FreightWaves: November Market Trends

Carriers, Shippers • Published on November 29, 2018

Thanks to all who attended FreightWaves’ November Market Trends Webinar, sponsored by Convoy. Despite tariffs and the rising dollar, November started slow for freight and has started to pick up volume ahead of the holiday season. Capacity continues to slowly increase.

To help you prepare for the holiday season, we’ll recap what’s going on with the demand and supply sides of the freight market — and add our own recommendations as well.

Demand: Bullish Short Term, Cooling Long Term

In the short term, demand should be increasing from the holiday wave. Retail, holiday food, and Christmas trees are driving up rates overall. Moving into early next year, demand is expected to continue to increase. Flatbed is likely to continue its increase (due to oil), and van increases are also likely to happen (due to construction demand). The market will not likely reach summer levels, however, as June and July were outliers with high volume.

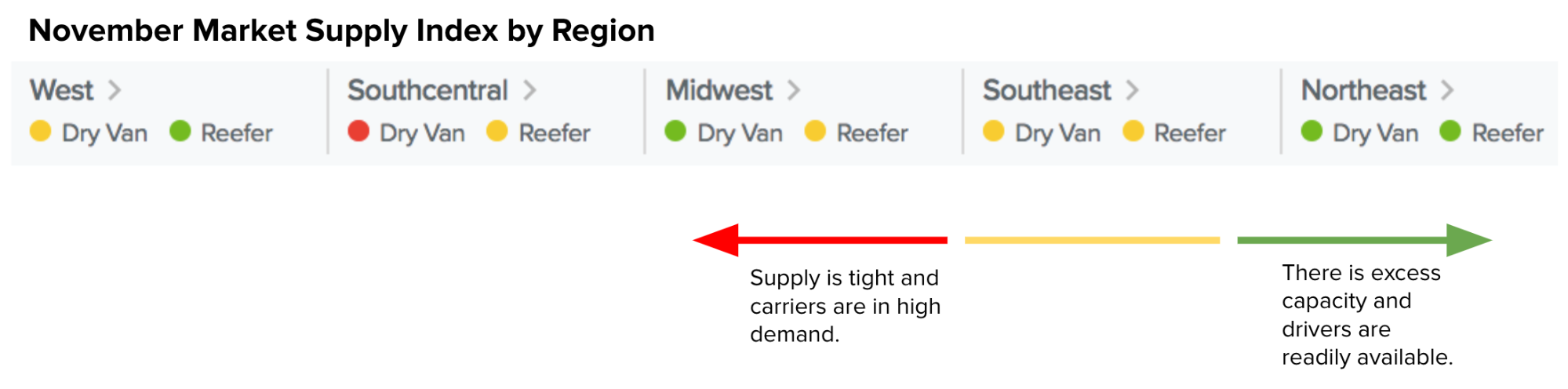

We see a regional breakdown of these effects on the dry van and reefer markets below:

On the macroeconomic side, bearish signals are beginning to pile up. Interest rates are expected to rise over 2019, pending new data which raises the dollar and slows the economy when exports are less valuable. China is also slowing down with their PMI at right around 50.

