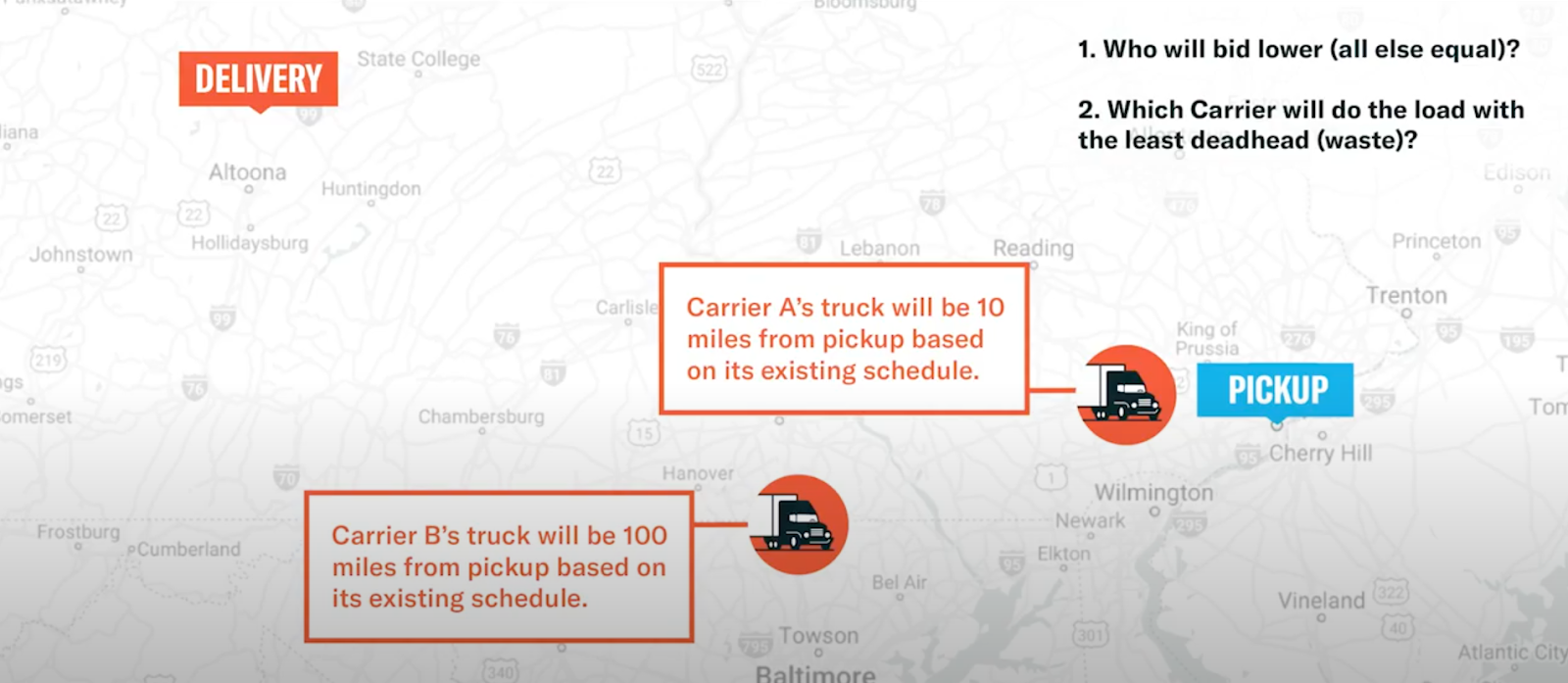

Aaron: Well, there are two ways of thinking about efficiency: distance, and time. In the example below, we look at finding the most efficient truck and have two different carriers bidding on the load. If a carrier is thinking about this load that’s heading from Philadelphia up toward State College, who is the most efficient truck here? Is it A or B?

With Carrier A being about 10 miles from pickup, they will have the least amount of empty miles to the next shipment. However Carrier B has to account for the 100 empty miles to pick up this shipment, which usually results in Carrier B submitting a higher rate via bidding.

