FreightWaves: February Market Trends Update

Industry Insights, Shippers • Published on February 21, 2019

Thank you to everyone who attended the FreightWaves February webinar, sponsored by Convoy. During the webinar, we covered how supply is no longer a bottleneck — except in frozen parts of the country. Plentiful supply stems from reduced demand as businesses react to slower growth and tariff changes. Below, we summarize the webinar for the demand and supply sides of the freight market, coupled with our own insights.

Demand: tariffs looming

Across the U.S., freight volume is continuing to stay at seasonal lows. The exception continues to be Los Angeles, where freight is coming in at elevated levels ahead of the Chinese tariffs, which go into effect on March 1. However, a deal may be coming, and the U.S. may be willing to hold off on enacting tariffs if that’s the case.

At the same time, the U.S. is reportedly considering targeting the Eurozone for auto imports. This could be especially impactful in Germany, given how the German PMI was most recently at 49.7, indicating manufacturing growth has stuttered.

Ocean shipping volume from Europe to the U.S. is spiking, potentially in anticipation of any tariffs.

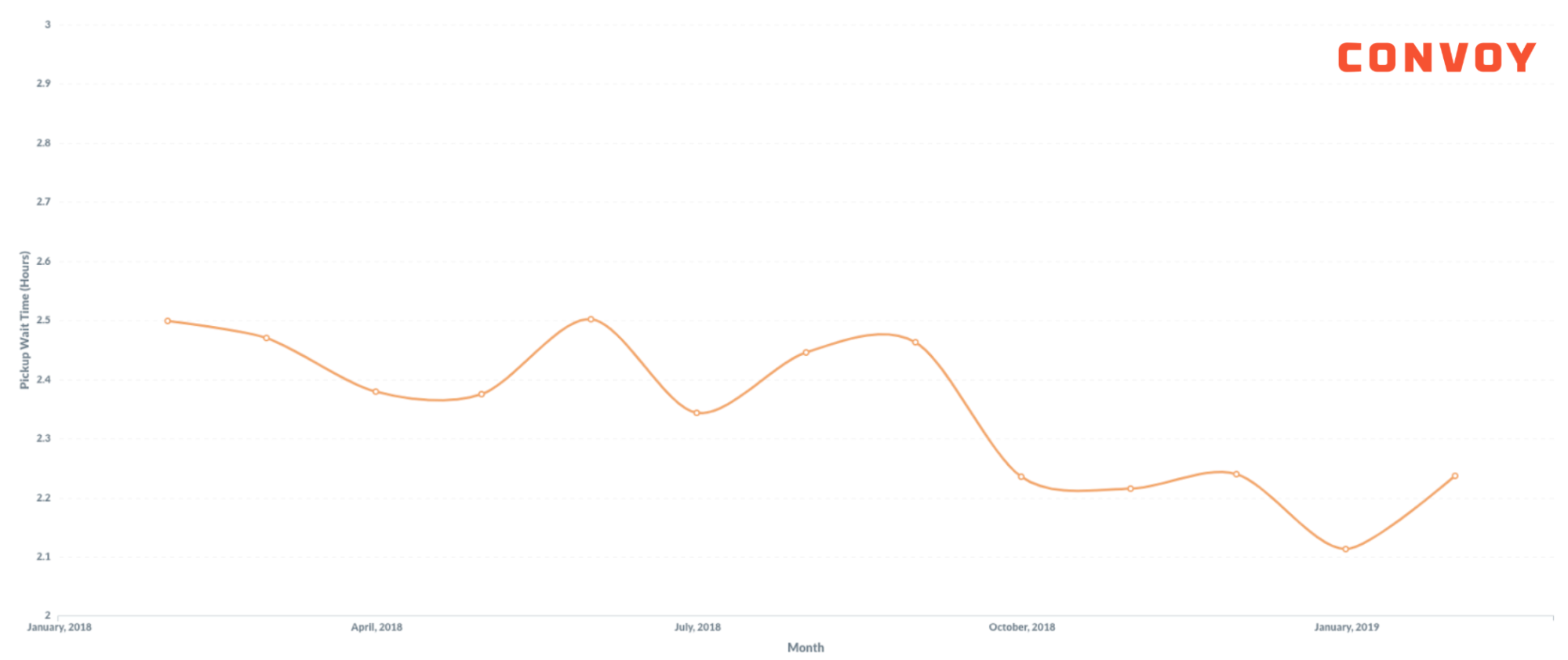

Wait times tick up in February, but down year over year

Looking at our data, we’re seeing wait times increase from January lows, indicating a slight increase in demand. However, year over year, wait times are still down, which matches the larger macroeconomic story.

The recent government shutdown was the longest in history. While the U.S. has secured government funding through the end of September, the effects of the latest shutdown are being felt across the economy, mostly through decreased demand from unpaid government contractors.

Supply: moving fast or frozen in place

On the supply side, tender rejection rates across the country remain near record lows. The rejection rate in the L.A. market is hovering below 3% as carriers are seeing lower spot rates and are flocking to contracts.

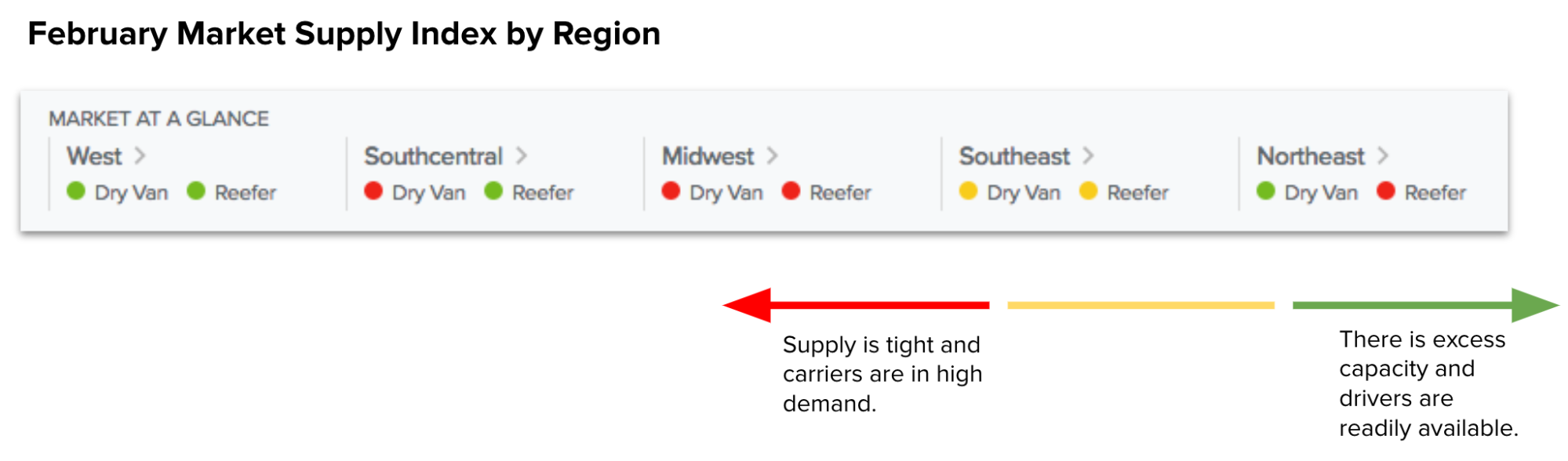

The only exception is in the Midwest and pockets of the Northwest, mainly Seattle. These areas are being hit with extreme winter weather that has frozen supply. Looking at Convoy’s Market Supply Index, we see the darkest red is in the Midwest, which is covered by ice today.

