Freight Market Update: Slowing demand and falling capacity

Freight Research • Published on October 11, 2022

Our September Freight Market Update analyzes data from multiple sources to inform your decision making and help you better manage your freight. To get fully up to speed on macroeconomic trends and their impact on freight, hear what’s top of mind for Fortune 500 shippers, and learn the best planning tips for the peak season, view our Q3 2022 Freight Market Update webinar.

September 2022 freight market overview

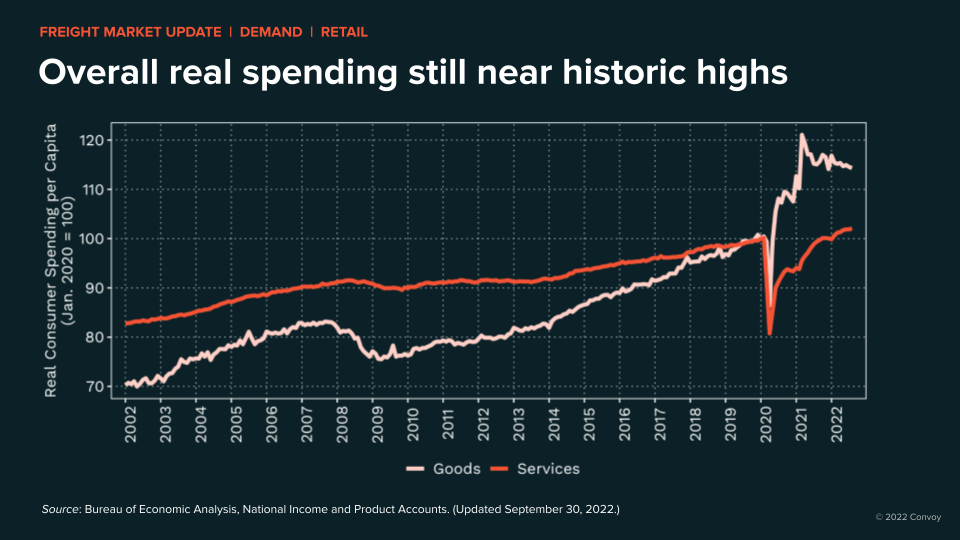

- Overall consumer spending remains near historic highs. However, that spending comes at the expense of savings, which reached lows not seen since the run-up to the 2008 financial crisis. This suggests the spending is becoming unsustainable.

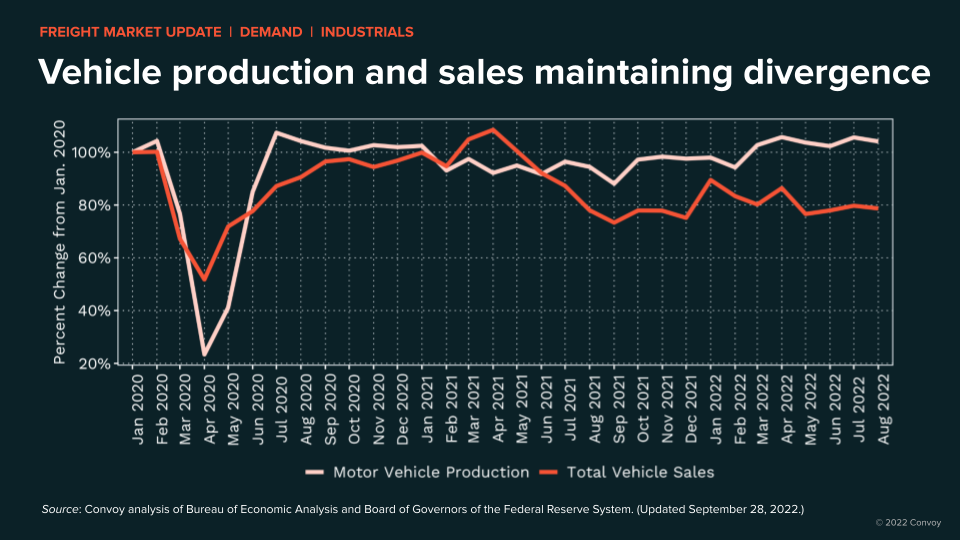

- Continued rising interest rates are impacting home and automotive purchases. There is significant likelihood that softer demand from these sectors lowers demand further. It is possible oil production begins ramping up, though not enough to offset the freight impact of slowing housing and automotive.

