FreightWaves: March Market Trends Update

Industry Insights, Shippers • Published on March 28, 2019

Thanks to all who attended FreightWaves’ March Monthly webinar sponsored by Convoy. Below, we summarize the webinar for the demand and supply sides of the freight market, and add insights from Convoy too.

Demand – Manufacturing Dragging the Economy

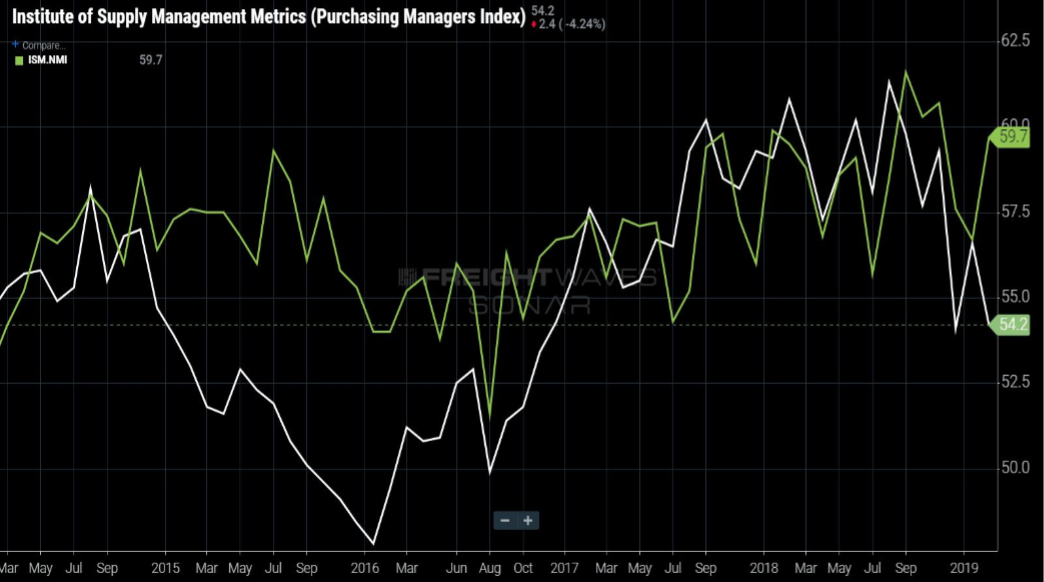

Overall, manufacturing has slowed, with ISM manufacturing dropping to its lowest levels in the past two years. Conversely, we’re seeing the service industry support the economy more. For trucking, this means we should see an outsized slowing in growth relative to the rest of the economy.

Below, we look at ISM for manufacturing versus service to show this growth differentiation. Manufacturing is in white, where non-manufacturing is green.

Tariffs Update

Tariffs have not had much news since our last update. US/German tariffs have had little to no news since the US mentioned auto tariffs in mid-February. US/Chinese tariffs now have an “indefinite” delay. Shipping rates for both corridors are reducing pricing along with risk reduction.

U.S. Federal Reserve Pausing Interest Rate Hikes

We’ve seen a brief inversion of the yield curve, which some see as an indicator that a recession is coming within the year. Beyond that, Powell has been indicating fewer and fewer rate increases coming for 2019. This indicates the Fed is seeing less macroeconomic growth and may need to reduce rates to increase macro growth and fight off coming recession.

Supply – Freight Capacity Everywhere

On the supply side, tender rejection across the country remains near record lows. The rejection rate in the L.A. market is hovering below 2% as carriers are seeing lower spot rates and are flocking to contracts. This is down from 3% in February in L.A. Volume is roughly flat out of L.A. over the same time.

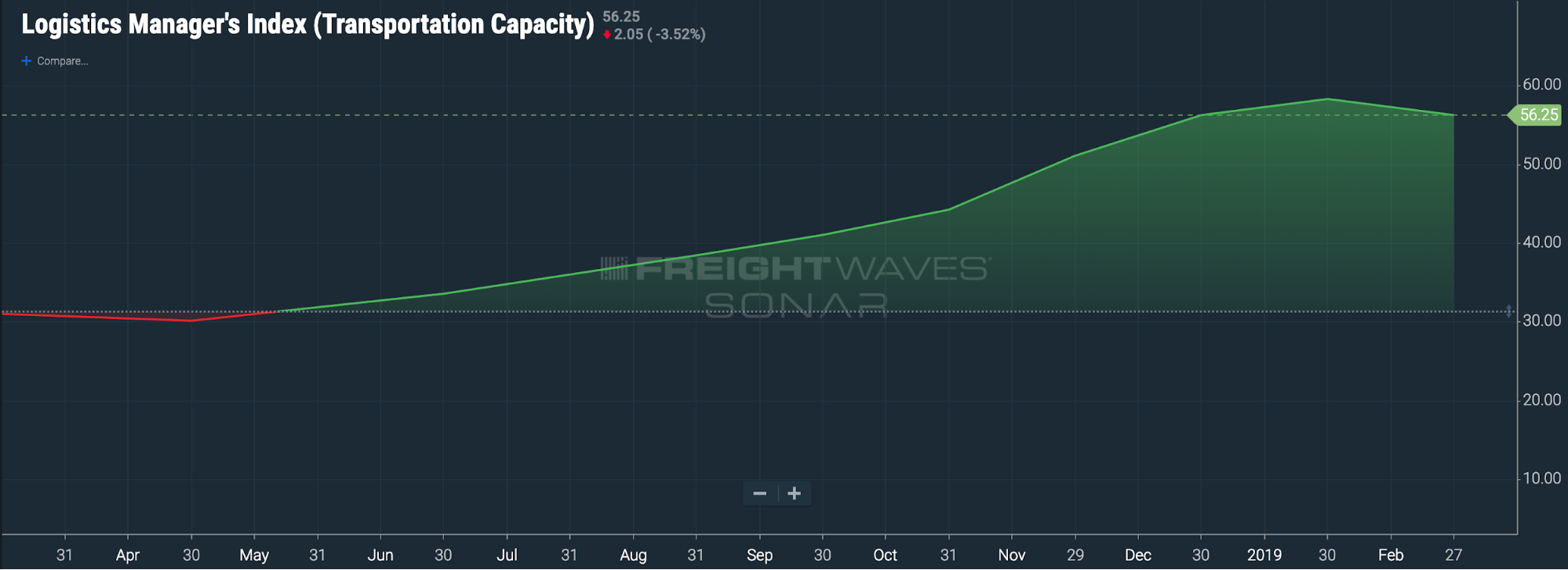

Looking longer term for supply, trucking hires are increasing. We see this turning into results by examining the Logistics Managers Index for Capacity (LMI.TPCP). This index shows hiring has been stable since December 2018. The index is considered stable when it is above 50. We’re continuing to see brokers pricing freight RFPs aggressively. These indexes indicate those who don’t factor in price decreases may have lower rewards in freight auctions.

Some capacity crunch may be felt later this year when Automatic On-Board Recording Devices (AOBRDs) are no longer going to be acceptable substitutes for ELDs on December 16, 2019. A recent survey found about 40% of industry experts expect capacity to decrease after AOBRDs, which should increase rates. However, this should not be as extreme as ELD mandate in 2018.