Trucking Freight Rates in Tight Markets vs. Soft Markets

Industry Insights, Shippers • Published on February 10, 2021

As any economist will tell you, supply and demand are primary drivers of price. Freight rates are no exception. When carrier supply is low and shipper demand is high, prices rise. When supply is high and demand is low, prices fall. The logistics industry refers to these conditions as tight and soft markets.

An understanding of the current market, the broader freight cycles, and the underlying forces that impact prices can help shippers better anticipate truckload rates and inform their freight procurement plans.

This guide covers:

- Why freight markets tighten and soften

- Ways to get competitive freight rates in tight markets

- Strategies for freight procurement in soft markets

- How a digital freight network offers coverage for all market conditions

Why freight trucking markets tighten and soften

Prices on load boards and spot tender bids reflect the state of the freight market. In tight markets, when there are more shipments than trucks available, prices tend to be higher than average. In soft markets, when there are fewer shipments than trucks, prices tend to be lower. So what causes changes in carrier supply and shipper demand?

Freight market supply: truck driver availability and costs

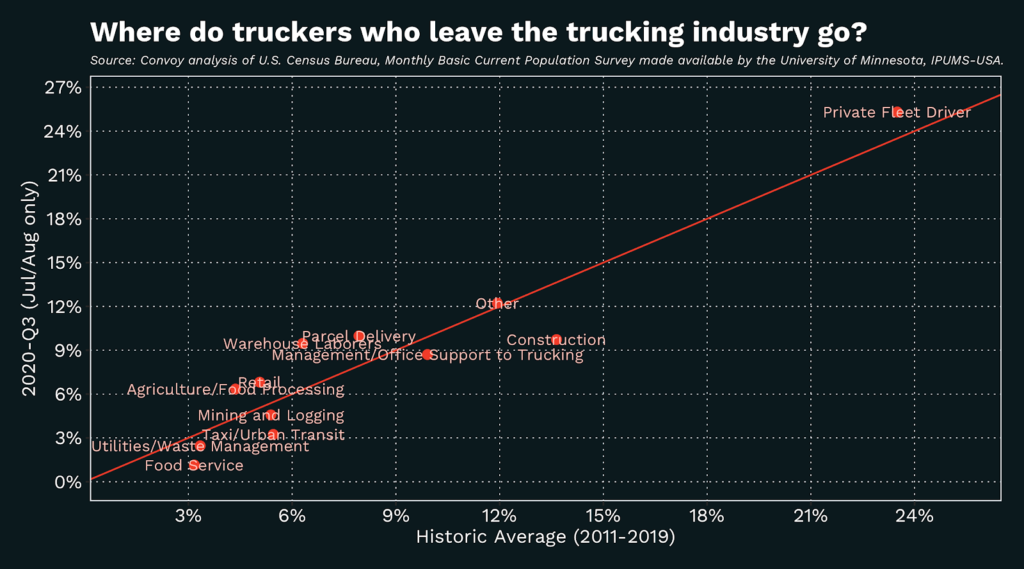

Truck driving remains one of the most popular careers in the United States, with more than 3 million truck drivers in North America. However, the American Trucking Association has documented an ongoing shortage in truck drivers. According to Convoy research, drivers in the past decade have exited the freight market in favor of employment in other industries.

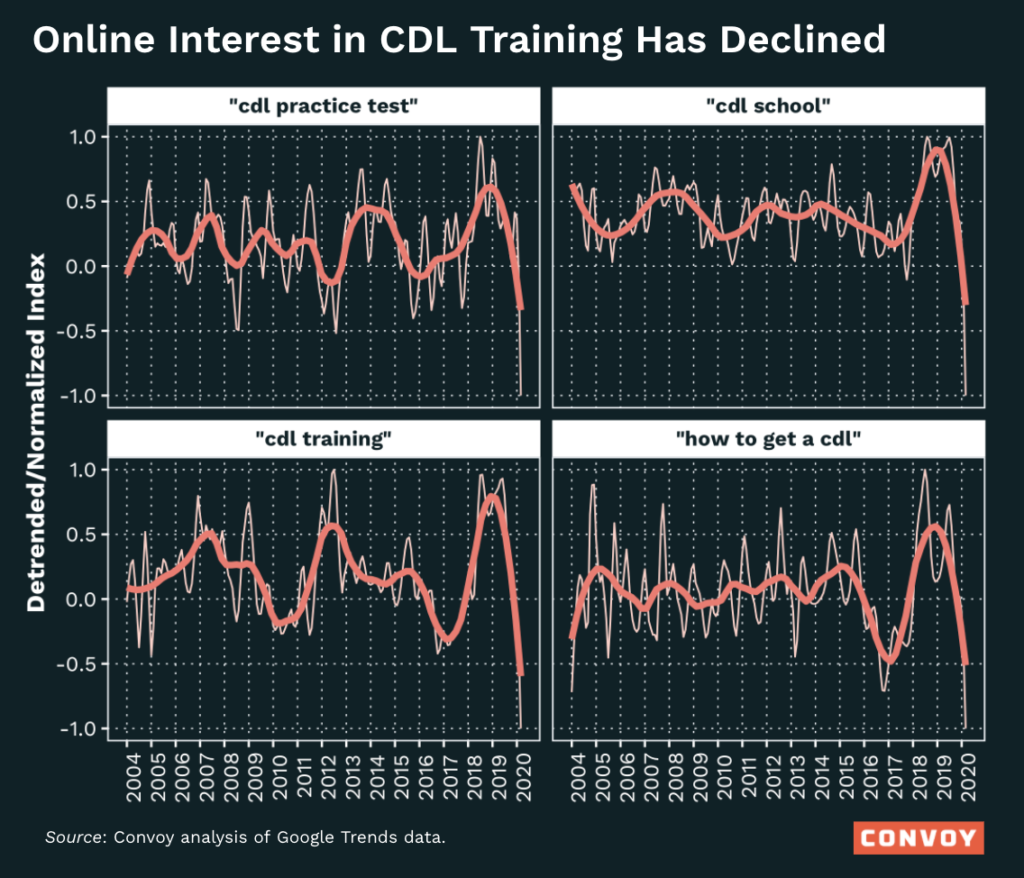

Meanwhile there appears to be fewer young people pursuing careers in trucking. Even though trucking has attracted laid-off workers during past recessions, Convoy found that online interest in CDL training has declined.