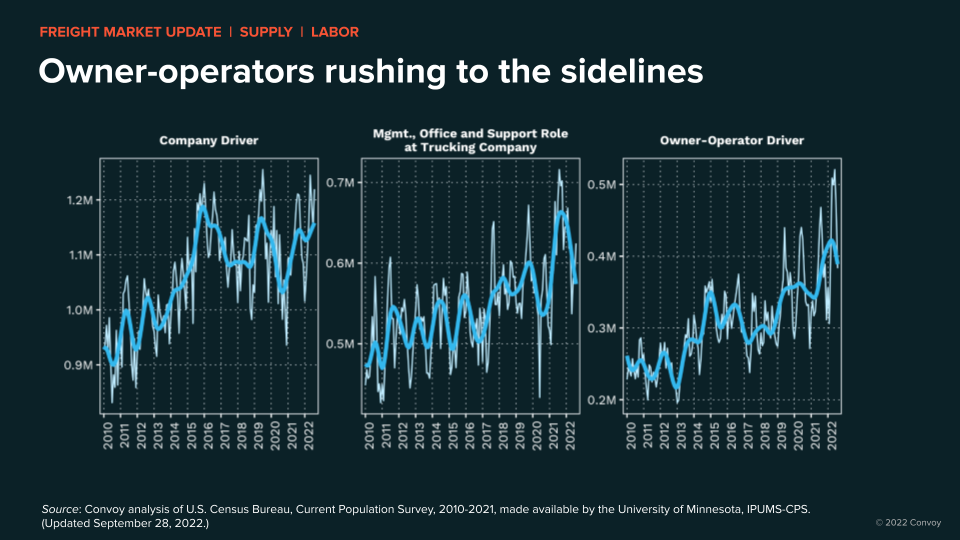

- Owner-operator capacity is leaving the market as elevated diesel prices persist and spot-contract pricing spread widens. With tender rejection rates sitting just below 6%, ample capacity appears present. Barring a major holiday surge, it seems likely the soft market persists through Q4.

Freight demand by industry

Consumer retail outlook

- Overall real spending is still near record levels even as the mix shift continues away from goods and more towards services.

- Elevated spending continues to come at the expense of decreased savings, with rates now near pre-financial crisis lows.

- Merchant wholesalers and retailers are experiencing record inventory levels as a result of inflationary pressures on spending and changing consumer tastes.

Food and beverage outlook

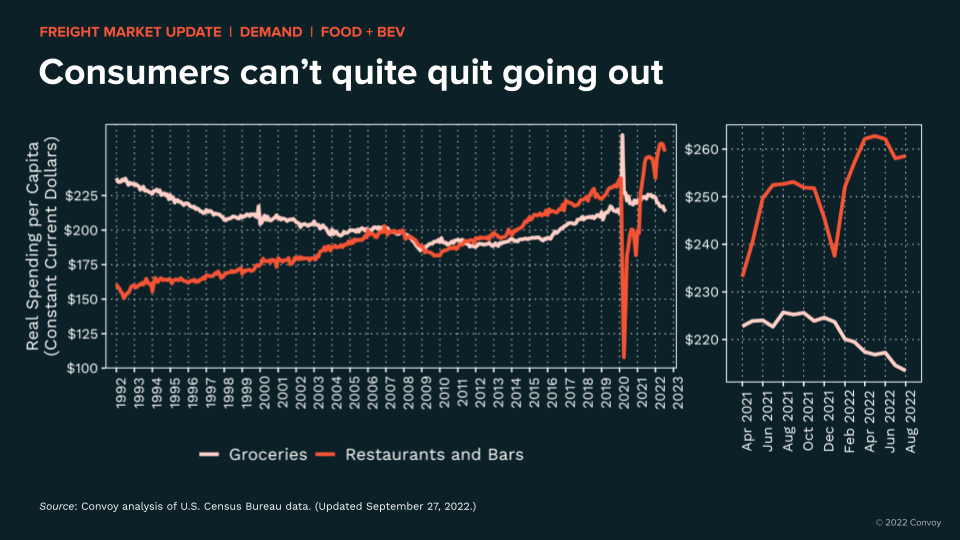

- Consumers continue biasing spending towards restaurants and bars versus groceries.

- A downward trend of agribusiness investments suggests interest rate hikes are creating pessimism for current and future conditions.

- Major commodity price declines moderated, although the expansion of severe or greater drought conditions may make this temporary if lower crop yields occur.

Industrials outlook

- Current and future business perceptions are predominantly negative and generally continuing a downward trend.

- A persistently wide gap between vehicle production and sales points towards the potential for excess inventory within the automotive sector.

- Decade-high interest rates depressed both immediate and 6-month forward-looking housing interest.

Freight Supply

Labor, fuel, and equipment overview

- Owner-operators are moving more aggressively to the sidelines with a 26% decline compared to the July peak (and with a 2% increase for company drivers).

- Owner-operator capacity declines are likely influenced by elevated diesel prices (even as crude spot prices decline).

- Tractor and trailer production are trending lower with tractor orders net replacement still quite negative.

More on the Freight Market Update

▶️ Interested in the full freight market insights and trends? Then catch our 25-minute on-demand webinar, supplemented with our source data and commentary in PDF form for easy sharing with your internal teams.

Watch Q3 2022 Freight Market Update.