Long-Haul Jobs are Driving Trucking’s “Shecession”

Freight Research, Shippers • Published on December 4, 2020

Trucking firms continued to add jobs in November according to data released this morning by the Bureau of Labor Statistics: Trucking industry employment increased by 0.9% (12,700 jobs, seasonally adjusted) in November, an accelerating pace from the 0.5% (7,400) pace reported from September to October. Compared to a year ago, truck transportation employment is still down 3.6% (55,400 jobs) reflecting the enormous headwinds that the industry is encountering in hiring quickly enough to keep pace with record holiday truckload demand. (Of course, since they are based on payroll data, the BLS numbers exclude the owner-operators and private fleet drivers who account for two-thirds of over-the-road drivers, and includes office and support workers at trucking firms.)

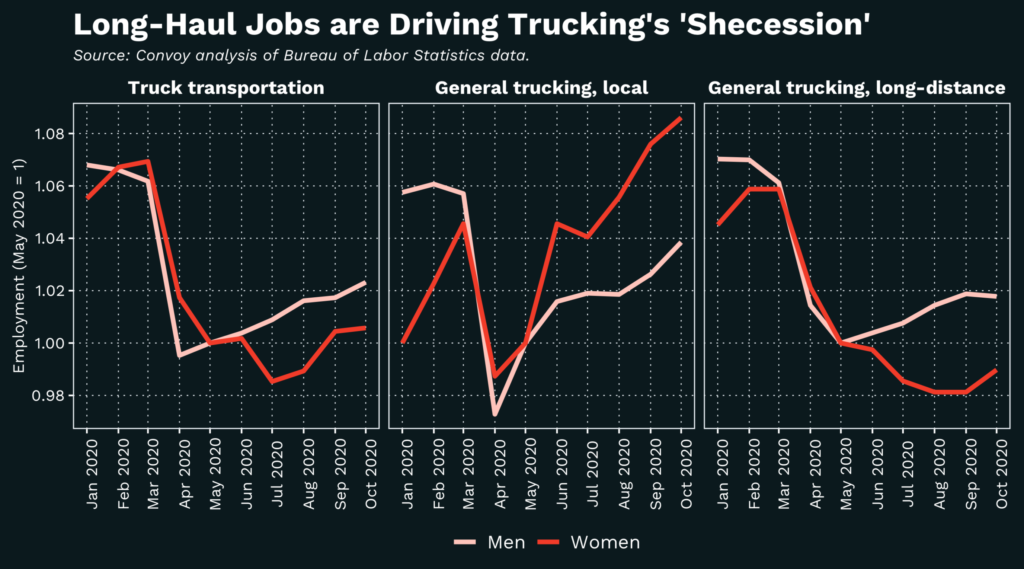

Labor market observers have labeled the Covid-19 induced recession a “shecession” (a portmanteau of “she” and “recession”) since employment among women has been slower to recover than employment among men after the labor market trough in May. This is true in trucking as in the rest of the economy. As of October, employment at trucking firms had rebounded by 2.3% from May among women compared to 5.8% among men. (Reporting of payroll employment disaggregated by sex is lagged one month behind reporting of overall employment.)

Some economists have speculated that additional childcare responsibilities as a result of patchwork school reopenings that disproportionately fall on women have kept more women out of the labor force in recent months. Diverging trends in employment among women at local versus long-haul trucking firms lends support to this idea: Since May the number of women employed at trucking firms that specialize in long-distance hauls is down by 1.1% while the number of men employed at these firms is up by 1.7%. At firms that specialize in local hauls, employment among women is up 8.6% while employment among men is up 3.8%.

This perhaps reflects a rising preference among women truckers for local jobs that keep them close to home. But also comes with consequences: Hourly wages as firms focusing on local hauls have been flat in recent months, while they have surged higher at firms that focus on long hauls.

As we’ve noted over the past two months, labor supply is exceptionally tight in the trucking industry right now, which is reflected in record spot market prices. The number of workers interested in training as new truck drivers is rising, and that new supply should begin to ease driver shortfalls in the coming months. But in the interim, there is clearly an opportunity to make it worthwhile for more women truckers to venture further from home.

View our economic commentary disclaimer here.