2017 Snapshot & the Start of 2018

Carriers • Published on March 21, 2018

For both the 30 year veteran and the new owner-operator, 2017 proved to be a memorable year for the trucking industry. The perfect storm of driver capacity crunches, hurricanes, and federal mandates created a market where truck prices surged and marketplace balance shifted. While this meant increased driver earnings across the country through the latter half of the year it also disrupted shipper process and expectations leading to a volatile increase in tender rejection rates and additional volume hitting the Spot market (+86% YoY).

Data from DAT Trendlines | December 2017

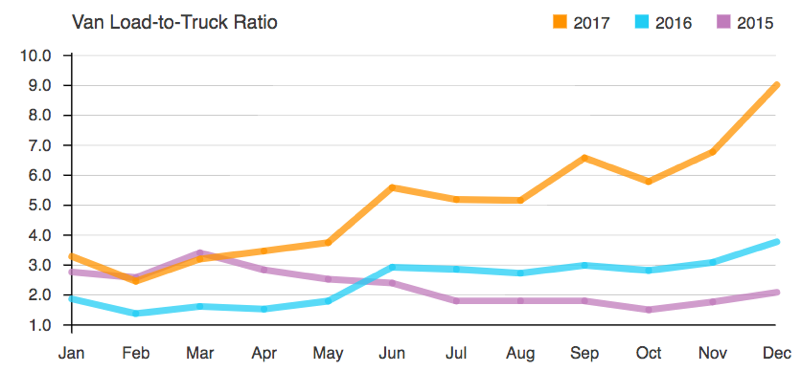

The surge of additional shipments falling through to the spot market overran the relatively thin supply available during the fourth quarter of 2017; leading to the highest national Van Load to Truck Ratios that DAT has seen during a month (9:1 in December). However, instability didn’t end with the holiday season.

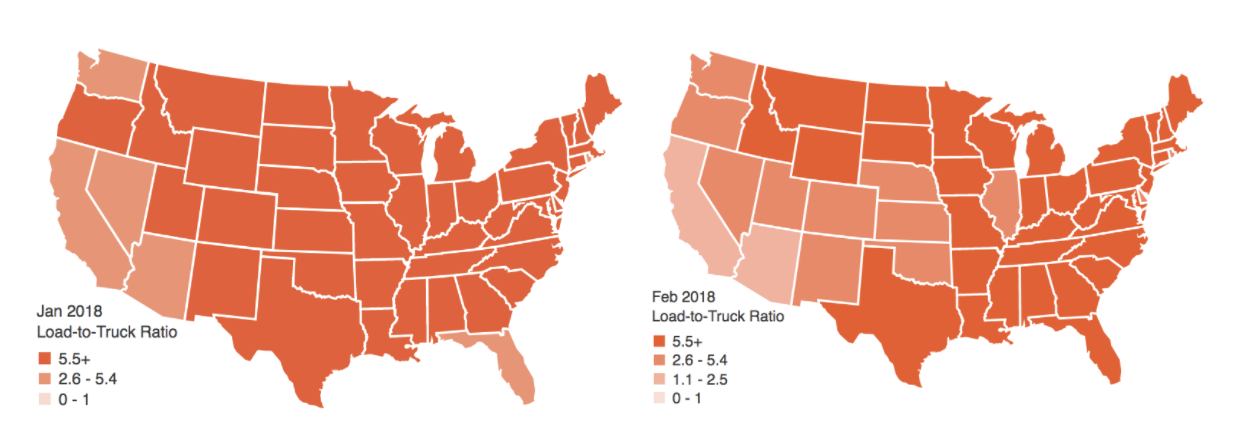

Data from DAT Trendlines | January 2018

With the ELD mandate falling just before the Christmas holiday many carriers opted for parking their trucks, further exacerbating an already unstable marketplace that carried over into January.

While the market has steadied during the traditional slow season for freight across the country, many indicators remain at or near record highs. Reefer rates reached an all-time high in January at $2.64/mile while the flatbed Load to Truck ratio increased in February skyrocketing to a lofty 66:1 across the country. The West Coast was the only area of the country that showed some reprieve during the first two months of the year as a later-than-normal Chinese New Year reduced the number of shipments coming out of California in addition to loads leaving Washington ports. Elsewhere, Van and ratios remained elevated in February showing a YoY increase of 185%.

The result of continued high demand and tighter supply conditions have left many shippers looking for new options or dealing with costly shifts in their operations. Carriers will likely continue to be selective when it comes to evaluating transit times and facility loading times; meaning shippers will need to be cognizant of pain points in their supply chain for truckers. Traditionally less desirable shippers will likely see additional difficulty finding capacity in a market where trucks are in high demand. This will be especially prevalent in the reefer market as produce begins to come out of Florida and Mexico in late March.

With diesel prices approaching a three year high, produce season right around the corner and ELD enforcement scheduled to begin in April, 2018 has the potential to continue putting never before seen pressure on an already delicate marketplace.

Stay tuned for our next market snapshot as we continue into 2018.