Long-term outlook for supply

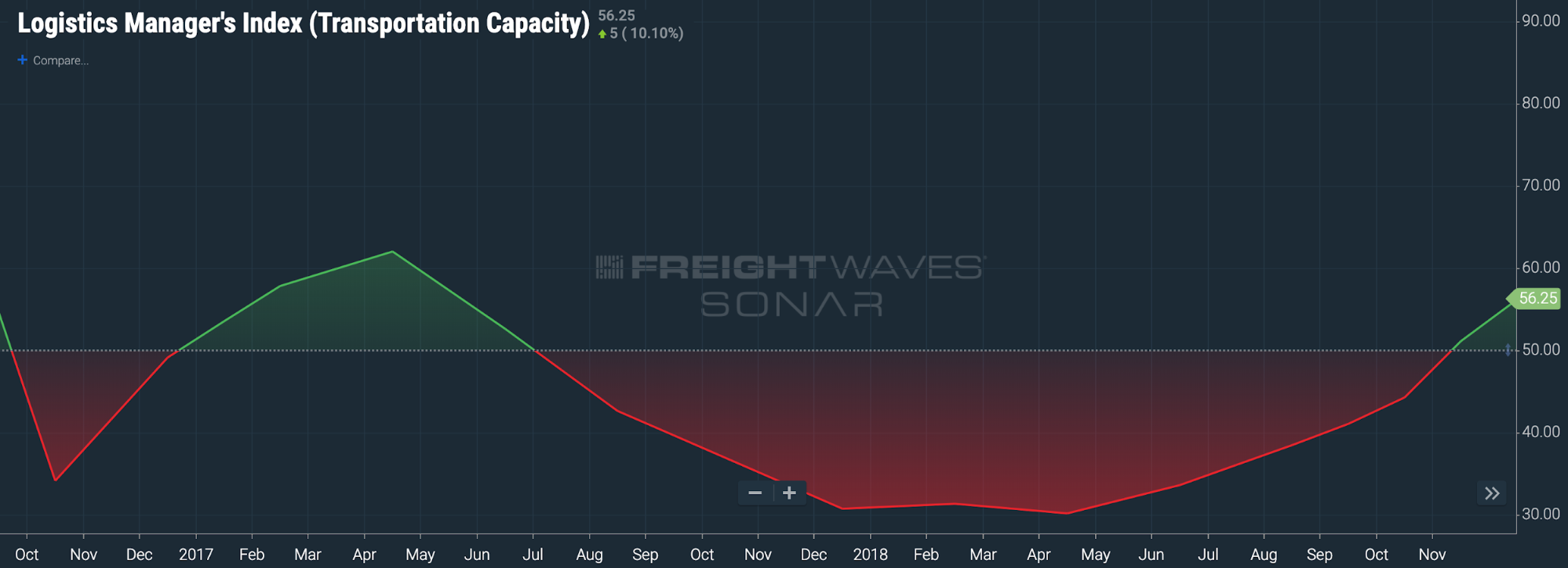

We see an increase in trucking hires. Looking at the Logistics Managers Index for Capacity (LMI.TPCP), we see the survey moving above 50, indicating the supply bottleneck is loosening. We’ll continue to monitor this as demand ramps up.

Brokers and carriers are starting to price more aggressively in anticipation of volume continuing to decrease. This should be top of mind for anyone negotiating freight RFPs or contracted lanes with brokers. If you don’t factor in a discount, you may lose out to competition.

Our Recommendation: Stay Warm and Move Freight Contracts

Over the next month, staying in warm areas of the country should pay off for shippers and carriers. L.A. will continue to have freight pour in ahead of tariffs, and the area should see decreased rejection rates when carriers move there to avoid the Midwestern tundra. Carriers who can safely bear the cold should be ready to move to the Midwest as the thawing begins to assist shippers with backlogged inventory.

Shippers should continue to move inventory ahead of increased pricing due to seasonality, geared to start in March and really take off in May/June. Demand spikes may be moving from the West Coast to the East Coast, so consider moving freight from Savannah, New York, etc. to get ahead of potential increased volume from Europe due to pending tariffs.

Shippers – Interested in learning more about our industry-leading tender compliance, on-time service, and data-driven insights? Request a demo.

Carriers – Interested in a hassle-free experience, detention pay, quick payments, and unique offerings such as Request-A-Load? Learn more on Fleet Cards or call us at 206-202-5645.