Low truck driver availability is among the factors contributing to the tight freight market the industry is currently experiencing. To combat some of the challenges around labor, carriers are increasing wages and offering bonuses to entice drivers to long-term employment, with driver wages rising throughout 2020.

Freight trucking demand: the economy and consumer behavior

The broader economy plays a major role in freight rates. When employment is high and consumer purchasing power increases, shippers are likely to see an increase in demand and need to transport more goods.

The broader economy plays a major role in freight rates. In Convoy’s 2020 Freight Insights Report, we tracked how larger macroeconomic trends and COVID-19 changed consumer buying behavior and impacted outbound truckload volumes across industries. As consumers stayed home and spent less of their income on services, they spent more retail and consumer packaged goods (especially online).

Freight market seasonality: predictable market tightening and softening

Seasonality is a critical component in freight rates. There are four key “seasons” in the freight industry that affect rates:

- Quiet season: January – March

For shippers, the new year often brings lower freight rates. This is a slower season due to post-holiday recovery and inclement weather. - Produce season: April – July

Produce season hits different regions across the US between the spring and summer. As produce season begins, demand for trucks increases. As competition for carrier capacity rises, so do truckload rates on the spot market. - Peak season: August – October

The late summer brings back to school season and a preparation for holiday buying. While Thanksgiving, Christmas, and New Year’s celebrations may be a few months away, shipping between manufacturers, distribution centers, warehouses, and retail locations occurs from August and October as businesses prepare for their busiest time of year. - Holiday season: November – December

This is when consumers buy and send goods to their loved ones, causing spikes in demand for retail, food, beverage, paper, and packaging shippers. Shippers and carriers work tirelessly to close out any open shipments before the end of the year.

Added volatility and marketing tightening

Natural disasters and inclement weather factor in as another contributor to market volatility. 2019 saw one of the tightest freight markets in recent history, much of which can be attributed to an overactive hurricane season. Shippers face seasonal risk management across regions, with annual hurricanes in the Atlantic, California wildfires, and strong winds and tornadoes in the Plains and Midwest. Natural disasters and inclement weather can immobilize trucks, disrupting transportation logistics, leading to volatility and tightening.

Freight trucking rates in tight capacity markets

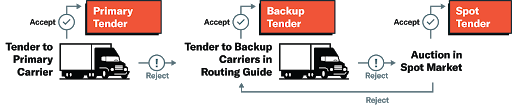

In tight markets, contract carriers are more likely to reject primary freight tenders to accept higher priced shipments on the spot market. Shippers can formulate a routing guide of backup carriers to avoid the spot market.

When procuring freight on the spot market, it can pay to plan ahead. Similar to booking flights or a hotel room, the further in advance you’re able to book, the more likely you will be able to secure a great rate. Last minute price drops also happen occasionally, but more often than not, spot rates will increase in the final days.

Convoy’s digital freight network is uniquely positioned to provide reliable and flexible capacity when demand surges past supply chain forecasts. It starts with detailed supply chain visibility, so companies are informed about recent and upcoming disruptions as early as possible. Next, Convoy provides access to a broad pool of carriers throughout the nation. Our customers can access this pool through services like our dynamic backup pricing from within their TMS or through tendering freight to Convoy on the spot market.

Finally, we offer Guaranteed Primary, a new program to avoid tender rejection, bypass the volatile freight RFP process, and get primary freight coverage from high-quality carriers at a low, fixed margin. With 100% tender acceptance, Guaranteed Primary offers peace of mind, even in tight markets.

Truckload freight rates in soft markets

In soft markets, the supply of carriers exceeds truckload demand from shippers. Freight rates fall as carriers compete with each other to win shipments. This gives shippers more options to find competitively priced freight, especially for spot loads.

A soft market can bring freight prices that are more affordable than a shipper’s contract rates. Occasionally, shippers will forgo their contract rates and opt for spot shipments to save on cost per load. However, this practice is less common for larger enterprise companies due to the operational burden involved in transitioning high volumes of contract tenders to spot.

To reduce the manual operations involved in spot freight, Convoy provides instant quotes and booking with guaranteed coverage for every load we bid on. This lets shippers tender spot freight with greater convenience, speed, and visibility, without the hassle of phone calls and time spent waiting for confirmation.

Freight partner solution for all market conditions

Market fluctuations are going to happen, forcing shippers to deal with shifting prices, rejected tenders, and other issues that lead to frustration and wasted time. Shippers are realizing there’s a better way to do business that reduces stress and uncertainty associated with changing freight markets.

Convoy is uniquely positioned to adapt to shifts in supply and demand to serve our customers. Our digital freight network uses machine learning, automation, and provides access to our massive network of carriers. This means your transportation team can have greater peace of mind whether the market is tight, soft, stable, or volatile.

If you’re in need of a freight partner with a proven track record in contract, backup, and spot freight in every market condition, Convoy can help. Fill out our contact form and a member of our team will follow-up with you soon.