Dodging Disasters

Freight Research • Published on September 3, 2021

Major natural disasters have become more frequent with accelerating global climate change. As we have seen repeatedly in recent years (see, for instance, here and here), these events can be massively disruptive for supply chains — cascading through the consumer retail and industrial sectors of the economy.

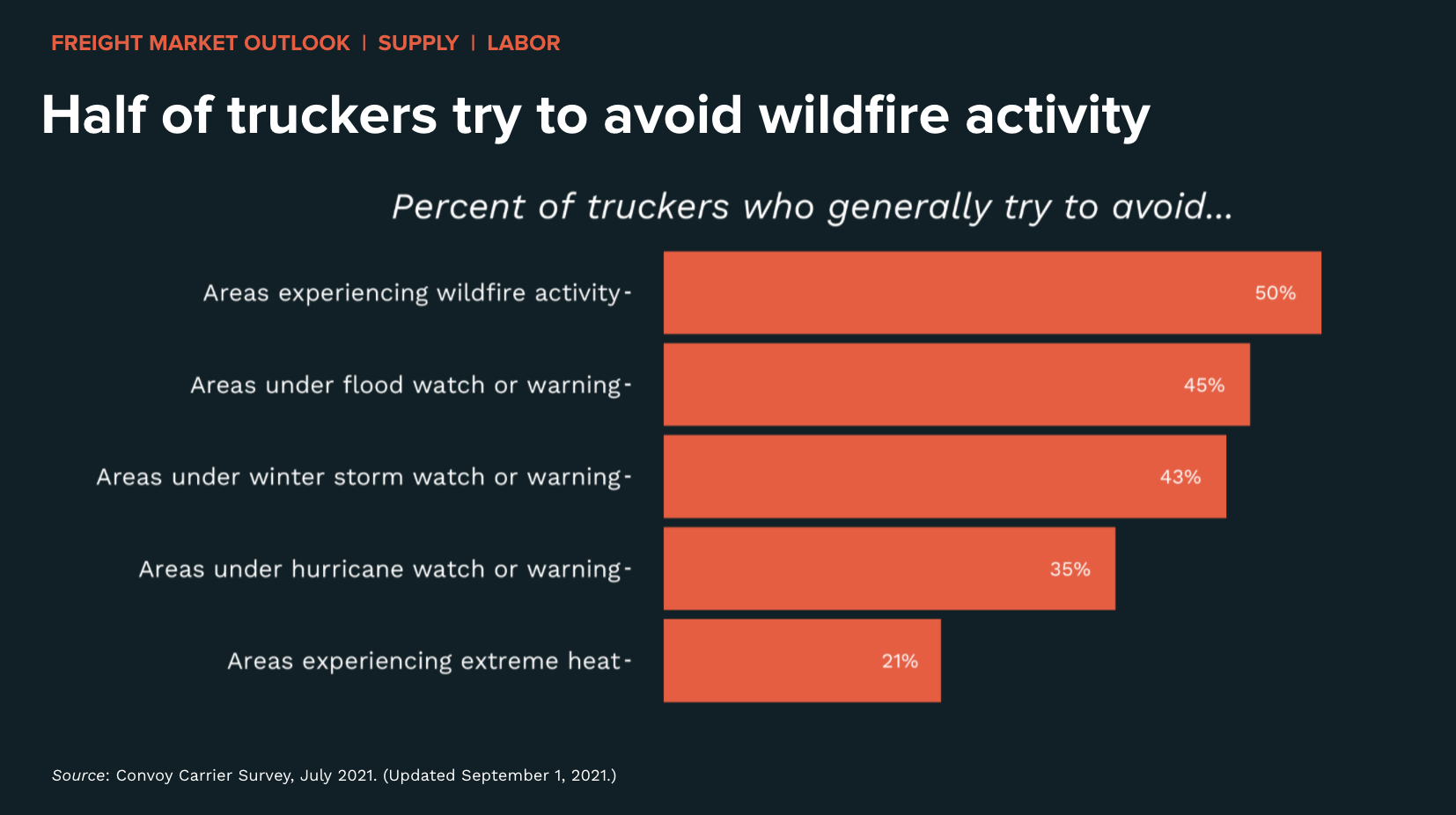

In a recent Convoy survey of 165 small and medium-sized trucking companies, we found that:

- Half (50%) of respondents generally try to avoid areas directly affected by wildfire activity;

- Upward of 40 percent try to avoid areas under winter watch/warning and areas under flood watch/warning;

- About one-third of trucking companies try to avoid hauling into areas experiencing hurricane activity; and

- About one-fifth try to avoid areas experiencing extreme heat.

Of course, “generally try to avoid” does not necessarily mean that they do so under absolutely no circumstances, but does provide an approximate indication of the magnitude of truckers’ perceived risk for various categories of natural disasters.

In an especially fragile and volatile freight market, such as the present, these ostensibly localized disruptions have the potential to reverberate throughout the country. Historically, truck costs have surged anywhere from 5% to 50% inbound to markets that are experiencing (or are expected to experience) major natural disasters — with substantial variation depending on the type, severity and timing of the weather event.

The market response is the result of two competing forces.

Demand typically surges during the days immediately leading up to anticipated weather events — for instance, hurricanes or winter storms which are usually predicted several days in advance — or during them for slower-moving phenomena such as wildfires as residents prepare (e.g., stock essentials, protect their homes). In the aftermath of particularly destructive natural disasters, inbound truckload demand also tends to remain elevated for several weeks (sometimes several months) as local economies recover and rebuild.

But demand changes are not the only shock to the freight system, supply also contracts during the more intense phases of natural disasters. Some individual truckers and trucking companies are, quite understandably, reluctant to put their lives and livelihoods at risk by hauling freight into potentially dangerous areas. (Of course, there are always a handful of risk-forward individuals who relish such opportunities.)

View our economic commentary disclaimer here.