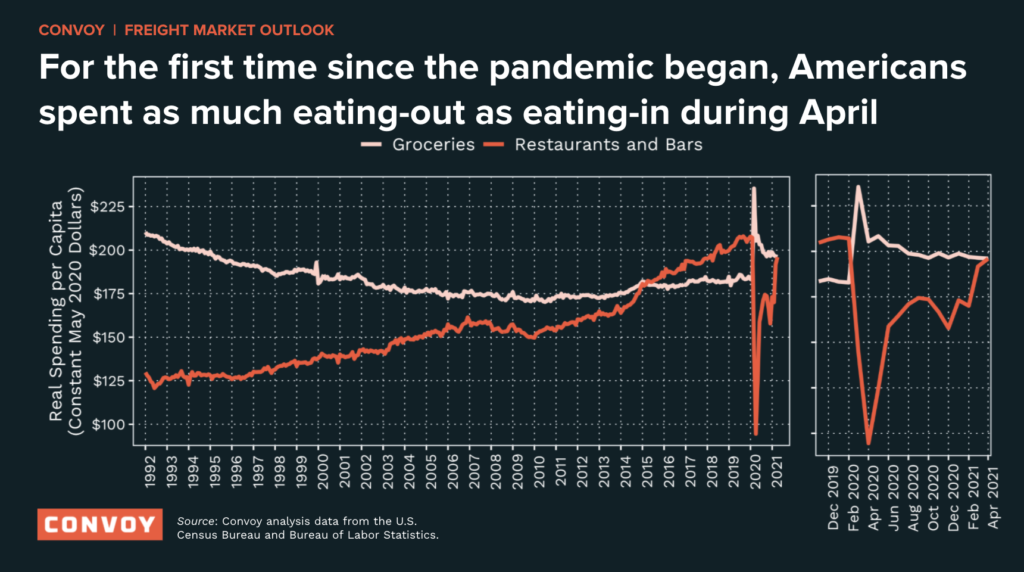

Eating-Out Caught Up With Eating-In during April for the First Time since the Pandemic Began

Freight Research • Published on May 14, 2021

Americans’ spending at restaurants and bars caught up with their at-home food spending in April 2021 for the first time since the start of the Covid-19 pandemic, according to data published today by the U.S. Census Bureau. It was a remarkable turnaround from a year ago when per-capita eating out dollars hit their lowest level in at least a generation. (The Census Bureau began reporting monthly retail sales in the early 1990s.)

Eating-out collapsed during the earliest weeks of the pandemic, but the food service industry quickly pivoted to take-away dining and total inflation-adjusted spending at restaurants and bars quickly recovered to 70%-80% of pre-pandemic dollars where it stagnated through Q4-2020 and Q1-2021. But it has begun to surge with springtime reopenings and is now only 5.7 percent below where it was before the pandemic; real grocery spending per capita has held up around 7 percent above pre-pandemic levels.

The sudden shift in Americans’ eating habits triggered a seismic realignment of the country’s food and beverage distribution networks. Freight demand from grocery retailers and food manufacturers surged in Q2-2020 and has since stabilized near its highest levels since the early 1990s. But there have been persistent questions about whether this pandemic-induced reversal of a longstanding secular trend in food consumption would have legs. Today’s data suggest that it may not.

Headline retail sales were essentially flat (seasonally adjusted) in April, although accelerating consumer price inflation is distorting the headline numbers as reported. After accounting for accelerating consumer price inflation (the retail sales data are reported in nominal dollar terms), retail sales fell by 0.8 percent in April.

Factory output data released separately by the Federal Reserve Board this morning suggest that accelerating consumer price inflation will be accelerated by industrial tailwinds on the near horizon. Factory output grew as the industrial sector recovery continues to lag behind the consumer retail recovery, but the pace of growth was slower than in recent months (February’s weather disruptions aside). Commodity input and supply chain disruptions clearly weighed down factory output — notably in the automotive sector where factory capacity utilization fell to its lowest level in a decade (ignoring the deep drop in April and May 2020 which were the result of pandemic-related factory shutdowns). Utilization in the oil and gas sector also remains well below historic trends despite high and rising energy prices.

Follow along with our Freight Research here.