Four Questions About the Outlook for Trucking Industry Employment

Freight Research, Shippers • Published on November 6, 2020

Trucking industry employment increased by 0.7% (9,600 jobs, seasonally adjusted) in October according to payroll data released today by the Bureau of Labor Statistics (BLS) — nearly matching August for the best month for job gains since the start of the pandemic and close to the monthly job gains at the last freight market peak in summer 2018. Over the past year, employment is still down by 66,000 jobs. (The not seasonally adjusted data showed a smaller 8,100 job increase from September. There are some reasons to be particularly cautious with the seasonally adjusted data right now — see more below.) But the data also raises several important questions about labor supply in the trucking industry.

Why has trucking industry employment failed to rebound to pre-crisis levels?

In the face of relatively strong truckload demand and indisputably high spot market truck prices, trucking industry employment remains surprisingly subdued, only 96% of where it was a year ago as of October. Of course, the BLS payroll employment metric does not include the critical owner-operator segment, but it does include back office and support workers at trucking businesses. It’s possible that trucking firms have been slower to staff up on back office workers even as driver payrolls grow, which could plausibly weigh on the headline industry number. But data from the Census Bureau’s (admittedly noisier) household survey suggest, if anything, the opposite: Seasonally adjusted employment among office and support workers in the trucking industry is slightly above where it was a year at the start of the year, while employment among drivers is still down.

How much of a toll have retirements taken on driver supply?

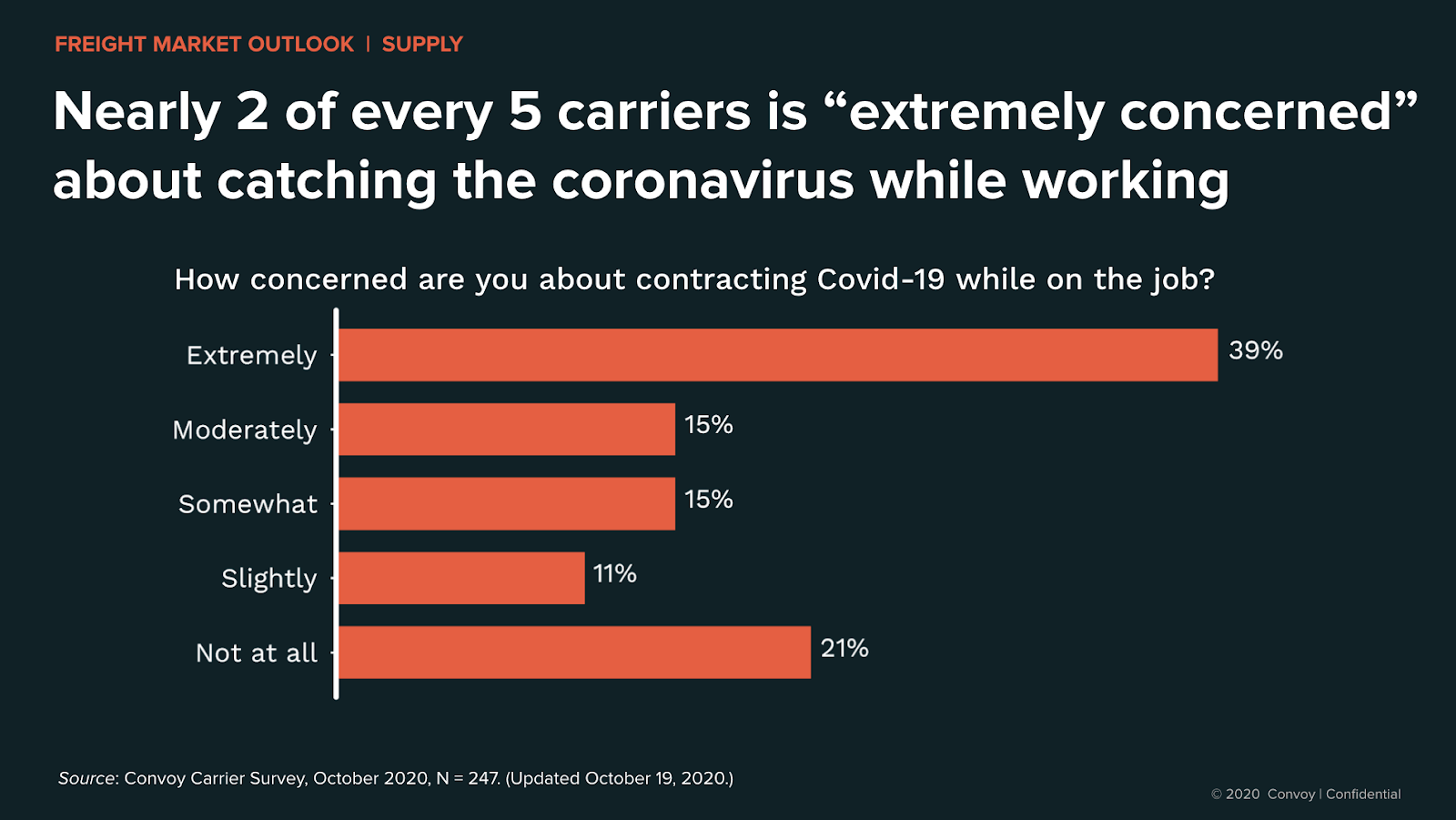

Retirements usually accelerate during economic downturns, a normal trend that is likely amplified by the particular health risks that the pandemic poses for older adults. I estimate that an additional 45,000 truck drivers left the labor force (primarily to retirement) in Q2 and Q3 above and beyond what might be expected given recent trends. (This number excludes private fleet drivers and includes 25,000 company drivers and 20,000 owner operators). Health risks likely have played a role here. According to a recent survey of still-active Convoy carriers suggests that nearly 40% of drivers are “extremely concerned” about contracting Covid-19 while out on the road (see chart below). The average age of drivers who exited the labor force was high in Q2 — the highest since 2015 — suggesting few will likely return to service even after the public health crisis is resolved.

How much will skewed seasonality distort the official print on parcel delivery jobs?

Last month I wrote about how parcel delivery jobs have been attracting a growing share of truckers who decide to shift into a new industry or occupation. According to the BLS data, parcel carriers have been adding about 100,000 to 110,000 jobs in recent months (compared to the same month last year), and year-over-year hiring touched 117,000 jobs in October. Parcel delivery hiring displays exaggerated seasonality: For most of the year, hiring runs around 10,000 jobs per month, but in November and December it surges more than ten-fold to well over 100,000 jobs per month. (The BLS category for parcel delivery services — NAICS code 4921 includes several, though not all, of the largest package delivery firms.) But there is nothing normal about 2020. There is little doubt that parcel delivery demand is likely to hit record highs this holiday season, but it has been consistently strong since the start of the pandemic and I suspect the standard ~10x seasonal adjustment will overstate the true hiring trend in the sector this year.

How much of a labor supply boost should we expect from the parcel delivery-to-truck driver pipeline?

Historically, parcel delivery has been an entry point to the transportation industry for workers who later decide to pursue more lucrative (but also more challenging) jobs in truck transportation. Over the past decade and a half, we have seen the number of parcel delivery workers who transition into truck transportation roles start to increase about three to four quarters after hiring surges at parcel delivery firms. On average, for every 1,000 workers who transition from other industries into parcel delivery, we see about 66 workers transition from parcel delivery into truck transportation about three quarters later. This means that recent parcel delivery hiring trends suggest a pipeline of about 30,000 to 40,000 new truck drivers sometime in mid-2021 — an influx that would nearly offset the accelerated retirements we saw in spring 2019.

View our economic commentary disclaimer here.