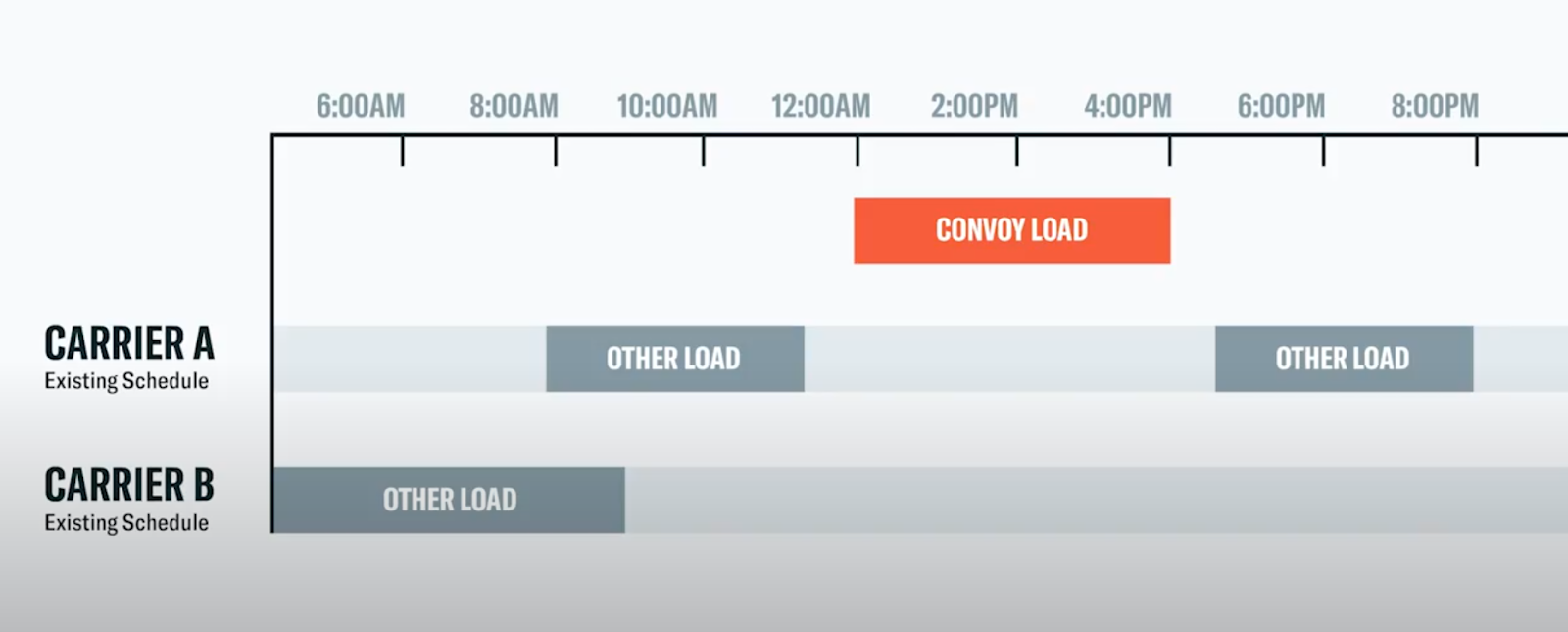

Similarly, if you think about the truck’s schedule and the drivers HOS, we can understand why rates vary between carriers. In the chart below, when you look at the two drivers’ schedules, is Carrier A or Carrier B more efficient?

Well the Convoy loads sandwiches nicely between carrier A’s other loads, and so they are the more efficient vehicle in this sense. Meanwhile Carrier B is more likely to find success with a different shipment that fits better into their schedule.

Distance and scheduling are two different ways to think about efficiency and how bidding helps us identify the most efficient carrier out there. When the system as a whole becomes more efficient, carriers can earn more, but with less hassle — again, for those carriers who run more efficiently than their competitors.

Macey: There’s one other thing that I would love to point out – carriers are never penalized for bidding in the Convoy marketplace. One of my friends in the local Atlanta market bids on about 100 shipments a day. Although he only ends up accepting about one or three of those confirmed bids, he isn’t penalized for the other 97 bids he didn’t confirm.

This is yet another example about how Convoy is squeezing out the inefficiencies in the market. By collecting these various price points in the market, Convoy can better understand what are carriers willing to run for and at what price across tens of thousands of carrier fleets. If the rate looks good, it matches up with your schedule, and criteria, take the load. But carriers are never penalized for contributing or throwing out their price out there.

“Stop Taking Cheap Freight”

Kevin: One of the complaints I hear in the industry all the time is it’s these new carriers that don’t know how to run their business. And they’re the ones out there just grabbing cheap freight, and that’s why the rates stay low. And there is some truth to that.

When new carriers are getting in, it changes the supply side and drives rates down due to increased competition on the supply side. And if carriers start taking that cheap freight, the typical scenario is they do it for a while and then they run out of steam and they leave the market. But there’s always somebody right behind them.

When I look at Convoy’s technology and what it’s doing and what it will continue to do and your example of the two trucks, we need to run a lot less empty miles as an industry. And it’s going to be better for all of us when we do. And the carriers that learn how to do this, that learn how to control their expenses and stop those inefficiencies and use the technology to keep the trailer loaded and the wheels turning, will survive.

Being a really efficient market, in my opinion, will drive out the bottom feeders. And I think we’ll become a stronger, more efficient industry. So I’m pretty excited about the technology and what it’s going to bring us in the future.