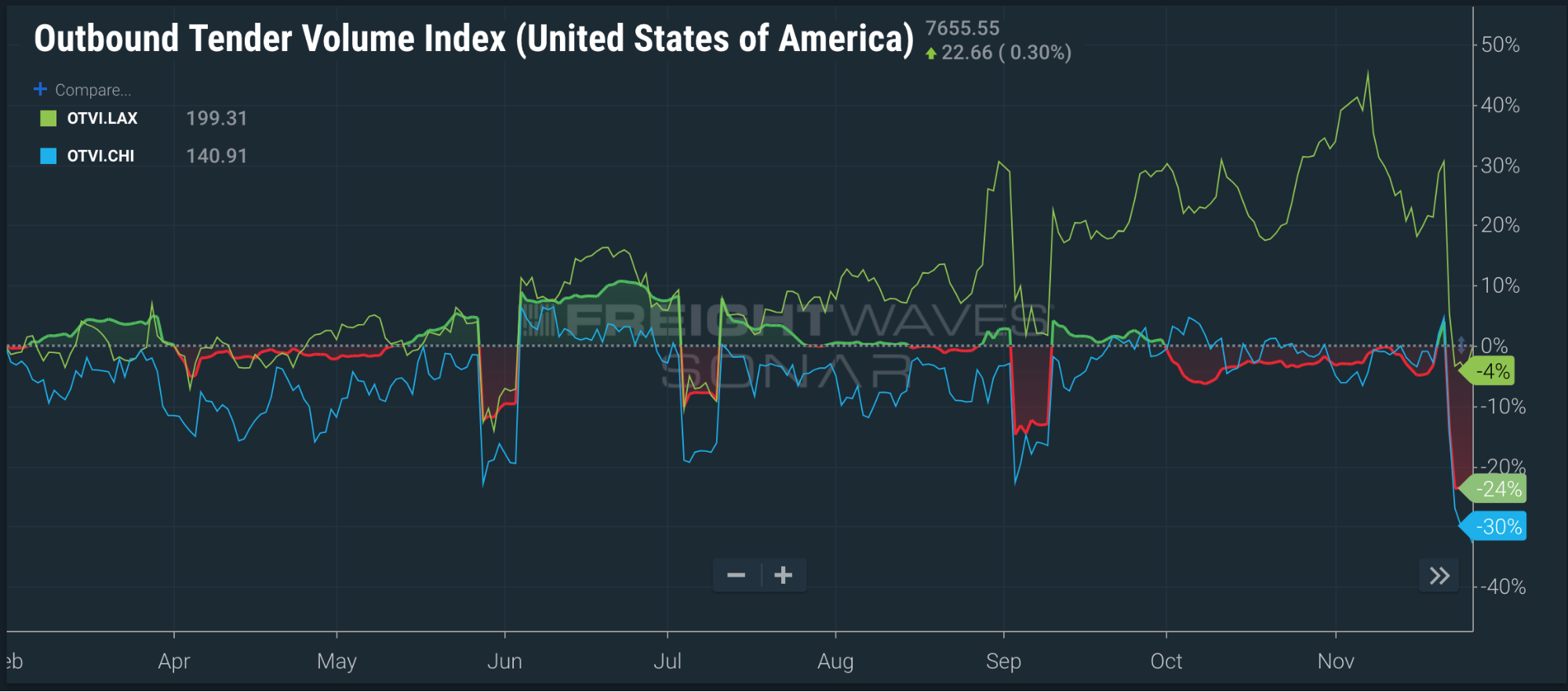

Tariffs — which are slotted to increase on January 1 from 10% to 25% — are continuing to drive volume in Los Angeles. In addition, there may be additional tariffs as soon as next week on autos. While volume in the U.S. has been steady throughout the year, we’ve seen it increase in L.A. since the summer to get ahead of the next tariff wave. Look for outbound demand in L.A. to continue to not match U.S. overall trends for the next month.

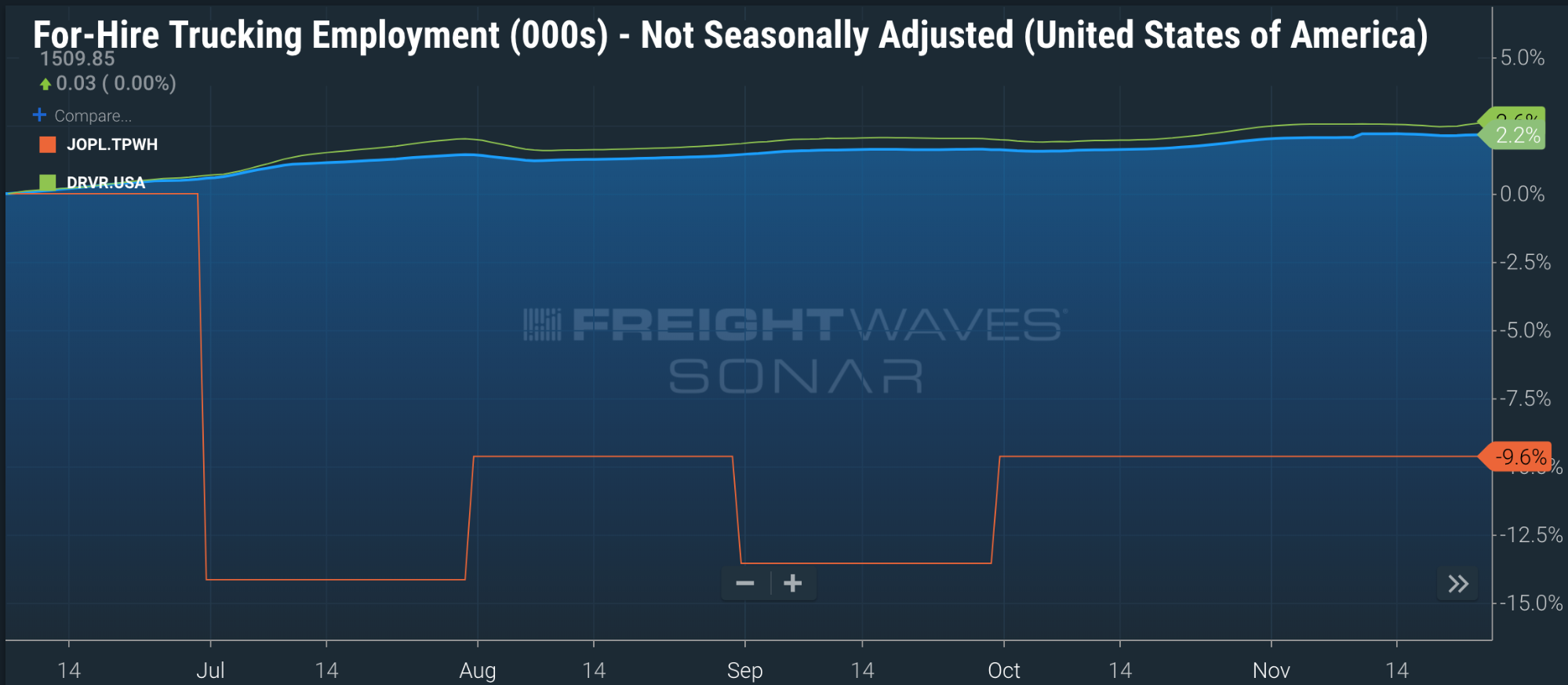

Supply: Number of Drivers Is Increasing

The trucking supply story for November continues to slowly improve. Hires for drivers are up 2% in the second half of the year while openings have decreased by 9%. Wages should continue to rise to meet rising demand next year, and we expect drivers to continue to steadily be hired over the next few months. Earnings reports are continuing to report fewer bottlenecks around driver shortages.

Convoy Recommendations: Maximize Your Contracted Freight Over the Holidays

Dry van and reefer demand is expected to continue to increase throughout the holidays. Shipping costs will increase with demand. Between now and mid-December, shippers should take advantage of low contracted rates and move as much freight as possible at those prices. When drivers take vacation to be with their families, supply decreases and spot prices go up. In January, demand will start to cool and the spot market will relax.

Shippers – Interested in learning more about our industry-leading tender compliance, on-time service, and data-driven insights? Request a demo or call us at 206-209-0305.

Carriers – Interested in a hassle-free experience, automated detention, free quick pay, and unique offerings such as Request-A-Load? Call us at 206-202-5645.